Ripple Eyes Trillion-Dollar Status as Garlinghouse Outlines Long-Term Strategy

Ripple CEO Brad Garlinghouse has sparked industry debate after stating that the crypto sector will eventually produce trillion-dollar companies, and that Ripple intends to be one of them.

As of February 2026, Ripple’s valuation stands near $40 billion, following a $500 million funding round in late 2025. Reaching a $1 trillion valuation would require approximately 25x growth from current levels, a target Garlinghouse addressed during XRP Community Day on February 11–12, 2026.

Strategy: From Acquisitions to Integration

After deploying billions of dollars in acquisitions during 2025, including the $1.25 billion purchase of Hidden Roadand the $1 billion acquisition of GTreasury, Ripple is shifting focus in 2026 toward integration.

Rather than continuing aggressive expansion, the company plans to unify its acquired infrastructure into a consolidated institutional financial platform. The objective is to create a seamless stack that combines liquidity, custody, treasury, and settlement capabilities under one ecosystem.

Garlinghouse emphasized that scale will depend not only on expansion, but on operational cohesion.

XRP as the Core Growth Engine

Garlinghouse reiterated that XRP remains central to Ripple’s long-term thesis, describing it as the “North Star” guiding the company’s strategy. He argued that Ripple’s enterprise value will expand in parallel with adoption of the XRP Ledger (XRPL) as a bridge for institutional liquidity and regulated financial rails.

Ripple CEO Brad Garlinghouse

Ripple CEO Brad Garlinghouse

The premise is straightforward: as XRP becomes embedded in cross-border settlement and tokenized asset infrastructure, Ripple’s positioning as the primary infrastructure provider strengthens proportionally.

Institutional Adoption Outlook

Monica Long projected that by the end of 2026, roughly half of Fortune 500 companies will have formal digital asset strategies in place. Ripple aims to serve as a core infrastructure partner for these institutions as an estimated 5–10% of capital markets settlement gradually migrates on-chain.

The broader bet is not simply on crypto asset appreciation, but on institutional workflow migration.

Key 2026 Initiatives

Institutional DeFi

The upcoming XLS-66 amendment to the XRP Ledger is designed to enable institutional yield generation directly on-chain, allowing participants to earn returns on XRP holdings within regulated frameworks.

Regulated Stablecoin Infrastructure

Ripple continues expanding the role of its RLUSD stablecoin, positioning it as a compliant settlement asset. RLUSD has recently met criteria for eligible collateral in U.S. derivatives markets, strengthening its utility within institutional trading environments.

Privacy Enhancements

The company is exploring Zero-Knowledge Proof (ZKP) technology to introduce confidentiality layers required by banks handling complex financial transactions.

XRP ETF Demand

Since their late-2025 launch, spot XRP ETFs have recorded over $1.2 billion in net inflows, indicating sustained institutional interest despite short-term price volatility.

The Long-Term Equation

For Ripple to reach a trillion-dollar valuation, institutional adoption, tokenized asset growth, regulatory clarity, and XRP network expansion would all need to scale simultaneously. The company’s 2026 focus appears centered on consolidating infrastructure and aligning enterprise growth with broader on-chain financial migration.

Whether the trillion-dollar milestone materializes will depend on execution and market conditions, but the strategy outlined suggests Ripple is positioning itself not as a speculative crypto firm, but as foundational infrastructure for digital capital markets.

The post Ripple Eyes Trillion-Dollar Status as Garlinghouse Outlines Long-Term Strategy appeared first on ETHNews.

You May Also Like

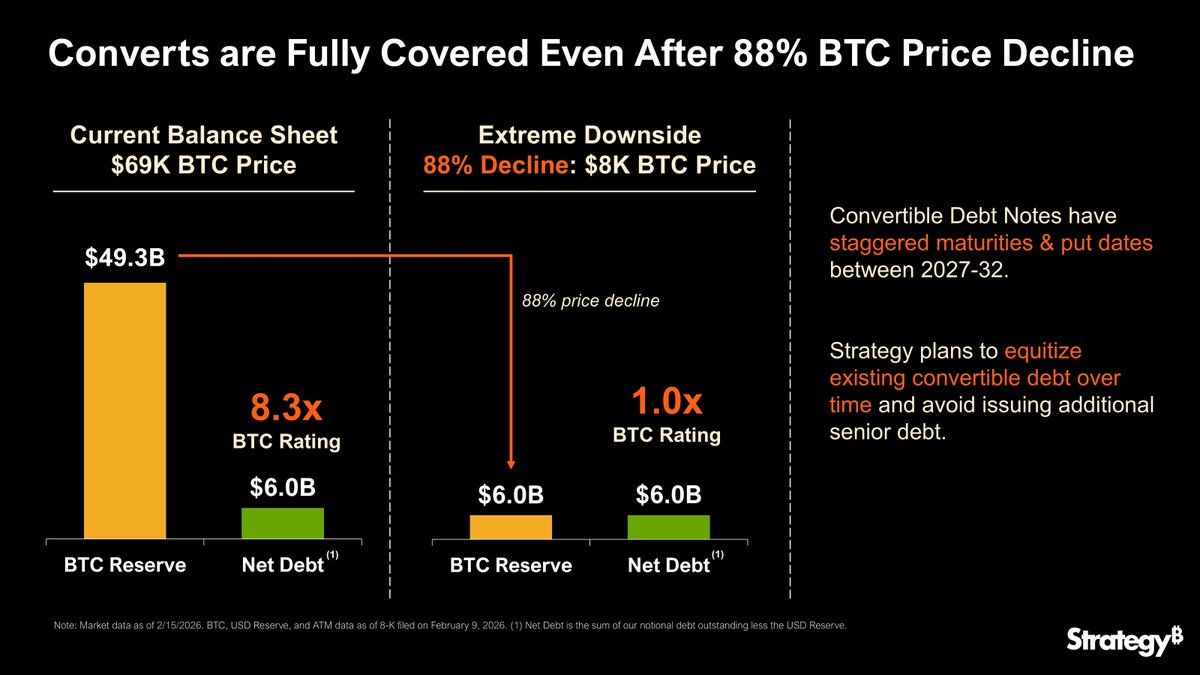

Strategy Can Fully Cover $6 Billion In Debt if Bitcoin Drops 90%, But What Happens Below That Line?

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more