Financing Weekly Report | 17 public financing events; Olas, an autonomous AI agent platform in the crypto field, completed a $13.8 million financing round, led by 1kx

Highlights of this issue

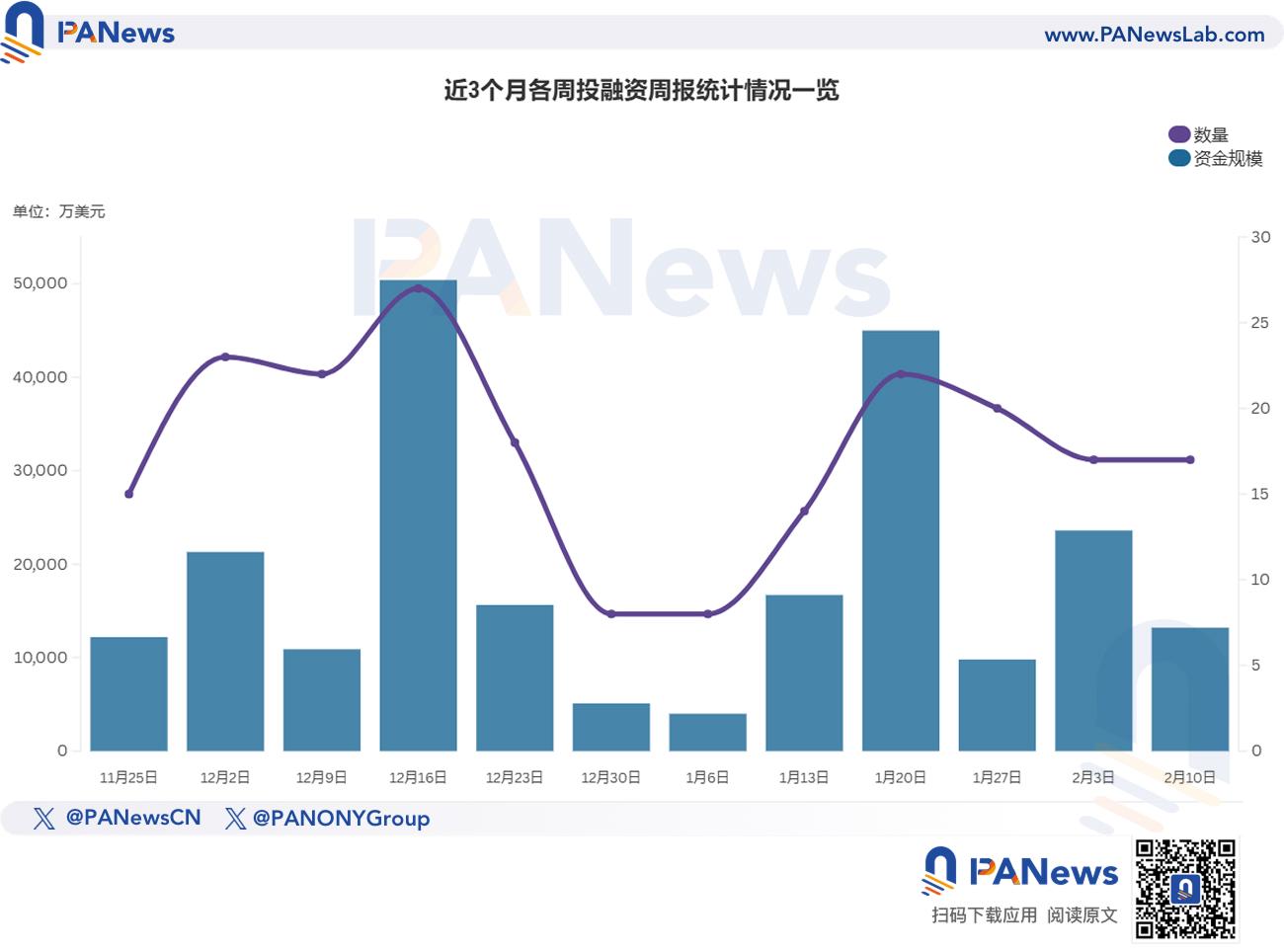

According to incomplete statistics from PANews, there were 17 blockchain investment and financing events around the world last week (2.3-2.9); the total funding amount exceeded US$132 million, which was a decrease compared to the previous week. The overview is as follows:

