CEX

Share

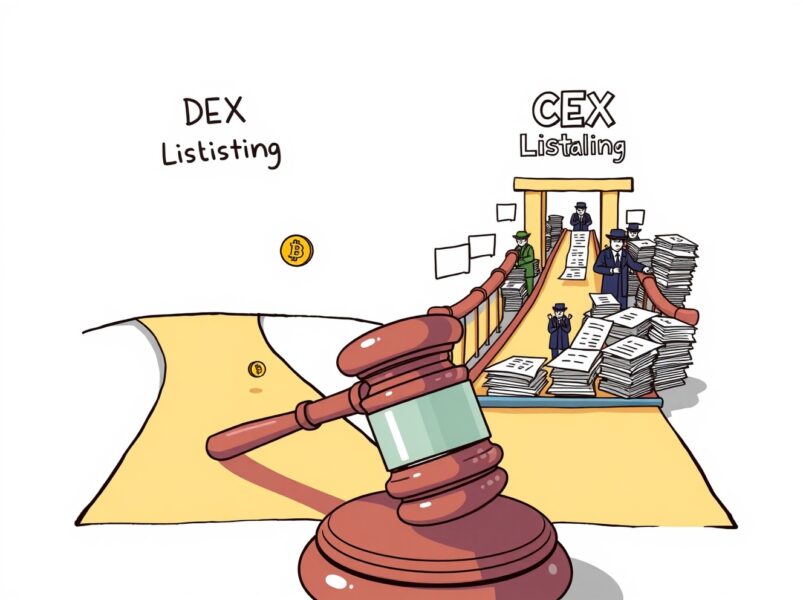

CEXs are platforms managed by centralized organizations that facilitate the trading of cryptocurrencies, offering high liquidity and user-friendly fiat on-ramps. Leaders like Binance, OKX, and Coinbase serve as the primary gateways for institutional and retail entry. In 2026, the industry focus is on Proof of Reserves (PoR), enhanced regulatory compliance, and hybrid models that offer self-custody options. This tag provides updates on exchange security, listings, and global market trends.

4180 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Trump orders more prayer in schools — after mocking GOP leader for praying

2026/02/06 05:42

Trump-Xi Call Eases U.S. Tensions; Gold Drops Below $5,000

2026/02/06 04:56

Why Ambani and BlackRock’s Fink see India as a long-term capital and AI growth

2026/02/06 04:56

Vitalik Buterin Proposes Multi-Tiered State Design to Achieve 1000x Ethereum Scaling

2026/02/06 04:52

Tom Lee’s BitMine Hits 7-Month Stock Low as Ethereum Paper Losses Reach $8 Billion

2026/02/06 04:47