XRP at $2.02 vs Digitap ($TAP) Crypto Presale – Which Is the Best Banking Token for 2026?

Ripple’s XRP has successfully defended its $2.00 support level multiple times, sparking excitement across the market. After several years of legal pressure, unachieved breakthroughs, and multiple delays, most investors thought XRP would explode once the regulatory uncertainty cleared.

Despite currently trading at $2.02, its upside momentum appears muted. In the meantime, retail investors have turned to Digitap ($TAP), an omni-bank ecosystem. The platform is built around real payments, no-KYC options, and global crypto-to-fiat settlement, emerging as the banking token with the strongest upside potential going into 2026.

The crypto market is no longer excited by promises. Users prefer functional financial tools that protect them in volatile conditions. While XRP represents the old vision of blockchain banking, Digitap represents the future of the sector. Although it is still in its crypto presale stage, Digitap offers real utility.

Investors now wonder, which model will dominate the next era of digital banking?

XRP Strong at $2.02 as Digitap Redefines Crypto Banking

XRP supporters highlight its resilience after the token survived multiple lawsuits, regulatory confusion, and bear markets. Despite the recent market downturn, XRP defended the $2.00 support level and now trades around $2.02, proving that the banking narrative is thriving. Cross-border settlement remains practical, institutional liquidity still exists, and XRP’s speed is undeniable.

However, XRP’s technology has not changed from previous years. Furthermore, the promises of RippleNet mass adoption are yet to happen at scale. Large financial institutions prefer custom software layers over relying directly on the XRP token. While XRP has strong fundamentals, it fails to capture the optimal value of its underlying network.

XRP’s main weakness is its dependency on institutional adoption. Retail investors cannot build utility significantly. The coin’s performance depends on regulatory clarity, corporate partnerships, and enterprise onboarding cycles that advance slowly.

In a world focusing on decentralized finance, user-controlled banking, and privacy-first financial tools, XRP seems traditional. This is where Digitap comes in and reshapes the industry. Its omni-bank ecosystem makes crypto spendable for normal users, making $TAP a good crypto to buy this December.

$TAP’s Crypto Presale Surges as Its Omni-Bank Delivers Early Utility

Digitap is thriving in its crypto presale stage because it flips the old model inside out. Instead of waiting for top financial institutions to integrate the technology, Digitap is building a fully functional banking ecosystem. The platform allows users to choose their privacy tier, control their funds, and move money globally without restrictions.

The app is already live, and its wallet already works. Users can download it and onboard without waiting for a corporate roadmap. This early-stage utility explains why Digitap’s presale is gaining traction.

Digitap’s omni-bank ecosystem merges crypto, fiat, payments, settlement, and global banking on one platform. It eliminates the need to use multiple apps to transact between crypto and fiat. In a time when markets are unpredictable and volatile, real-world financial tools become more valuable than speculation and hype.

XRP Serves Banks — Digitap Serves People

XRP was primarily built to serve banks. Digitap is built to serve people.

XRP depends on institutional trust. On that note, banks have to adopt Ripple’s technology for the XRP token to thrive. This extensive institutional dependency slows XRP’s momentum because traditional financial institutions move cautiously, not aggressively.

Meanwhile, Digitap is designed for users who want privacy, speed, and flexibility without giving up control to a centralized authority. Users can accept crypto today and change it into fiat instantly. Additionally, the platform supports cross-border payments without high fees.

Digitap is delivering banking use cases that XRP promised years ago directly to individuals, without requiring global financial institutions to change their infrastructure. In a mostly fearful, liquidity-starved market, people trust what they can see and use. Thus, the $TAP crypto presale is a great investment opportunity this December.

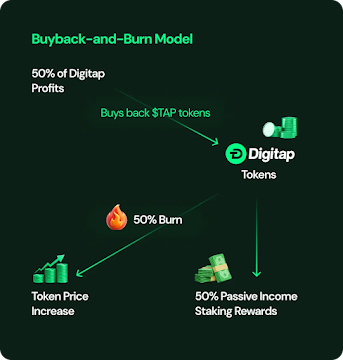

$TAP’s Revenue-Backed Burns Create the Scarcity XRP Lacks

Digitap’s mechanics are designed to benefit token holders. Normal users can profit from an ecosystem that generates real revenue via its financial services. Some of that revenue will be used to buy $TAP tokens from the market and burn them. This strategy reduces supply, creates structural price support, and enhances long-term valuation.

XRP does not have such a system because its supply is large, centrally released, and influenced by Ripple’s escrow unlocks. While XRP’s tokenomics are perfect for stability, they lack the huge upside potential that a crypto presale token with live utility can deliver.

Digitap’s fixed supply and revenue-based burns ensure that supply is continuously reduced. For long-term investors, this strategy creates a built-in scarcity engine that persists irrespective of market conditions. Modern crypto investors want a financial product that works even when the market is stagnant or volatile.

XRP’s Stability Shines, But $TAP’s Presale Offers Real Multipliers

XRP’s dominance thrives from its massive utility. In that context, the project is recognized globally, traded widely, and listed on leading exchanges. However, high liquidity goes hand-in-hand with high maturity. Since it is a large token, XRP would need a huge inflow to record multiple gains.

On the other hand, Digitap is in its crypto presale stage and could deliver massive multiplier growth in 2026. Despite being in early development stages, the project is building infrastructure that enables it to avoid the risks connected to vaporware presales.

Digitap has passed SolidProof and Coinsult audits. This has helped users to feel safe in a market heavily affected by uncertainty and volatility. It has also gained user traction and raised significant capital in its presale with minimal marketing. Thus, it offers an opportunity for early investors to see huge returns in the coming months.

While XRP is likely to remain stable in 2026, Digitap is positioned to grow exponentially.

Holiday Surge: Digitap’s Festive Sale Drops 24 Rewards in 12 Days

Digitap has introduced something huge after a strong crypto presale performance in the completed rounds. It has launched a 12-day Christmas event to reward investors while the rest of the market struggles in the red zone. This Digitap Christmas sale offer is appealing.

The $TAP coin is deeply discounted. Interestingly, it is now available at a better rate through the festive drops that run from December 13–24.

Every 12 hours, users will access new surprises that range from free Premium and PRO accounts to massive $TAP bonuses. Thus, the festive campaign will offer 24 rewards in 12 days. This event also includes limited-slot and time-restricted gifts.

Remarkably, this event features glowing advent boxes, green-and-gold visuals, and a snow-globe countdown. Once the holiday drop is over, mega festive offers and a New Year countdown will follow. Users can just log in, open the Offers tab, and collect rewards before they disappear permanently.

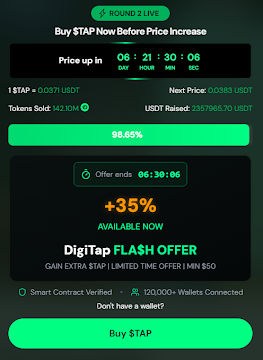

Digitap Surges Past $2.3M as Presale Heats Up at 73% Discount

Digitap has raised over $2.3 million in early funding, dominating the crypto market this year due to its growth potential and massive banking utility.

Currently selling at $0.0371, $TAP’s crypto presale low entry price explains why investors are buying aggressively. More than 142 million $TAP tokens have been sold. Interestingly, the current price is a 73.5% discount from the launch value of $0.14.

Digitap Leads the New Era of Blockchain Banking

The future of blockchain banking will be determined by user adoption, real utility, and demand for privacy. Although XRP is relevant, it represents the old digital banking model. Digitap represents the new model offering users global access, control of their funds, and practical financial tools that work regardless of market conditions.

As more users seek alternatives to traditional banking, demand migrates to platforms that offer stability, flexibility, and personal financial control. Digitap is well-positioned for the transition. Going into 2026, investors no longer wonder whether blockchain banking will grow; they ask which token will dominate the growth.

Currently, Digitap is leading that race. Therefore, $TAP is one of the best altcoins to buy this December.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post XRP at $2.02 vs Digitap ($TAP) Crypto Presale – Which Is the Best Banking Token for 2026? appeared first on Live Bitcoin News.

Ayrıca Şunları da Beğenebilirsiniz

The Channel Factories We’ve Been Waiting For

XRP Price Prediction: Can Ripple Rally Past $2 Before the End of 2025?