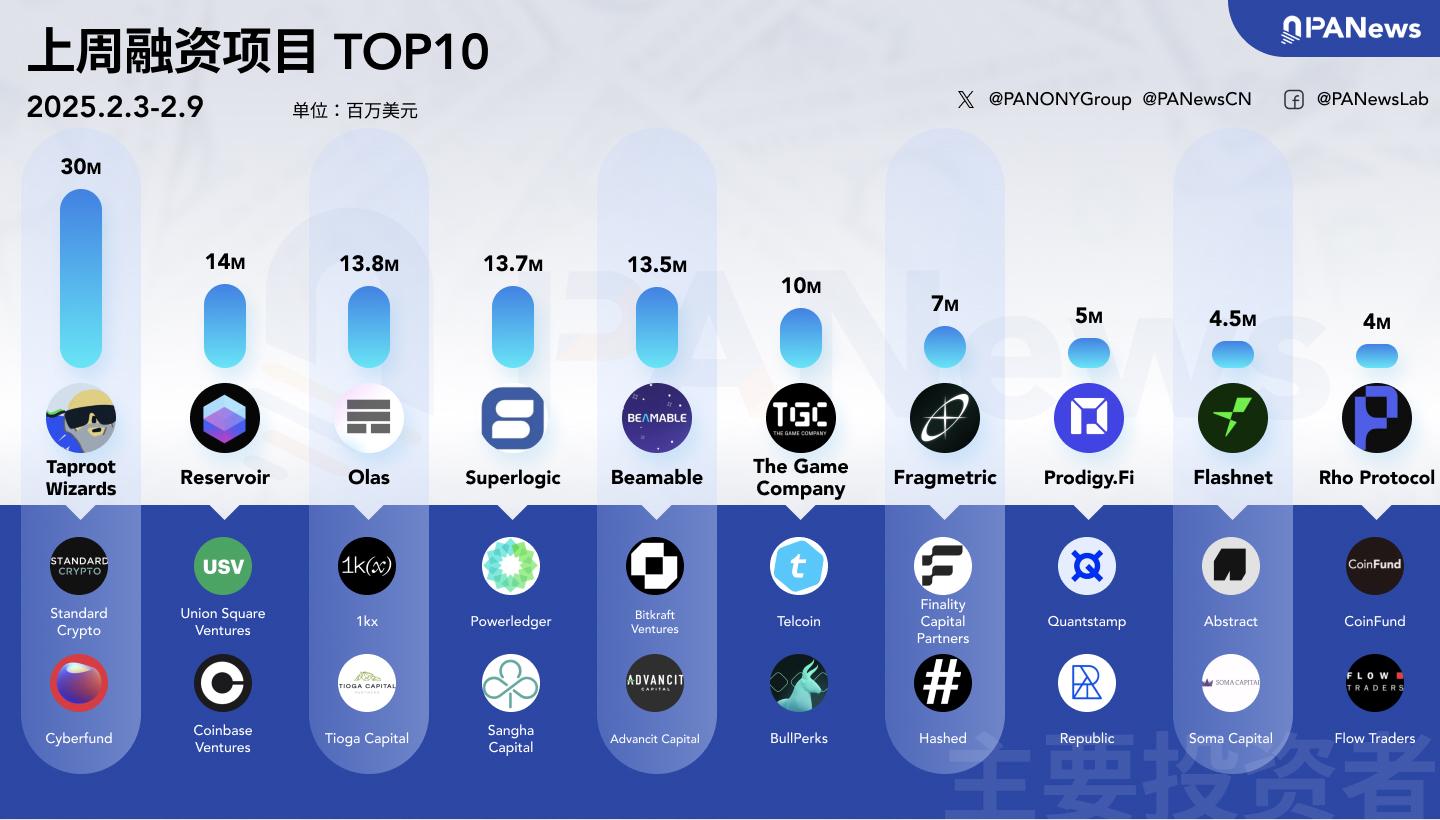

- DeFi announced four investment and financing events, among which Fragmetric announced that it had completed a $7 million seed round of financing, led by Finality Capital Partners and Hashed;

- The Web3 gaming track announced two investment and financing events, among which blockchain gaming infrastructure company TCG completed a $10 million financing, with Telcoin, BullPerks and others participating in the investment;

- One investment and financing event was announced in the AI+Web3 field. Olas, an autonomous AI agent platform in the crypto field, completed a $13.8 million financing led by 1kx.

- The DePIN track announced one investment and financing event. DePIN project Beamable completed a $13.5 million Series A financing, led by Bitkraft Ventures.

- The Infrastructure & Tools sector announced five investment and financing events, among which crypto trading infrastructure company Reservoir completed a $14 million Series A financing round led by Union Square Ventures;

- Two investment and financing events were announced in the Others category. Among them, Taproot Wizards is conducting a new round of financing of US$30 million, led by Standard Crypto;

- Centralized finance announced two investment and financing events. Hex Trust completed a new round of strategic financing led by Morgan Creek Digital.

DeFi

Solana Restaking Protocol Fragmetric Completes $7 Million Seed Round, Led by Finality Capital Partners and Hashed

Fragmetric announced that it has completed a $7 million seed round of financing, led by Finality Capital Partners and Hashed, with participation from Hypersphere, Presto Labs, Bitscale Capital, Halo Capital and Flowdesk, and support from several angel investors in the Solana and Restaking ecosystems. Fragmetric is committed to building the first Liquid Restaking site in the Solana ecosystem, focusing on NCN (Node Consensus Network) reward distribution and LST (Liquid Staking Tokens) management, aiming to optimize capital efficiency and enhance Solana's security and decentralization capabilities.

Prodigy.Fi Completes $5 Million Seed Round and Receives Funding from Berachain Foundation

Prodigy.Fi, a decentralized yield and on-chain dual investment trading platform, announced the completion of a $5 million seed round of financing, led by Quantstamp and Republic, with participation from Arbelosxyz, PANONY Group, RSK Capital and Samara Alpha. This round of financing will be used to promote its DeFi yield mining and trading product development on Berachain.

In addition, ProdigyFi has also received RFB funding from the Berachain Foundation and plans to distribute 10%-15% of BERA to testnet users as rewards.

Bitcoin native exchange Flashnet completes $4.5 million seed round, led by Abstract

Flashnet announced the completion of a $4.5 million seed round led by Abstract, with participation from UTXO, Soma Capital, HF0, Chapter One and other institutions. Flashnet is committed to building a permissionless, non-custodial native Bitcoin exchange, eliminating reliance on intermediaries, and fully on-chaining BTC transactions to reduce transaction costs, eliminate counterparty risk, and provide 24/7 permissionless access. In addition, Flashnet is working with Brale to launch USDB, the first Bitcoin stablecoin, and Privy to optimize the user experience. The platform plans to announce more details in the coming weeks and prepare for the official launch.

Rho Labs Completes $4 Million Seed Round, Led by CoinFund

Rho Protocol has completed a $4 million seed round of financing, led by CoinFund, with participation from Auros, Flow Traders and Speedinvest. Rho Protocol is the first native crypto interest rate market, providing perpetual contract financing, staking and lending rate transactions. Since the launch of the Beta version in June 2024, Rho has brokered more than $7 billion in trading volume, focusing on efficient interest rate derivatives trading and providing risk management tools for institutions, ETF issuers and stablecoins. The financing will be used to expand trading functions and institutional cooperation to promote the maturity of the crypto financial market.

Web3 Games

Blockchain gaming infrastructure company TCG completes $10 million in financing, with Telcoin, BullPerks and others participating

The Game Company (TCG), a Dubai blockchain cloud gaming infrastructure company, has completed a $10 million equity and token round of financing, with Telcoin and its CEO Paul Neuner, BullPerks, NodeMarket, HyperCycle and Singularity DAO participating. The company said that over the past two years it has built a platform that can be used to play any game on any device in the world through a PC or console, and uses its proprietary ultra-low latency cloud technology to deliver high-performance games. The Game Company has piloted the system with several early adopters. In September 2024, TGC announced a strategic partnership with Aethir, a GPU-based decentralized computing infrastructure provider. Since then, it has joined Google and Microsoft's startup programs.

GOAT Gaming, the AI gaming network on Telegram, completes $4 million in strategic financing

According to official news, GOAT Gaming, the AI gaming network on Telegram, announced the completion of a $4 million strategic financing, led by TON Ventures, Karatage, Amber Group, and Bitscale Capital, with participation from Framework Ventures, Mirana Ventures, and Folius Ventures. This financing brings the total financing of Mighty Bear Games, the game studio behind the game, to $15 million. According to reports, GOAT Gaming, created by Mighty Bear Games, is a gaming platform on Telegram that offers competitive and casual games with real cash prizes. The platform is powered by AlphaGOATs, autonomous AI agents that can compete, make money, and grow. Its AlphaAI tool suite enables third-party developers to seamlessly publish, monetize, and expand games. Earlier in July 2022, it was reported that the game studio MightyBearGames completed a $10 million financing, led by Framework Ventures.

AI

Olas, an autonomous AI agent platform in the crypto space, completes $13.8 million in financing, led by 1kx

Olas, an autonomous AI agent platform in the crypto field, has completed $13.8 million in financing to support the launch of an "agent app store" called Pearl. This round of financing was led by 1kx, and Tioga Capital, Sigil Fund, Zee Prime Capital, Borderless, Keyrock and other companies also participated in the investment. The Olas team said that the funds will be used to support its agent app store, which aims to achieve democratized access to user-owned AI agents. At the same time as announcing the financing, Olas also launched the Olas Accelerator program, which provides $1 million in funding and OLAS token rewards to developers who build agents on the platform. Olas's technology stack includes Olas Stack and Olas Protocol, which incentivize the creation and co-ownership of AI agents. The team said that it has facilitated more than 3.5 million transactions from agents on nine blockchains.

DePIN

DePIN project Beamable completes $13.5 million Series A financing, led by Bitkraft Ventures

Decentralized gaming infrastructure platform Beamable has completed a $13.5 million Series A financing led by Bitkraft Ventures, with participation from Arca, Advancit Capital, 2Punks, P2 Ventures, Solana Foundation, Scytale Digital, defy.vc, GrandBanks Capital and Permit Ventures. The new round of financing aims to accelerate the development and expansion of the Beamable Network, a decentralized physical infrastructure network (DePIN) that aims to change the way game backend infrastructure is built and operated.

Infrastructure & Tools

Crypto trading infrastructure company Reservoir completes $14 million Series A financing, led by Union Square Ventures

Reservoir, a provider of crypto token trading infrastructure, announced the completion of a $14 million Series A financing round, led by Union Square Ventures, with participation from Coinbase Ventures, Variant, Archetype, 1kx, and others. Union Square Ventures partner Nick Grossman joined the Reservoir board of directors. After this round of financing, the company will expand to full-chain token trading. Its products include Relay (a cross-chain bridge and exchange platform for Solana, Bitcoin, Tron, and EVM chains), Reservoir Swap (a decentralized trading API), and Reservoir NFT (NFT market and API). CEO Peter Watts said the company's goal is to support the seamless flow of millions of tokens between thousands of chains and promote innovation in financial and cultural applications. The current Reservoir team has 25 people and plans to expand to 40 people by the end of the year, focusing on recruiting members of the product, engineering, design, and marketing teams.

Enterprise-level loyalty platform Superlogic completes $13.7 million Series A financing, led by Powerledger

Superlogic, an enterprise-level loyalty platform driven by blockchain and artificial intelligence, announced the completion of the first round of Series A financing of US$13.7 million, led by Powerledger, and investors include Sangha Capital, 10SQ, Nima Capital, Actai Unicorn Fund, Hyla Liquid Venture Fund, Liquid 2 Ventures, etc. In addition, blockchain and enterprise funds such as Amex Ventures, Galaxy Interactive, Mirabaud Lifestyle Impact and Innovation, and Recharge Capital also participated in the investment. This round of financing brings Superlogic's total equity financing to over US$21 million, which will accelerate its provision of white-label experience technology for global brands. Superlogic uses AI-driven technology to provide customers with personalized reward experiences, and helps brands improve user loyalty through API integration or white-label platforms.

Crypto startup Coala Pay completes $3.5 million seed round

Crypto startup Coala Pay has completed a $3.5 million seed round of financing, led by Castle Island Ventures, with participation from Lattice Fund, Factor Capital, and the founders of crypto charity platform The Giving Block. The company will use the funds from this round of financing to expand its team and recruit employees with experience working for the United Nations and the U.S. government. According to reports, the company is committed to connecting humanitarian aid organizations with potential donors. Coala Pay helps review donors and local aid organizations, requiring both parties to provide detailed documents to prove their legitimacy. Once both parties are whitelisted, each party can access the other's files as needed. Instead of signing a physical contract, Coala Pay creates a smart contract for stablecoin transactions and generates a token to store information and track the use of funds.

Encrypted collaboration terminal project Herd completes $1.8 million Pre-Seed round of financing

The crypto collaboration terminal project Herd announced the completion of a $1.8 million Pre-Seed round of financing, led by Semantic Ventures, with participation from Archetype and Hardi Meybaum. According to reports, Herd is developing a collaboration terminal, or "coterminal," designed to simplify interaction with on-chain contracts. The platform enables users and AI agents to collaboratively search, understand, and write existing on-chain contracts as off-chain and on-chain outputs.

RWA end-to-end solution Fraktion completes 1.1 million euros in seed round financing, with Tezos Foundation and others participating

Fraktion, an end-to-end RWA solution, announced the completion of a €1.1 million seed round of financing, with participation from Cabrit Capital, Tezos Foundation, Vox Capital, and well-known angel investors such as Olivier Huby, Andréa Bensaïd (Eskimoz) and Guillaume Mayot (Lukeion). Fraktion will be launched on the Tezos blockchain in mid-2023 and is committed to the tokenization and management of real-world assets. Fraktion's technology combines simplicity and performance to help B2B clients quickly launch investment platforms while reducing operating costs and cultivating investor loyalty. The new funds are intended to accelerate the development of its technology platform and expand its influence in the field of real-world assets.

other

Ordinals

Taproot Wizards is raising $30 million in a new round of financing, led by Standard Crypto

Bitcoin Ordinals project Taproot Wizards is raising $30 million in its first post-seed round. This round of financing is led by Standard Crypto, an early supporter of Taproot Wizards, and participated by Cyberfund, Collider Ventures and other institutions. The project will use the new funds to promote the development of the OP_CAT ecosystem to enhance Bitcoin's smart contract capabilities.

It is reported that Taproot Wizards was founded in 2023. In February 2023, the minting of Taproot Wizard #0001 produced a 4MB block, which was the largest block and transaction in Bitcoin at that time. The team also launched the Ordinals series Quantum Cats, which is currently the highest market value among Bitcoin NFT projects.

Meme

Berachain Ecosystem Meme Coin Project Henlo Completes $3 Million Seed Round Financing, with Framework Ventures and Others Participating

Henlo, a meme coin project driven by the Berachain ecosystem community, announced the completion of a $3 million seed round of financing, with participation from Framework Ventures, SNZ Capital, Rubik VC, Baboon VC, Paramount Capital, Primitive Ventures, Asylum Ventures, etc. According to reports, Henlo.com is a community-driven meme coin project built in the Berachain ecosystem. It was founded with the spirit of humor and the uninhibited spirit of cypherpunks, aiming to redefine the way people interact with cryptocurrency by valuing culture rather than practicality.

Centralized Finance

Hex Trust Completes New Round of Strategic Financing Led by Morgan Creek Digital

Hex Trust, a digital asset custody and market service provider, has officially announced that it has completed a new round of strategic financing, led by Morgan Creek Digital and participated by Injective. Although the company did not disclose the specific amount of this round of financing, it disclosed that its total financing has exceeded US$100 million. Hex Trust also stated that it will launch a C round of financing later this year and make potential strategic acquisitions. Its business currently covers Hong Kong, Singapore, Dubai, France and Italy.

Crypto payment company INXY Payments completes $3 million in new round of financing, led by Flashpoint VC

Crypto payment company INXY Payments announced the completion of a new round of financing of US$3 million, led by Flashpoint VC and participated by a group of angel investors. It is reported that INXY Payments is headquartered in Cyprus and has obtained EU authorization to integrate crypto payments into traditional business operations and ensure compliance. The new funds are intended to be used to optimize its multi-currency processing, automatic payment and cryptocurrency and legal currency conversion functions.

Venture Capital Fund

0G Foundation launches $88 million fund to promote AI-driven DeFi agents

0G Foundation announced the establishment of an $88 million ecological fund to promote the development of AI-driven decentralized finance (DeFi) applications and autonomous financial agents (DeFAI). Investors include Hack VC, Delphi Ventures, Bankless Ventures, OKX Ventures, etc. 0G Labs co-founder Michael Heinrich said that the combination of AI and blockchain is ushering in a critical moment. The fund will support applications such as automated revenue optimization, on-chain trading robots, decentralized insurance agents, cross-chain arbitrage, and expand to supply chain automation, AI governance, decentralized scientific research and other fields.

NEAR Foundation Establishes $20 Million AI Agent Fund to Promote Decentralized AI Development

The NEAR Foundation announced the establishment of a $20 million AI Agent Fund to promote the development of decentralized AI. The fund will focus on investing in autonomous and verifiable AI agents built on NEAR technology and deploy them on-chain in the coming months. Investment targets include innovative applications such as agent tokenization, AI role-playing games, and permissionless AI oracles, with the goal of expanding the application scenarios of the integration of Web3 and AI. The fund will cooperate with ecological projects such as the Horizon AI accelerator and AI hackathon to support developers in exploring NEAR's unique advantages in combining AI and blockchain, and promote the large-scale development of decentralized AI agents.

StarkWare launches $4 million venture capital fund to accelerate blockchain innovation in Africa

Blockchain developer StarkWare launches $4 million venture capital fund to accelerate blockchain innovation in Africa. The fund aims to provide African entrepreneurs and builders with everything they need to create blockchain-based startups in Africa. This includes:

- Financial support: Grants up to $150,000, with more advanced teams receiving larger investments (typically up to $500,000)

- Infrastructure to meet all its needs, either directly on Starknet or as a Starknet appchain/L3s

- Guidance and technical expertise to help them succeed

Ayrıca Şunları da Beğenebilirsiniz

Optum Golf Channel Games Debut In Prime Time

Google's AP2 protocol has been released. Does encrypted AI still have a chance?