DEX

Share

DEXs are peer-to-peer marketplaces where users trade cryptocurrencies directly from their wallets via Automated Market Makers (AMM) or on-chain order books. By removing central authorities, DEXs like Uniswap and Raydium prioritize privacy and user sovereignty. The 2026 DEX landscape is dominated by intent-based trading, MEV protection, and cross-chain liquidity aggregation. Follow this tag for the latest in on-chain trading volume, liquidity pools, and the technology behind permissionless swaps.

34639 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

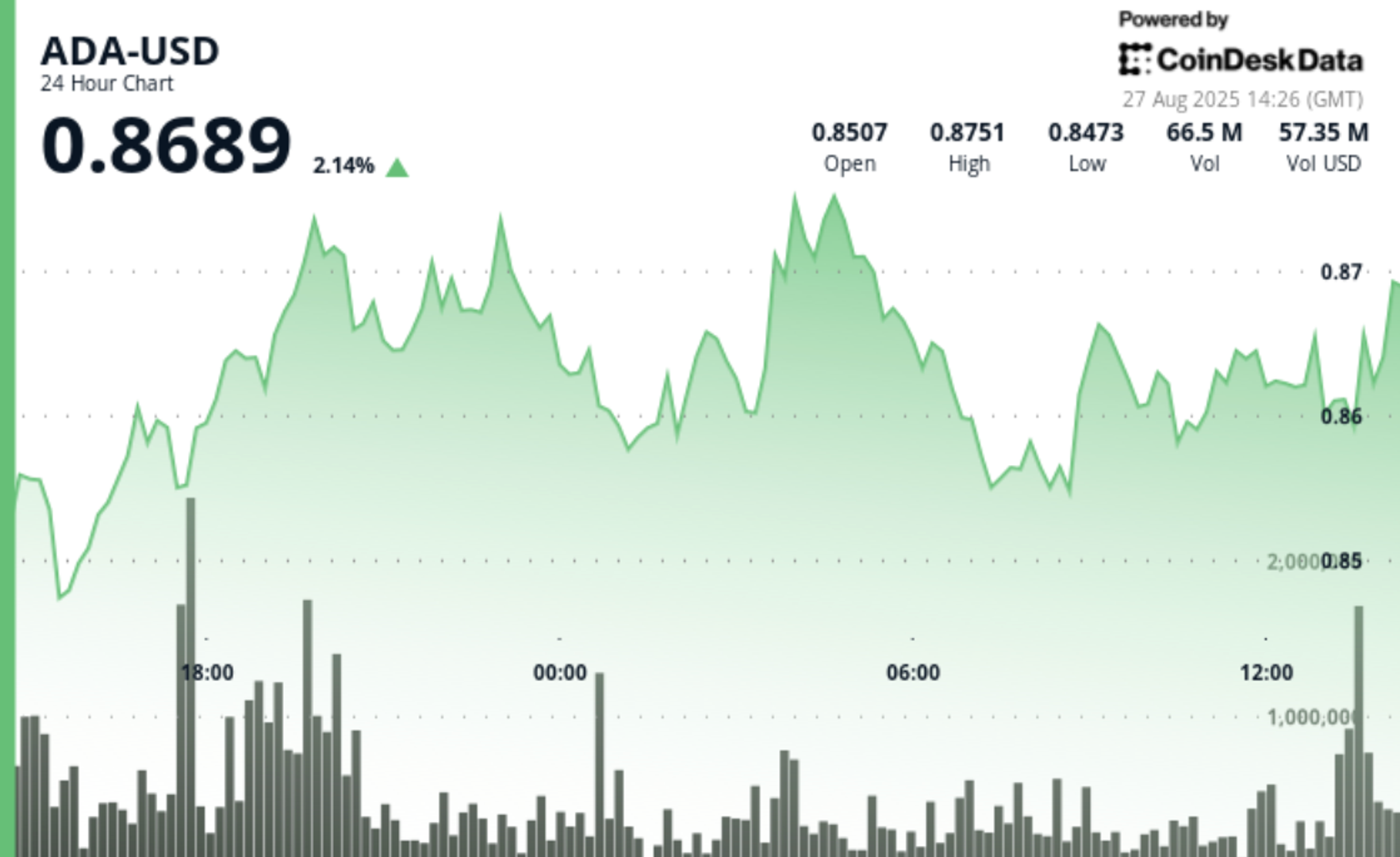

Cardano Gains 2%, Shrugs Off ETF Delay

Author: Coinstats

2025/08/27

Share

Recommended by active authors

Latest Articles

XRP Retests $1.29 Support: Is $2 Still in Play or Will LiquidChain Capture the Momentum?

2026/02/06 16:33

Strategy Defines Its Bitcoin Stress Point After Q4 Volatility

2026/02/06 16:16

XRP retraces 61% from its peak – But THIS signal hints at deeper trouble

2026/02/06 16:03

Solana Price Prediction: Head & Shoulders Sets $42 Target

2026/02/06 15:56

Tether Invests $150 Million in Gold.com to Expand Tokenized Gold Access

2026/02/06 15:51