Launchpad

Share

Launchpads are decentralized platforms that facilitate early-stage fundraising for new Web3 projects through Initial DEX Offerings (IDOs). They provide investors with curated access to token sales while offering startups a community-driven capital injection. In 2026, launchpads have evolved into full-stack incubators, focusing on project quality and long-term sustainability. Follow this tag for the latest in token distribution models, tier-based participation, and the emergence of the next generation of "unicorn" protocols across various blockchain ecosystems.

2909 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Best Wallet Token to 10x?

Author: BitcoinEthereumNews

2025/11/25

Share

Recommended by active authors

Latest Articles

U.S. Treasury Rules Out BTC Buys as GOP Senators Push For Use Of Gold Reserves

2026/02/05 04:35

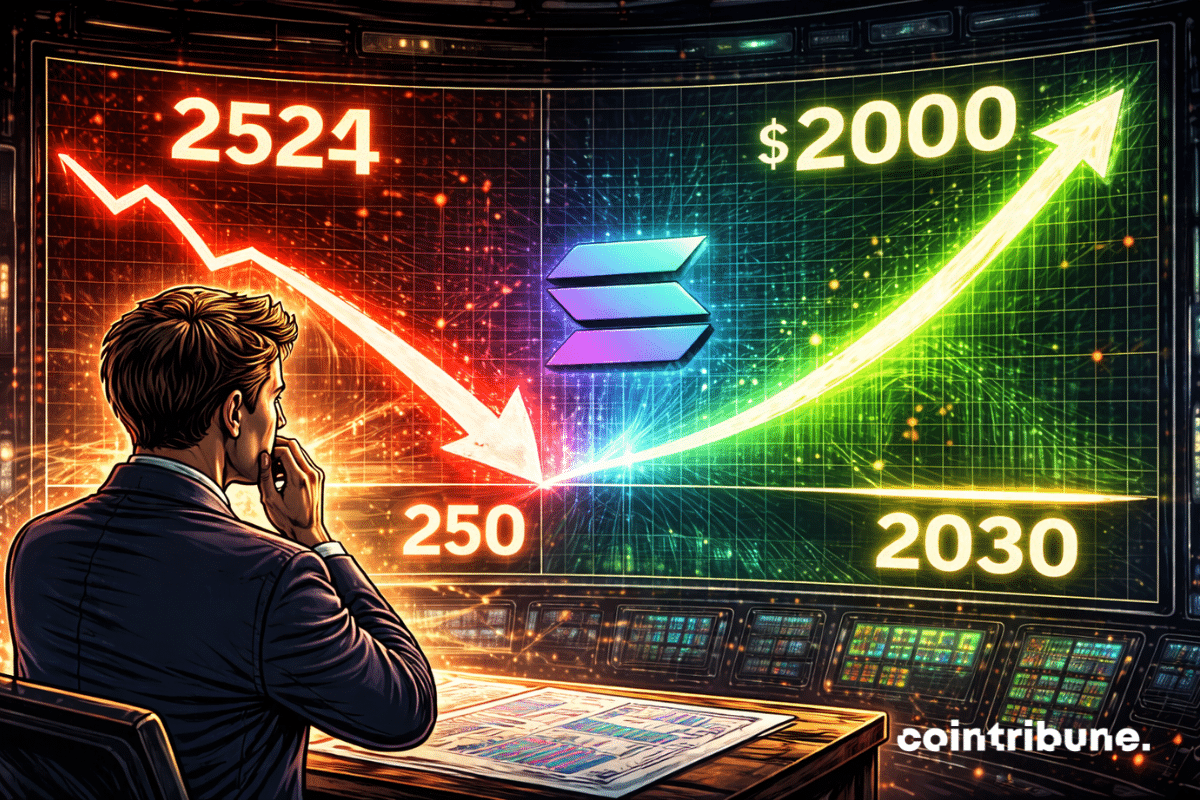

Solana To Hit $250 In 2026 ? Bank Explains Why

2026/02/05 04:05

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

2026/02/05 04:00

This is Trump's plot to rig the midterms — we must unite to beat it

2026/02/05 03:57

Over 80% of 135 Ethereum L2s record below 1 user operation per second

2026/02/05 03:52