We Have a New Ethereum All–time High

For years, Ethereum has been the forgotten middle child. Bitcoin basked in its “digital gold” narrative, sucking up ETF approval headlines and Wall Street’s reluctant love. Solana played the fast, flashy younger sibling, while Ethereum quietly kept building.

Until this week, ETH hadn’t touched its 2021 high of $4,878. Meanwhile, Bitcoin blew past its 2021 peak months ago. For Ethereum, the lag was embarrassing—a protocol with the most developer activity and the backbone of DeFi, yet still stuck under its own ceiling.

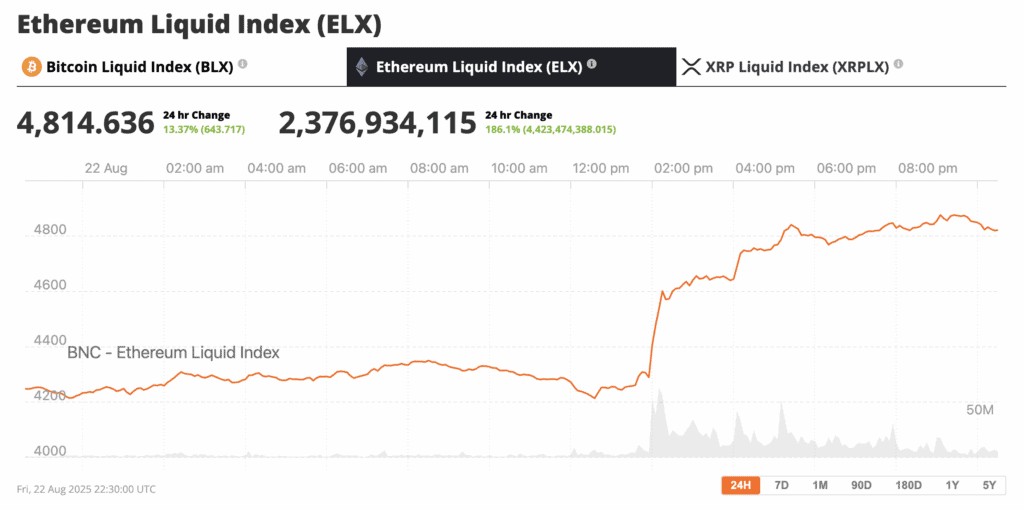

Not anymore. On Friday, ETH shot up nearly 15% in 24 hours, hitting $4,879 according to BNC, beating its old record by a single dollar. Symbolic? Yes. But in markets, symbolism is fuel.

Ethereum has achieved a new all time high, source: Ethereum Liquid Index

The Powell Catalyst

The proximate trigger was Jerome Powell’s Jackson Hole speech, where he all but waved the white flag on interest rates. The Fed Chair hinted at cuts ahead, sending risk assets—and especially crypto—into overdrive. Bitcoin jumped almost 2.5% in minutes. Ethereum, more sensitive to liquidity flows, ripped nearly 8% in an hour.

This is the first time in years ETH has outpaced BTC in momentum. The narrative is shifting: Ethereum is no longer trailing—it’s leading.

Why Now?

The ETH rally isn’t just macro froth. A few structural tailwinds have been quietly building:

- ETF Mania – Spot Ethereum ETFs, launched mid-2024, are seeing inflows that now rival Bitcoin. Just last week, U.S. Ethereum ETFs sucked in over $1 billion in a single day.

- Treasury Accumulation – Corporates are aping MicroStrategy’s playbook but swapping BTC for ETH. BitMine Immersion has piled up $7B worth of ETH, while SharpLink Gaming holds $3.5B. ETH treasuries are becoming a real thing.

- Regulatory Green Light – The SEC, now under a Trump White House, has loosened restrictions on staking. Liquid staking providers can pay out rewards without being treated like securities. That’s a huge unlock for ETH’s core yield narrative.

- The Stablecoin & Tokenization Wave – The GENIUS Act passed last month gives stablecoins a clear legal framework. Almost all major stablecoins run on Ethereum rails. Add in tokenized treasuries, real estate, and bonds—and ETH looks less like “tech stock beta” and more like the settlement layer of the 21st-century financial system.

Supply Crunch on Deck

Glassnode data shows ETH balances on exchanges have fallen to nine-year lows—just 14.9 million ETH left on centralized platforms. Why? Because people are staking, locking, or hoarding. A shrinking liquid supply plus surging ETF demand is the same recipe that juiced Bitcoin earlier this year. ETH is finally baking the same cake.

The Road Ahead

Prediction markets now give ETH an 85% shot at breaking $5,000 before year-end. Standard Chartered, not exactly known for moonboy optimism, raised its Ethereum target to $25,000 by 2028. For context: that’s the market cap of Apple.

Will it get there? Maybe. Maybe not. But here’s the takeaway: Ethereum isn’t just catching up to its past—it’s staking a claim on the future. Bitcoin is a pristine asset. Ethereum is the economy being built on-chain. If crypto survives the next cycle, it will likely be because ETH proved it could carry the weight of global finance.

You May Also Like

eurosecurity.net Expands Cryptocurrency Asset Recovery Capabilities Amid Rising Investor Losses

Ethereum to boost scalability and roll out Fusaka upgrade on Dec 3