Dogecoin Dips Before Major Breakout? Here’s the Scoop

TL;DR

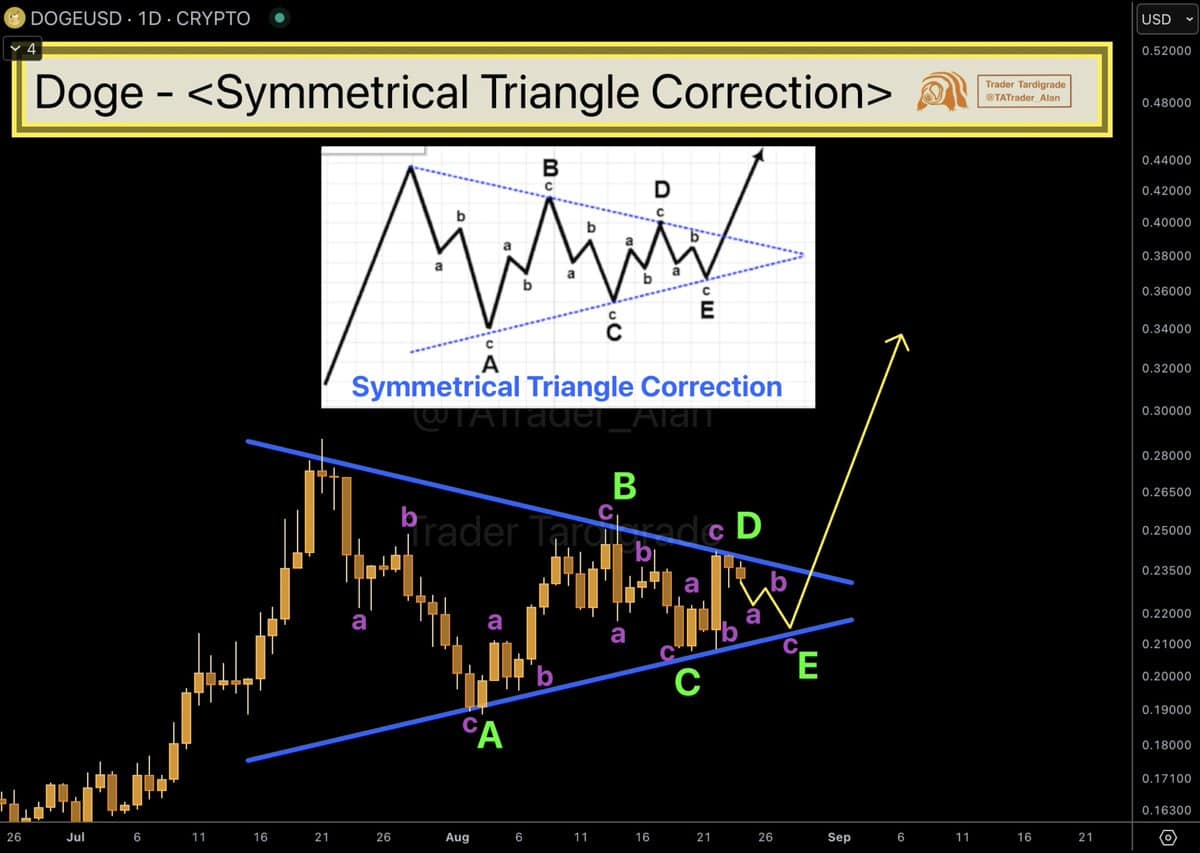

- Dogecoin forms a triangle pattern, with analysts closely watching the $0.25 resistance and $0.22 support levels.

- The price compresses near a breakout zone, signaling a potential move toward $0.31 or a drop to $0.19.

- Mixed market sentiment and rising crypto developments add fuel to Dogecoin’s tightening price action.

Price Action and Key Levels

Dogecoin (DOGE) was trading below $0.23 at press time, with a 24-hour decline of 4%, while it has remained flat on the weekly chart.

Meanwhile, trading volume reached over $3 billion during the same period. The recent price movement comes as DOGE forms a symmetrical triangle on the 4-hour chart, a structure commonly linked to periods of tightening price action.

Analyst Ali Martinez shared a chart showing the price nearing the lower boundary of this pattern. He commented that there may be “one last dip before the breakout.”

Support is marked at $0.22, while resistance sits near $0.24. A move beyond this zone could lead to $0.26, $0.28, and $0.31, based on common retracement extensions.

Technical Outlook From Analysts

Martinez believes DOGE could rally toward $0.3 if the current setup plays out. The price action is compressing near the triangle’s apex, often a signal of an incoming move. If the asset closes below $0.22, however, the setup may break down, bringing $0.209 and $0.19 into focus.

Another analyst, Trader Tardigrade, examined the daily chart through the lens of Elliott Wave Theory. They noted that Dogecoin appears to be in a five-part correction pattern, commonly labeled A through E.

According to their interpretation, “a motive wave in uptrend will follow this correction pattern.” This aligns with previous market cycles where such corrections are followed by trend continuation.

The pattern remains intact and is approaching its end phase. Traders are watching for confirmation on direction as the price narrows within the structure.

Source: X

Source: X

$0.25 Resistance and Market Setup

Umair, a chart analyst on X, pointed to the $0.25 resistance level as a key zone. He noted that “recovering this will lead to 31c,” but added that failure could push DOGE back to $0.21 or $0.1949. The level has held as resistance multiple times in recent months.

Technical indicators show the Relative Strength Index (RSI) near 57, which reflects steady momentum without extreme buying pressure. The asset is currently squeezed between a rising support trendline and horizontal resistance.

Volume remains average, with no confirmation of a breakout yet. A move above $0.25, accompanied by rising volume, may validate the pattern.

Broader Market Context and Sentiment

MarketProphit shared that sentiment around DOGE is currently mixed. While general trader sentiment shows optimism, the platform’s proprietary model remains cautious. This split in outlook reflects current uncertainty in the market.

Several industry developments could be contributing to increased attention. The Federal Reserve has softened its stance on crypto banking regulations.

Elsewhere, Thumzup acquired Dogehash in a $50 million deal. The company stated this move creates the largest Dogecoin mining operation to date.

The post Dogecoin Dips Before Major Breakout? Here’s the Scoop appeared first on CryptoPotato.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

BNB Chain Takes Lead in RWA Tokenization, Expert Sees BNB Rally to $1,300

Read the full article at coingape.com.