On-chain investigation MrBeast: How did the "world's number one internet celebrity" with 300 million fans make more than $20 million by promoting tokens?

Original article: MrBeast Investigation

Authors/Contributors: @hxnterson , @kasperloock , @angelfacepeanut , @somaxbt , @rfparson

Compiled by: Zen, PANews

MrBeast (real name Jimmy Donaldson) is the most popular blogger on Youtube, perhaps the only one. His channel has more than 325 million subscribers, and a video that is "outdated" for 4 months can still get 156 million views on platform X in a week and earn $260,000. He is well-deserved to be the "world's number one internet celebrity."

But he has been in the spotlight lately for various controversies. These include allegations of fake videos, running illegal lotteries, and hiring employees with questionable backgrounds. MrBeast has also come under fire for his involvement in cryptocurrency, with YouTube users Rosana Pansino and DogPacks404 among those speaking out about the issue. However, their investigation only scratched the surface of MrBeast's cryptocurrency activities.

Since then, a team of researchers has conducted a more detailed analysis and found connections to more than 50 cryptocurrency wallets associated with MrBeast. Their findings show that MrBeast has a long history of insider trading, misleading investors, and using his influence to promote tokens, which he then dumped on the market. This article will delve into the various tokens and insider trading associated with these allegations, investigate MrBeast's activities in his more than 50 secret wallets, and expose insider trading and suspicious transactions.

MrBeast’s wallet address “Network”

