US economic data disappoints again, leaving the crypto market in a state of flux. A complete analysis of short-term, medium-term, and long-term trends.

By Axel Bitblaze

Compiled by Tim, PANews

Many people must be wondering whether the current trend of the crypto market is a fluctuation before breaking through new highs, or a signal that the market has reached its peak?

In reality, it’s not that simple. The short, medium, and long term scenarios can look very different.

I will provide a comprehensive analysis of BTC, ETH, and altcoins before they enter each stage:

Now let’s get straight to the point: the next few months will determine how this cycle plays out, and I think this tweet is worth revisiting.

Let’s start with what’s happening now.

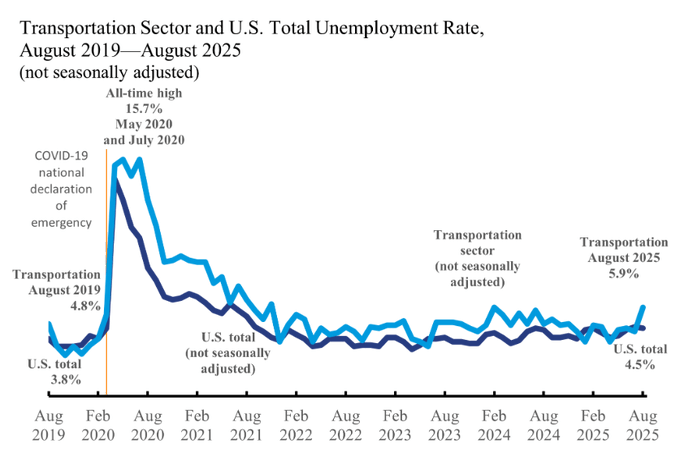

Data last Friday showed the unemployment rate climbed to 4.3%, the highest level since 2021.

Nonfarm payrolls showed just 22,000 jobs added, compared to expectations for more than three times that.

The U.S. job market has been surprisingly strong for years.

Even as growth slows, hiring remains strong.

This report changes that trend.

This is the first time since the outbreak that both unemployment and hiring rates have turned red at the same time.

The market reacted immediately to the news.

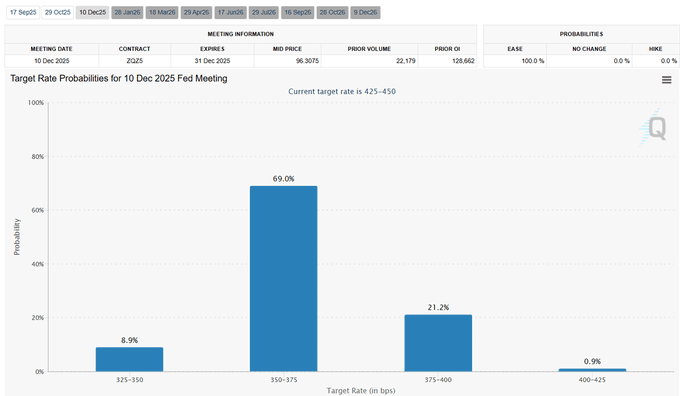

Futures market pricing shows that the market believes the probability of a rate cut in September has reached 100%.

Most expect a 25 basis point rate cut, but the Fed could still opt for a 50 basis point cut.

Beyond that, traders see a greater than 75% chance of three or more rate cuts in 2025.

The turning point finally came.

But there is one thing you need to understand, a rate cut does not mean that everything will immediately go up and not down.

The reason is that interest rate cuts will not affect everything overnight.

For cryptocurrencies, the short-term, medium-term, and long-term outlooks will be very different.

Short-term impact

The short-term impact is likely to be bearish.

When unemployment rises, it first triggers fears of a recession in the market.

This is why gold is hitting new all-time highs while risk assets are underperforming.

Here's what might happen:

- Bitcoin may retest its recent lows.

- Ethereum and altcoins could drop 10–20% or more.

But that doesn't mean the cycle is over.

This reflects how traders behave when negative economic data first hits: they sell risky assets and move into safe assets.

Medium-term impact

With the Fed's rate cuts imminent, the bond market will adjust and yields will fall.

Lower yields mean more borrowing and lending, leading to higher spending.

It will also help companies increase borrowing to expand their businesses or conduct buybacks.

Increased spending means higher profits for companies, and their stock prices will soar.

When stocks rise, Bitcoin and altcoins tend to rise even more.

A new change has emerged in this cycle: institutional entry.

