Comparing Six Deep Learning Feature Extractors for CBIR Tasks

Table of Links

Abstract and 1. Introduction

-

Materials and Methods

2.1 Vector Database and Indexing

2.2 Feature Extractors

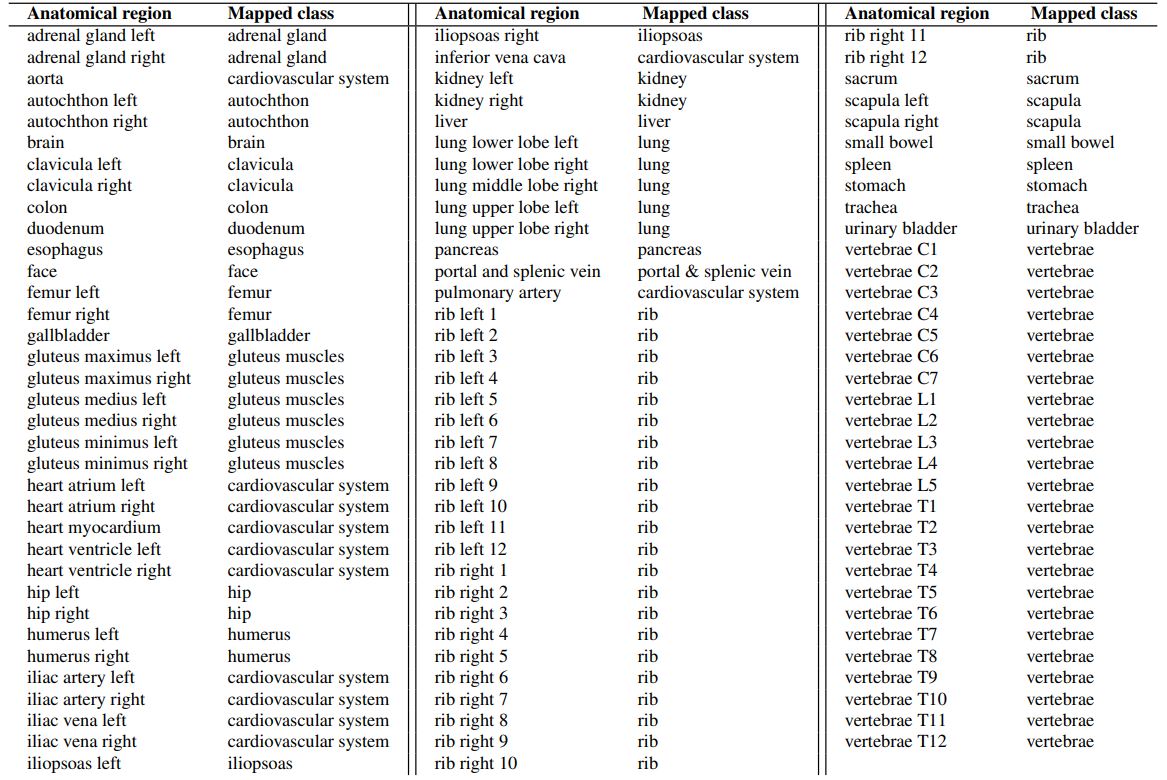

2.3 Dataset and Pre-processing

2.4 Search and Retrieval

2.5 Re-ranking retrieval and evaluation

-

Evaluation and 3.1 Search and Retrieval

3.2 Re-ranking

-

Discussion

4.1 Dataset and 4.2 Re-ranking

4.3 Embeddings

4.4 Volume-based, Region-based and Localized Retrieval and 4.5 Localization-ratio

-

Conclusion, Acknowledgement, and References

2.2 Feature Extractors

We extend the analysis of Khun Jush et al. [2023] by adding two ResNet50 embeddings and evaluating the performance of six different slice embedding extractors for CBIR tasks. All the feature extractors are based on deep-learning-based models.

\

\ Self-supervised Models: We employed three self-supervised models pre-trained on ImageNet [Deng et al., 2009]. DINOv1 [Caron et al., 2021], that demonstrated learning efficient image representations from unlabeled data using self-distillation. DINOv2 [Oquab et al., 2023], is built upon DINOv1 [Caron et al., 2021], and this model scales the pre-training process by combining an improved training dataset, patchwise objectives during training and introducing a new regularization technique, which gives rise to superior performance on segmentation tasks. DreamSim [Fu et al., 2023], built upon the foundation of DINOv1 [Caron et al., 2021], fine-tunes the model using synthetic data triplets specifically designed to be cognitively impenetrable with human judgments. For the self-supervised models, we used the best-performing backbone reported by the developers of the models.

\ Supervised Models: We included a SwinTransformer model [Liu et al., 2021] and a ResNet50 model [He et al., 2016] trained in a supervised manner using the RadImageNet dataset [Mei et al., 2022] that includes 5 million annotated 2D CT, MRI, and ultrasound images of musculoskeletal, neurologic, oncologic, gastrointestinal, endocrine, and pulmonary pathology. Furthermore, a ResNet50 model pre-trained on rendered images of fractal geometries was included based on [Kataoka et al., 2022]. These training images are formula-derived, non-natural, and do not require any human annotation.

\

:::info Authors:

(1) Farnaz Khun Jush, Bayer AG, Berlin, Germany (farnaz.khunjush@bayer.com);

(2) Steffen Vogler, Bayer AG, Berlin, Germany (steffen.vogler@bayer.com);

(3) Tuan Truong, Bayer AG, Berlin, Germany (tuan.truong@bayer.com);

(4) Matthias Lenga, Bayer AG, Berlin, Germany (matthias.lenga@bayer.com).

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

You May Also Like

The Next Bitcoin Story Of 2025

Strategy Defines Its Bitcoin Stress Point After Q4 Volatility