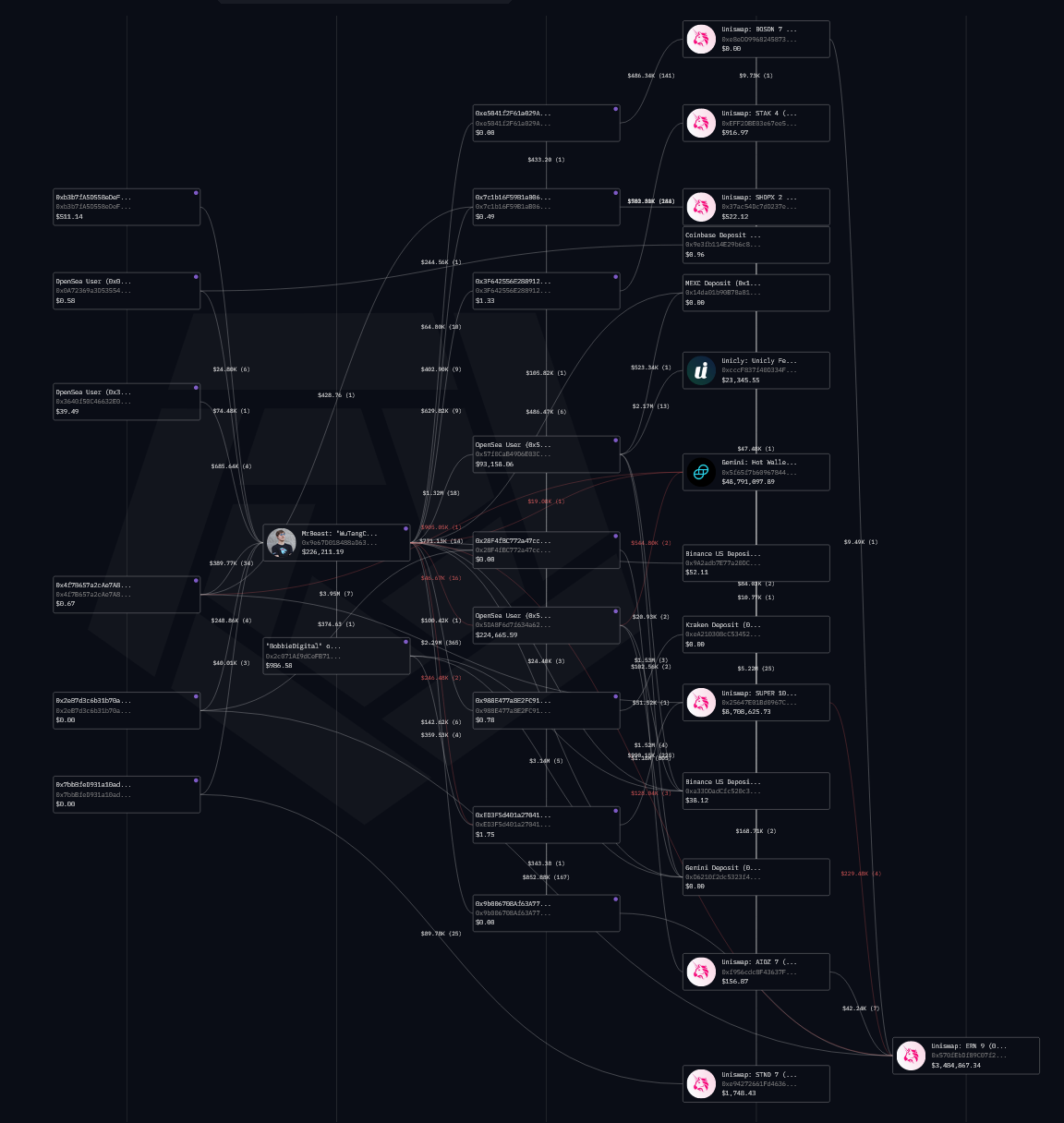

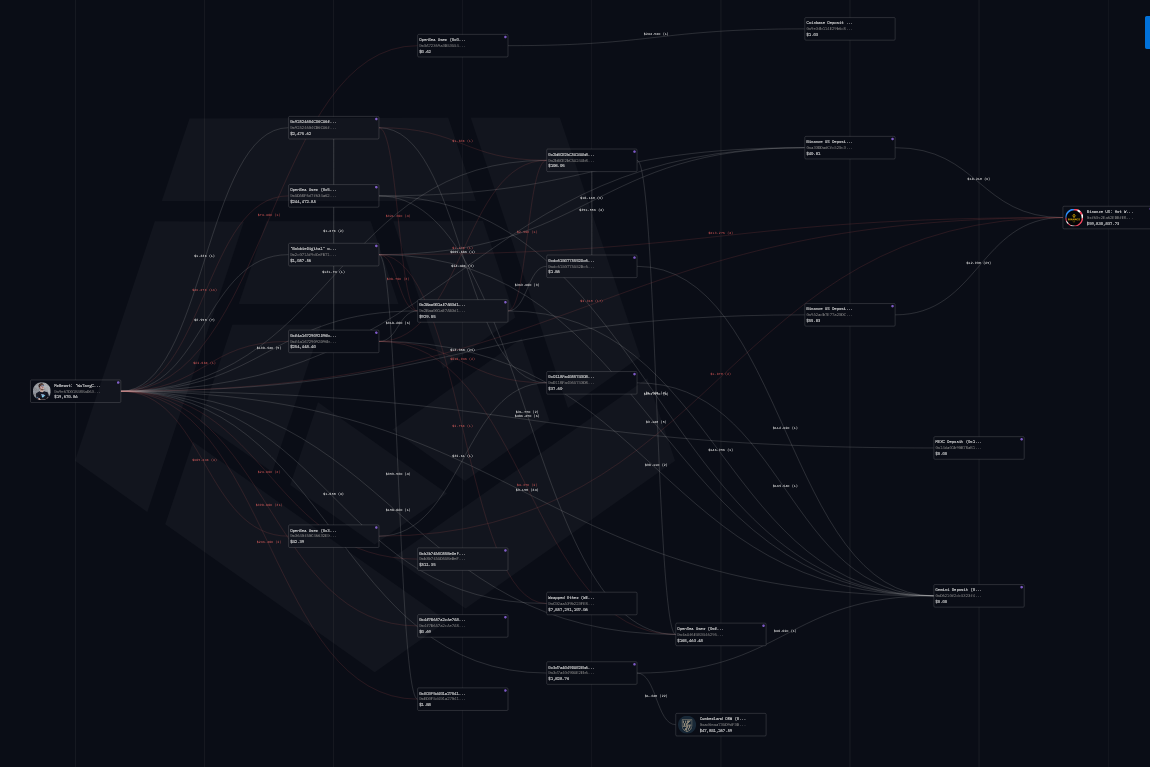

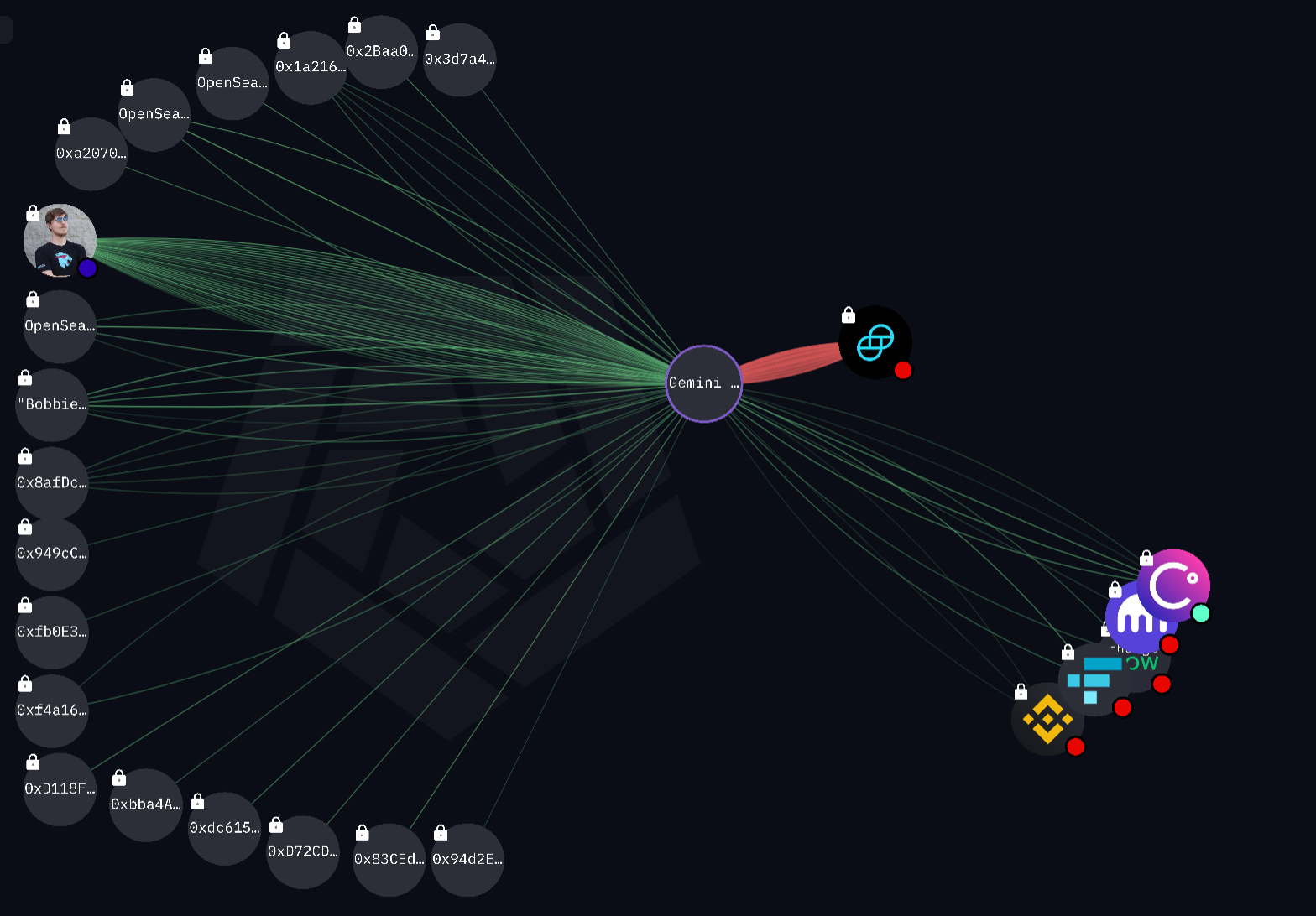

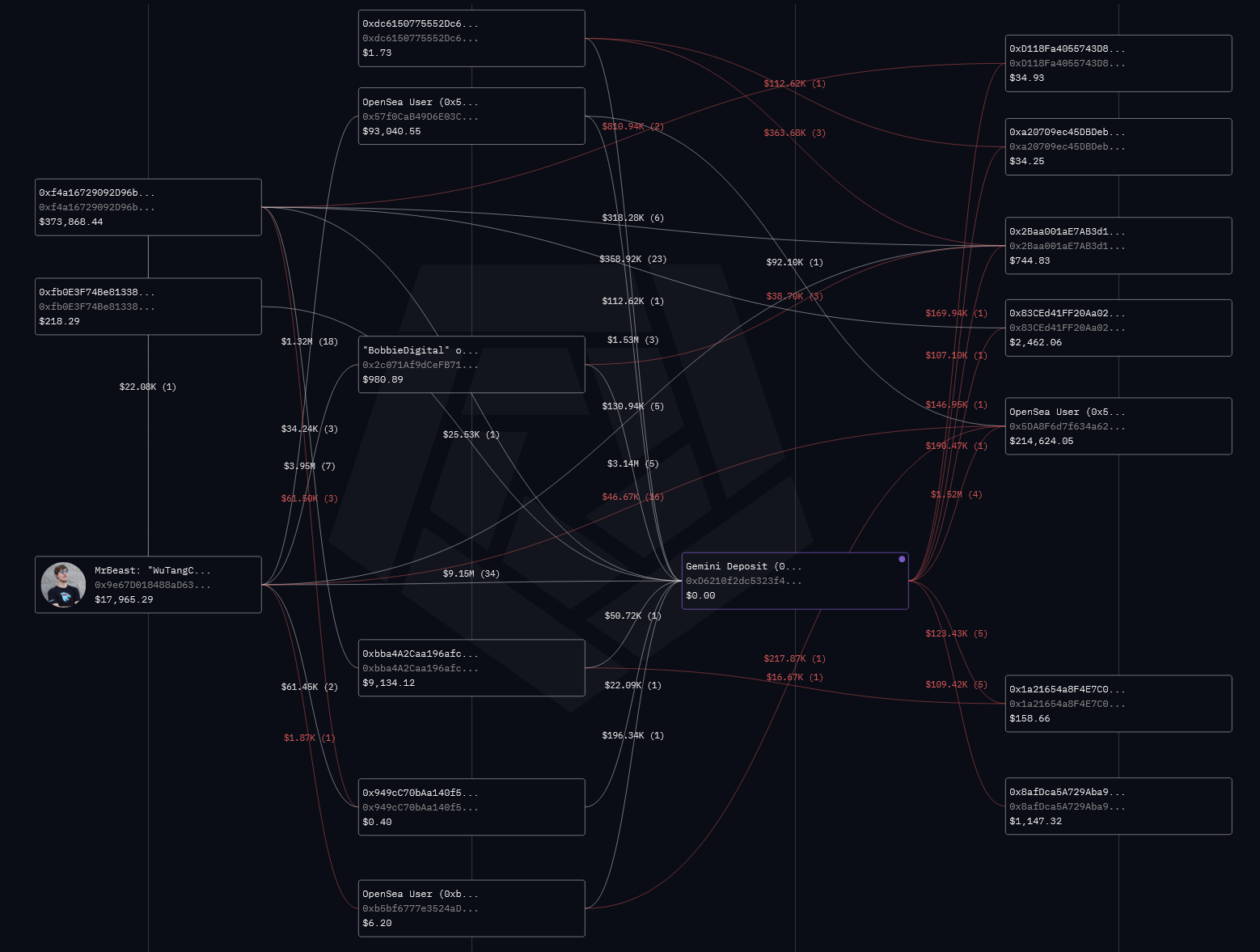

First, to identify wallets associated with MrBeast, on-chain researcher @angelfacepeanut mapped MrBeast’s wallet network:

On-chain analyst @hxnterson added a few more wallets:

MrBeast’s main wallet address is 0x9e67D018488aD636B538e4158E9e7577F2ECac12, and multiple secondary wallets are usually branched from this address. As mentioned in the tweet in the figure below, he has publicly revealed his wallet address many times, such as when he announced the purchase of CryptoPunks. In addition, in multiple projects related to MrBeast, such as SuperFarm, ERN, Refinable, etc., related allocations were also sent to this wallet 0x9e6.

In a podcast clip, MrBeast discussed his acquisition of CryptoPunks and VeeFriends, which is consistent with his on-chain activity, showing that he purchased VeeFriends in two wallets. One of the wallets is: 0x3640f50C46632E03F2677f85Ec0372a8Dd70b8f4 .

While MrBeast uses a variety of exchanges, his most common ones are Gemini and Binance. The total amount of transfers to his Binance account exceeds $13 million.

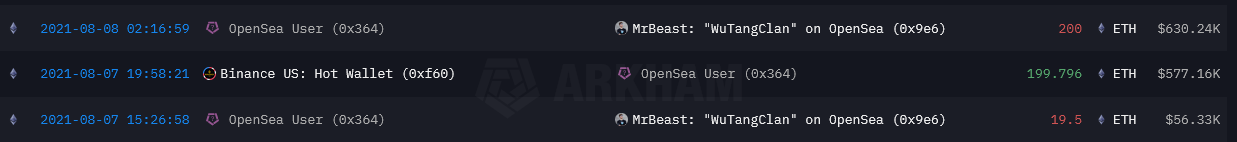

The aforementioned wallet 0x364 belongs to Binance, and then transferred 200 ETH (worth $630,240) to MrBeast’s main wallet 0x9e6. This wallet interacted with 0xb5bf6777e3524aD0ffCC5a37375cc49a4BE92F64, which had a large outflow to Gemini’s deposit address 0xD6210f2dc5323f4a1B4b766a0e732d6DfA26935B (sent $196,340 to this deposit address).

Although many of MrBeast's wallets are connected to each other and have a lot of money flowing into each other, an important piece of evidence connecting them to MrBeast is the shared deposit address. Specifically, when you want to deposit funds to an exchange, the exchange creates a deposit address, which is often reused. When we look at MrBeast's web wallets, most of them share the same deposit address 0xD62. This means that when MrBeast wanted to send funds to his Gemini exchange, he used the address 0xD62 provided by Gemini, and here you can see that several wallets associated with MrBeast also send funds to this exchange address.

Gemini Deposit 0xD62 Wallet Interaction:

In this trace, we put the Gemini deposit address 0xD62 at the center, with all the MrBeast-related wallets surrounding it. You can see how they interact with each other and how large amounts of money flow in and out of each other.

But while the shared Gemini deposit address 0xD62 is a strong indicator, the researchers used other factors to link MrBeast to the wallet. These factors include large inflows from MrBeast-confirmed wallets, large outflows to MrBeast-confirmed wallets, and their level of interaction with other MrBeast-related wallets.

A good example is the 'BobbieDigital' wallet 0x2c07, which has a large inflow from MrBeast - millions of dollars worth of tokens are sent to it for farming, and then transferred to Binance and Gemini deposit address 0xD62, the latter of which is an exchange frequently used by MrBeast. At the same time, this wallet also sends funds to several other wallets associated with MrBeast and conducts token transactions through MetaMask (a common feature of MrBeast wallets). Therefore, it can be strongly suggested that this is his wallet. After investigation, about 25 wallets associated with MrBeast have been identified.

SuperVerse (formerly SuperFarm)

The first project was SuperFarm (now called SuperVerse). SuperVerse is a cryptocurrency token that promises to do everything from building an NFT marketplace to integrating with games to create gaming economies, promising games like Pizza Heroes and Imposters, though development on both of those games is on indefinite hold.