Spot Bitcoin and Ethereum ETFs have opened up direct channels for pension funds and asset management companies; approval of altcoin ETFs is also imminent.

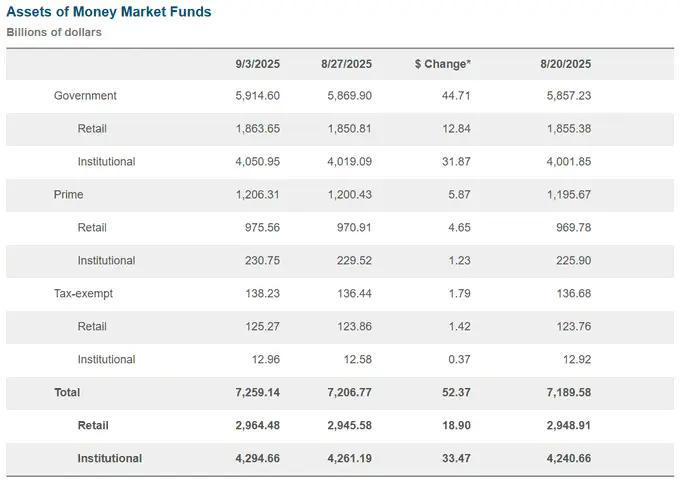

In addition, there is $7.2 trillion in funds parked in money market funds, which will see outflows if Treasury yields start to fall.

Imagine if even just 1% of the funds flowed into cryptocurrencies, it would be enough to push Bitcoin and altcoins to new highs.

That's why the fourth quarter of 2025 looks so important.

Liquidity will start to return.

The stock saw more buying.

And cryptocurrencies may be the biggest winners among all risk assets.

Bitcoin typically leads trends while altcoins lag, but in past cycles their biggest gains have come near the end.

If history repeats itself, early 2026 could be a frenzy phase for altcoins as Bitcoin stabilizes at higher levels.

Long-term effects

After the mid-term rebound, risks reappear.

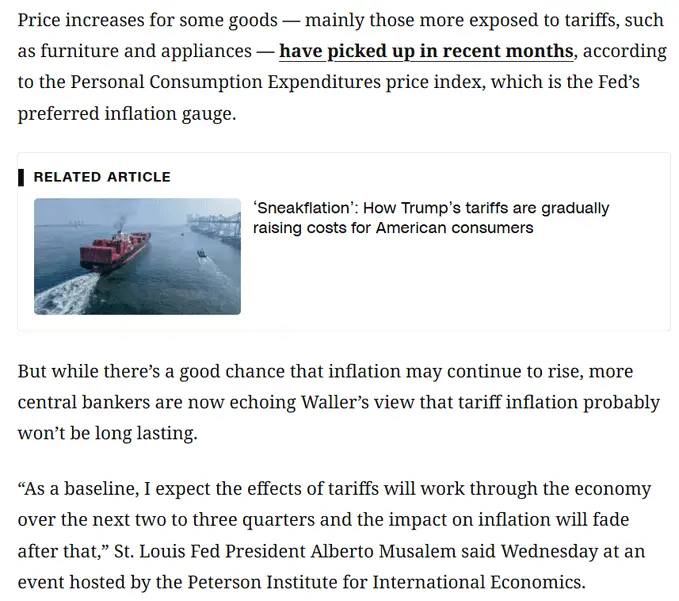

The tariffs introduced earlier this year will take another 6-8 months to fully show up in inflation data.

This suggests that early 2026 could be the time when inflation starts to rise again.

If inflation climbs while unemployment remains high, the Fed may be forced to pause its rate cuts or even raise them again due to concerns about stagflation.

The combination of a weak job market and rising prices has historically typically marked the end of an economic cycle.

It is environmental factors that may trigger a stock market crash and a crypto bear market.

So the script is this:

- Short term (next 3-4 weeks): market volatility, pullbacks, and panic trading.

- Medium term (Q4 2025 to January 2026): Liquidity returns, Bitcoin hits new highs, and altcoins enter a frenzy phase.

- Long term (from Q1 2026): Inflation risks rise and the Fed’s response could mark a cycle top.

Final Thoughts

Last Friday's weak jobs data suggested one thing: the Fed is about to pivot.

Typically, a shift in Fed policy signals poor economic conditions, so a short-term adjustment seems likely.

But as things unfold, I think the crypto market will be the biggest winner by Q4 2025.

You May Also Like

U.S. Moves Grip on Crypto Regulation Intensifies

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include: