Shiba Inu (SHIB) Plunges by 20% in 2 Weeks: Another 80% Crash Comes Next?

Shiba Inu (SHIB) has lately been a pale shadow of its former self, with its valuation tumbling by double digits in a matter of weeks.

According to some analysts, the bad days for the bulls might be just starting.

Devastating Crash Ahead?

As of press time, SHIB trades at around $0.000006127, representing a 20% decline on a 14-day scale. Its market cap slipped to around $3.6 billion, making it the 30th-biggest cryptocurrency. Recall that it ranked much higher in the spring of last year when the capitalization neared $10 billion.

One popular analyst who touched upon the meme coin’s downfall is Ali Martinez. He claimed that the recent drop below $0.00000667 could have opened the door to a much deeper collapse to as low as $0.00000138. Such a move south would represent a whopping 77% crash from current levels.

Several key indicators also suggest that SHIB’s price could be headed for a further plunge. Over the past 24 hours, the Shiba Inu team and community have burned a negligible 483 coins, representing a 99% decline from yesterday’s figure.

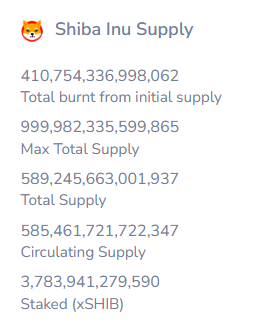

The ultimate goal of the mechanism, adopted in 2022, is to reduce the meme coin’s overall supply, potentially making it more valuable in time (assuming demand remains constant or heads north). Data shows that the current circulating supply is roughly 585.46 trillion tokens after more than 410.7 trillion SHIB have been scorched over the years.

SHIB Supply, Source: shibburn.com

SHIB Supply, Source: shibburn.com

Meanwhile, Shibburn – the X account spreading information about the recent token burns – has been inactive lately. The last update on the matter, from January 9, showed that the daily and weekly burn rates have been unimpressive.

Shiba Inu’s Relative Strength Index (RSI) supports the bearish scenario. Over the past few hours, the metric’s ratio exceeded 70, indicating the asset is overbought and could be gearing up for a pullback. The technical analysis tool ranges from 0 to 100, where readings between 30 and 70 are considered neutral, whereas anything below 30 may be viewed as a buying opportunity.

SHIB RSI, Source: RSI Hunter

SHIB RSI, Source: RSI Hunter

Can the Bulls Return?

Contrary to Martinez’s grim prediction, the analyst who goes by the X moniker Vuori Trading argued that SHIB may explode in the foreseeable future.

They claimed that the asset remains in the “bear trap” stage, characterizing the setup as “pure manipulation before shooting higher.” The analyst set a target of “at least” $0.00014, which would be an all-time high and represent a staggering 2,200% increase from the ongoing valuation.

Despite the recent price plunge, SHIB investors don’t appear to be rushing to sell. In fact, CryptoQuant’s data shows that the number of coins stored on exchanges has declined over the past month. This trend signals a shift toward self-custody and reduces immediate selling pressure.

SHIB Exchange Reserves, Source: CryptoQuant

SHIB Exchange Reserves, Source: CryptoQuant

The post Shiba Inu (SHIB) Plunges by 20% in 2 Weeks: Another 80% Crash Comes Next? appeared first on CryptoPotato.

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688

UAE Launches First Regulated Stablecoin as ADI Trends Higher