SuperVerse was heavily promoted by individuals such as EllioTrades. Ellio is a YouTube crypto marketer with a questionable history of promoting crypto tokens to his fans and then selling them. Alex Becker also promoted SUPER and mentioned it in his videos. Influential influencers such as MrBeast, KSI, and LazarBeam also promoted the token to their fans, with on-chain activity showing that MrBeast, KSI, and LazarBeam made more than $10 million in profits.

SUPER conducted a pre-sale ICO for public investment, with each $SUPER token selling for $0.02. However, at launch, the price of SUPER increased 50 times, jumping to $1 each. Early public investors thought they had made a 50x profit, but ultimately had their investment refunded through a legal loophole. However, investors such as MrBeast and KSI reaped the rewards of their investment and sold the tokens to their followers.

A leaked screenshot from an EllioTrade livestream shows his Twitter communications, indicating MrBeast’s interest in committing $100,000, which is likely for the $SUPER presale.

MrBeast used his brand and influence to promote Super, tweeting about Super from his Twitter /X account:

MrBeast replied "👀" to @SuperFarmDAO in a now-deleted tweet. @SuperFarmDAO has since gone private and changed its name to @SuperVerse, and MrBeast now follows them.

KSI, who is connected to MrBeast’s network, also participated in the marketing of $SUPER and subsequently sold it to his followers (see Zach XBT’s X thread for details).

