DEX

Share

DEXs are peer-to-peer marketplaces where users trade cryptocurrencies directly from their wallets via Automated Market Makers (AMM) or on-chain order books. By removing central authorities, DEXs like Uniswap and Raydium prioritize privacy and user sovereignty. The 2026 DEX landscape is dominated by intent-based trading, MEV protection, and cross-chain liquidity aggregation. Follow this tag for the latest in on-chain trading volume, liquidity pools, and the technology behind permissionless swaps.

34103 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

ZIONS BANCORPORATION ANNOUNCES PRICING OF SENIOR NOTES

2026/02/05 07:45

Recovery extends to $88.20, momentum improves

2026/02/05 07:34

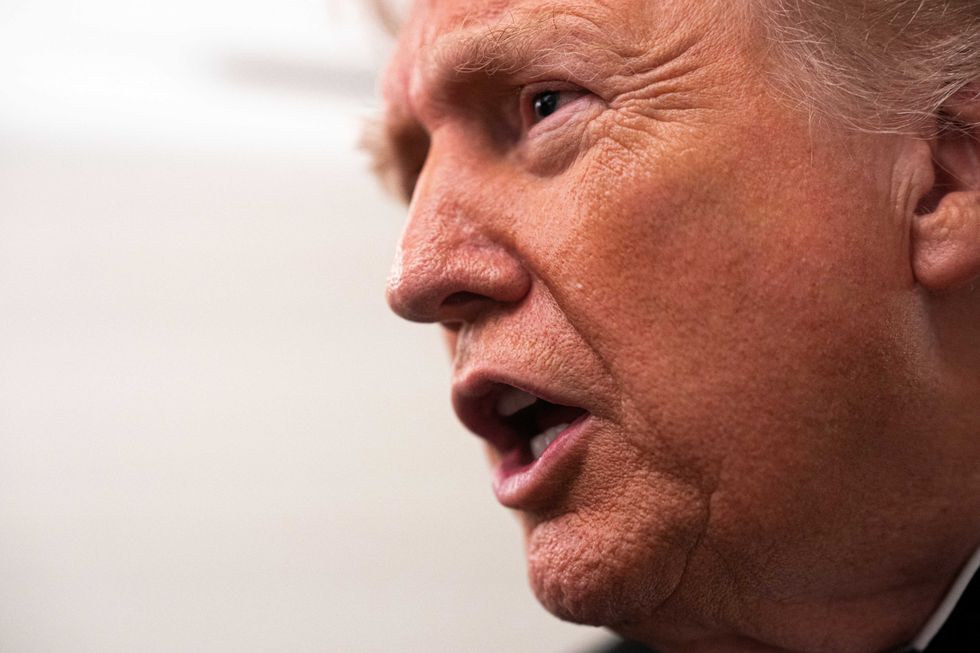

Trump lawyers get an earful from judge over desperate new move: 'Two bites at the apple'

2026/02/05 07:15

VIRTUAL Weekly Analysis Feb 4

2026/02/05 06:48

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

2026/02/05 03:49