Index

Share

A crypto Index provides a way for investors to gain diversified exposure to a specific basket of digital assets through a single tokenized product. These indices often track specific sectors, such as DeFi, DePIN, or RWA, and are automatically rebalanced via smart contracts. In 2026, AI-managed thematic indices have become the gold standard for passive investing, allowing users to track the "blue chips" of the Web3 economy without manual portfolio management. This tag covers index methodology, rebalancing frequency, and the benefits of diversified crypto baskets.

25752 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

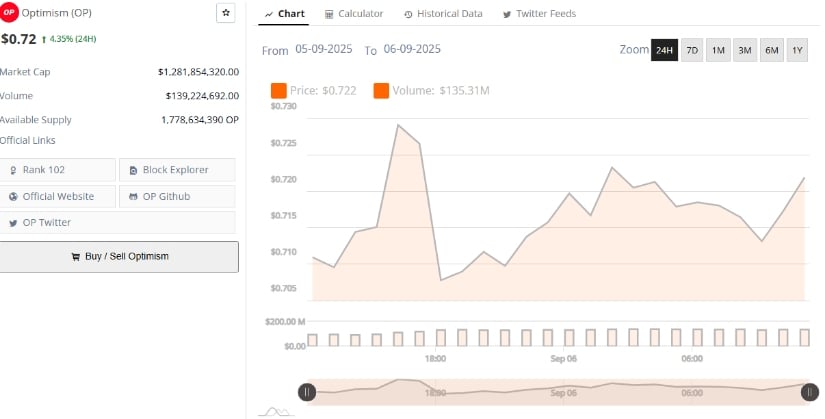

Sinks below 0.80 on weak NFP data

Author: BitcoinEthereumNews

2025/09/07

Share

Recommended by active authors

Latest Articles

The UA Sprinkler Fitters Local 669 JATC – Notice of Privacy Incident

2026/02/07 07:30

Stablecoin Yield Talks: White House Resumes Crucial Negotiations Between Banks and Crypto Industry

2026/02/07 07:25

Tether Expands Institutional Push With USD₮-Powered t-0 Network

2026/02/07 07:20

Why crypto is down and when it might bottom: Insights from Bitwise’s Matt Hougan

2026/02/07 07:17

TrumpRx Explained: Why Markets are Watching This New Pharma Website

2026/02/07 06:33