On-chain history

Summarize

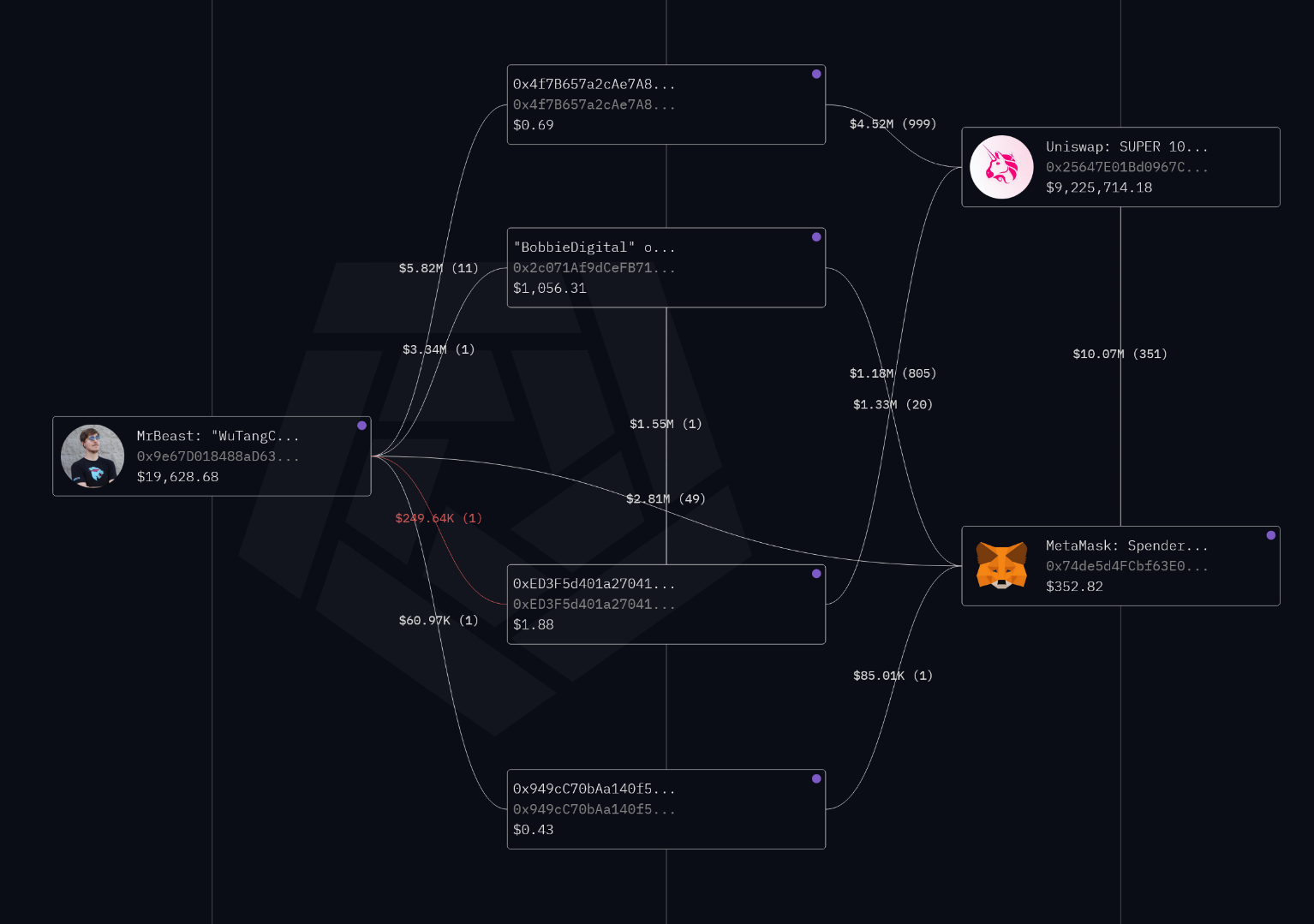

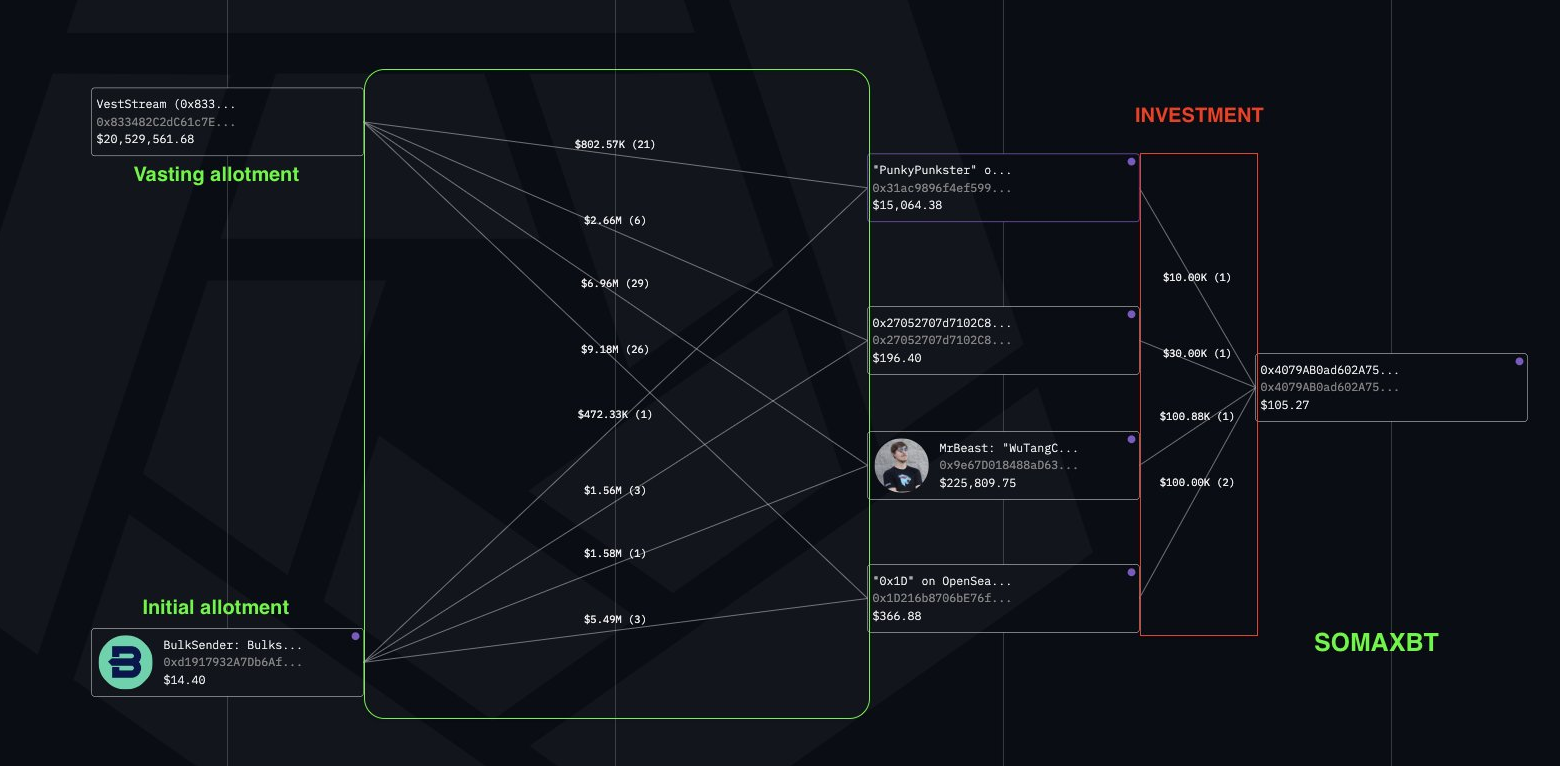

MrBeast's wallet received an initial batch of 1 million SUPER tokens in his primary wallet 0x9e6. This wallet distributed the supply to a secondary wallet 0x4f7 which was designated for farming in small increments between March and June 2021. Over time, MrBeast continued to receive SUPER supply and distributed it to three wallets, the primary of which was his 'BobbieDigital' wallet 0x2c0 which farmed between August and October 2021, with the supply then moving to 0xED3 to farm over a similar time period and finally to 0x949 which sold $80,000 worth of tokens in August 2024. Overall, MrBeast made a profit of $7.5 million from his initial $100,000 investment.

Detailed analysis

The SomaXBT X thread shows pre-sale investments and allocations matching the leaked DM conversation.

- On February 22, 2021, MrBeast’s wallet received an initial batch of 1 million SUPER tokens in his main wallet 0x9e6.

- On March 30, 2021, MrBeast sent 1 million SUPER tokens (worth $3.62 million) to his secondary wallet 0x4f7B657a2cAe7A8808Df1D889838d5Da33007ae8.

- On March 30, 2021, over the next few days, wallet 0x4f7 sold almost all of the supply.

Over the next few months, MrBeast’s primary wallet 0x9e6 received multiple token unlocks, which were then sent to secondary wallet 0x4f7:

- May 8, 2021: 237,670 SUPER (worth $526,790)

- May 10, 2021: 94,662 SUPER (worth $213,810)

- May 12, 2021: 113,425 SUPER (worth $232,320)

- May 18, 2021: 250,640 SUPER (worth $379,230)

- May 20, 2021: 135,207 SUPER (worth $126,420)

- May 27, 2021: 258,727 SUPER (worth $246,270)

- June 9, 2021: 785,292 SUPER (worth $451,690)

- June 19, 2021: 468,968 SUPER (worth $239,890)

During this period, wallet 0x4f7 withdrew $6,271,959.19.

- On July 27, 2021, wallet 0x4f7 sent 360,250 SUPER (worth $213,880) to MrBeast’s main wallet.

- Between June and August, MrBeast’s SUPER-related activities were temporarily quiet, but he accumulated several token unlocks.

- On August 16, 2021, MrBeast transferred 3,506,000 SUPER (worth $3,340,000) to his “BobbieDigital” wallet 0x2c071Af9dCeFB7155659B662480CbB867997739.

- On August 17, 2021, the 0x2c0 'BobbieDigital' wallet sent 1,500,000 SUPER (worth $1,550,000) to the secondary wallet 0xED3F5d401a270416e5008ce35E07Eb0721D6f8B4.

Between August 17 and September 9, 2021, 0xED3F5 sold almost the entirety of its SUPER supply, making a profit of $1,173,601.06.

On September 18, 2021, 0xED3F5 transferred the remaining 335,000 SUPER (worth $249,640) back to the main wallet 0x9e6.

On October 6, 2021, 0x2c0 sold all of his SUPER holdings for a profit of $1,236,915.03.

On September 18, 2021, 0xED3F5 transferred the remaining 335,000 SUPER (worth $249,640) back to the main wallet 0x9e6.

On October 6, 2021, 0x2c0 sold all of his SUPER holdings for a profit of $1,236,915.03.

Subtracting MrBeast’s $100,000 pre-sale investment and the $240,800 purchase cost in 2023, the total profit for all wallets is approximately $11,447,453.96

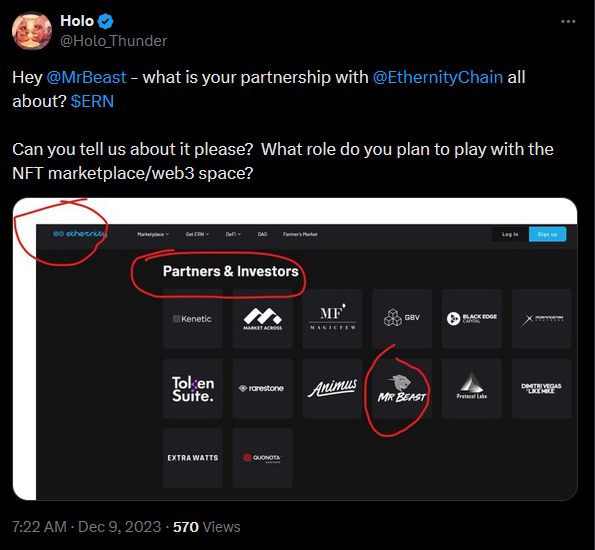

ERN (Ethernity Chain)

Launched in 2021, Ethernity Chain was originally a platform focused on verifying the authenticity of NFTs and providing a secure digital collectibles trading market. It quickly gained attention through exclusive series endorsed by celebrities such as Muhammad Ali and Perrey. The platform is based on Ethereum and provides users with a trusted NFT trading space.

More recently, Ethernity has moved toward Layer 2 solutions, aiming to enhance the scalability of blockchains in the entertainment sector and integrate artificial intelligence to improve functionality.

However, the project is mainly driven by two cryptocurrency evangelists, KoroushAK and Cryptorand.

MrBeast comments on EthernityChain on X platform

MrBeast branding used on ERN website

MrBeast and ERN collaborate on Twitter Space

On-chain history

Summary

MrBeast received a large amount of tokens from the ERN presale and then accumulated more supply. He transferred about half of the ERN tokens to 0x2eB7 and then the remaining tokens to 0x9b00. Both wallets sold their tokens shortly after, returning a total of $1,835,033. Five months later, MrBeast received the next batch of token allocations and sold them on the market, returning $2,976,277. A few months later, MrBeast received a smaller unlock fund and held it.

Detailed analysis

- 2021-03-08 MrBeast main wallet 0x9e6 received 72k ERN tokens from presale (worth $458,000 at the time)

- 2021-03-08 MrBeast purchased $128,000 worth of ERN in three transactions.

- 2021-05-03 MrBeast transferred 35k ERN to the side wallet 0x2eB7d3c6b31b70a480D4aF1BD8cD05c1b10d38d6 (worth $647,000 at the time)

- 2021-05-04 MrBeast's 0x2eB7 wallet started selling all its holdings, and the wallet was emptied within a day. The 0x2eB7 wallet made a profit of $857,062.

2021-05-04 MrBeast transferred 43k ERN to side wallet 0x9b00 (worth $1.06 million at the time)

2021-05-04 Similar to 0x2eB7, MrBeast’s 0x9b00 wallet sold all ERN in one day and made a profit of $977,971.5.

2021-10-29 MrBeast main wallet allocated 181.8k ERN tokens (worth $2.04 million)

2021-10-30 MrBeasts main wallet 0x9e6 then sold all ERN supply, returning $2,976,277.

2021-05-26 MrBeast's main wallet 0x9e6 allocated 54.5k ERN (worth $1.175 million)

2024-10-18 MrBeast moved his supply to new wallet 0x5ba, which he still holds and has not sold.

After deducting MrBeast's initial purchase, MrBeast netted $4,649,337.96 across three wallets.

AIOZ

AIOZ is another token that MrBeast invested in and received a good return from. AIOZ is a token that claims to be the DePin for Web3 AI, Storage, and Streaming. AIOZ marketed MrBeast’s initial investment as support for its project.

MrBeast is mentioned as a supporter on the AIOZ website

On-chain history

MrBeast received AIOZ allocations at two different times:

- 2021-04-02 833.33k AIOZ Sent to MrBeast

- 2021-04-13 This allocation was sent to wallet 0x28F4fBC772a47cc08cD7Eb5a9a2420300cbefCff

- 2021-05-02 166.667k AIOZ Sent to MrBeast

- 2021-05-11 Then send this allocation to the same wallet 0x28F

Starting from 0x28F4, MrBeast sold his holdings within a month. After 225 transactions, MrBeast's profit was calculated to be approximately $1,005,059 (from Debank)

Refinable

Refinable is a crypto project that aims to become a well-known NFT marketplace. It has attracted a lot of attention because its backers include well-known figures such as MrBeast, who follow the project on Twitter, increasing its visibility and credibility in the crypto community. Refinable also uses MrBeast's brand image on its website to promote its cryptocurrency.

On-chain activities

MrBeast received Refinable (FINE) token allocations on two dates:

- April 27, 2021 208.333K tokens (561.19K USD)

- May 23, 2021 59.584K tokens (49.49K USD)

On-chain history shows that MrBeast sold his position after the launch and made a profit of $193,926.

Although Refinable hit an all-time high of $4 when it launched, it currently trades at less than $0.002, down 99.96% since launch.

As part of the MrBeast network, KSI has also invested in Refinable, buying it before the August/September 2021 surge.

insider trading

An analysis of MrBeast’s wallet revealed that he had invested in cryptocurrency projects multiple times during the pre-sale period, earning lucrative returns. Unlike active trading, MrBeast only made a few investments, all of which were highly successful.

The researchers compiled a list of investments MrBeast has made that have yielded huge returns. They believe this is the result of insider trading, as MrBeast, as a full-time content creator, is mostly focused on his social media brand and his various businesses and partnerships. Cryptocurrency investing requires time and focus, sifting through hundreds of potential investment opportunities to find the right ones. Given MrBeast’s track record of earning huge returns as a full-time content creator and owner of multiple businesses, it is highly likely that his success in cryptocurrency investing is not the result of sharp trading instincts, but simply knowledge of insider information, especially regarding upcoming brand deals and partnerships in his network, including figures such as KSI, GaryVee, and LazarBeam.

Investigations revealed striking similarities in the cryptocurrency activities of MrBeast, KSI, LazarBeam, and Alex Becker, most of whom had collaborated with MrBeast on YouTube. On-chain analysis showed that they were also involved in many of the same projects. This suggests that they may have had insider information about promotions and opportunities before the public was aware of them, allowing MrBeast to reap significant gains with just a few strategic investments.

In addition to the projects mentioned above, the survey also found that MrBeast-related projects include CryptoPunks, VeeFriends, SHOPX, XCAD, Jigstak (STAK), Polychain Monsters (PMON), Boson Protocol (BOSON), Standard Protocol (STND), Ally Direct (DRCT), Ternoa (CAPS), METIS L2 (METIS), PlayMetaGods, MetaWars, etc. MrBeast's income from these projects is also very considerable, mostly concentrated around US$600,000, and the lowest STND is also US$130,000. For more detailed analysis and research, please refer to the original report.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm