First Football Media Rights RWA Pool Launched on Chiliz Chain

The startup Decentral has launched what it calls the first football media-rights real-world asset (RWA) pool on Chiliz CHZ $0.0302 24h volatility: 7.1% Market cap: $306.17 M Vol. 24h: $36.05 M Chain, expanding the sports-focused network into tokenized cash flows tied to broadcasting deals. The move adds a new capital-markets angle to Chiliz’s ecosystem, which has so far been driven primarily by fan tokens and SportFi applications.

Decentral’s new pool packages revenue from football media rights into on-chain instruments that investors can access through Chiliz Chain infrastructure. The product targets sports-related cash flows, such as broadcasting and sponsorship income, positioning them as yield-bearing RWAs within a permissioned structure focused on regulatory compliance, according to the announcement.

The launch fits into a broader push by Chiliz to open a “sports RWA” vertical, including tokenized revenue-share notes and long-term royalty structures linked to sports IP, according to their website and their recent launches. By placing these instruments, Chiliz and Decentral aim to give clubs and rights holders additional funding channels while exposing crypto-native investors to football-linked income streams.

Chiliz’s Role in Sports Web3

Chiliz operates a dedicated, EVM-compatible layer-1 blockchain designed for sports organizations, powering fan engagement products such as Socios fan tokens and SportFi apps. The network works with more than 70 major clubs and leagues, enabling tokenized fan rewards, NFT drops and other on-chain experiences built around existing sports brands.

Beyond fan tokens, Chiliz Chain supports NFT marketplaces, Web3 loyalty programs and now RWA tokenization for tickets, collectables and income-generating rights in sport. This specialization is meant to attract teams, sponsors and rights holders that want blockchain-based financing or engagement tools without building infrastructure from scratch.

CHZ Drops 6% Amid Modest Selling Pressure

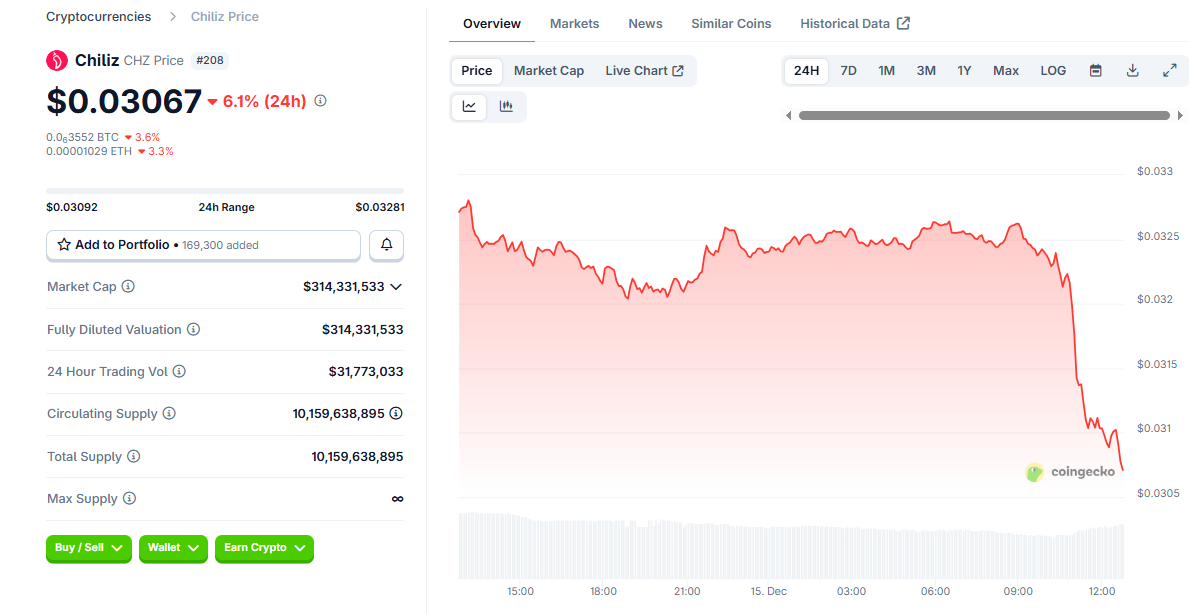

The Chiliz token (CHZ) is trading at around 0.0308–0.0325 USD today, with the latest readings at 0.03072 USD, according to the article’s publication date. Over the last 24 hours, the token has slipped 6%, reflecting modest selling pressure after earlier gains in November, according to Coingecko.

CHZ price down 6% | Source: Coingecko

Market data places CHZ’s capitalization in the low hundreds of millions of dollars, ranking it in the 200s among tracked cryptocurrencies. Today looks relatively flat, with short-term movement around current levels, suggesting traders are still assessing the impact of the new RWA strategy and recent partnerships in the sports vertical.

nextThe post First Football Media Rights RWA Pool Launched on Chiliz Chain appeared first on Coinspeaker.

Môže sa vám tiež páčiť

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?