Why is the lending platform HyperLend the pillar of Hyperliquid ecosystem liquidity?

Author: HyperLend

Compiled by: Felix, PANews

PANews Note: This article only represents the author’s views and does not constitute investment advice, DYOR .

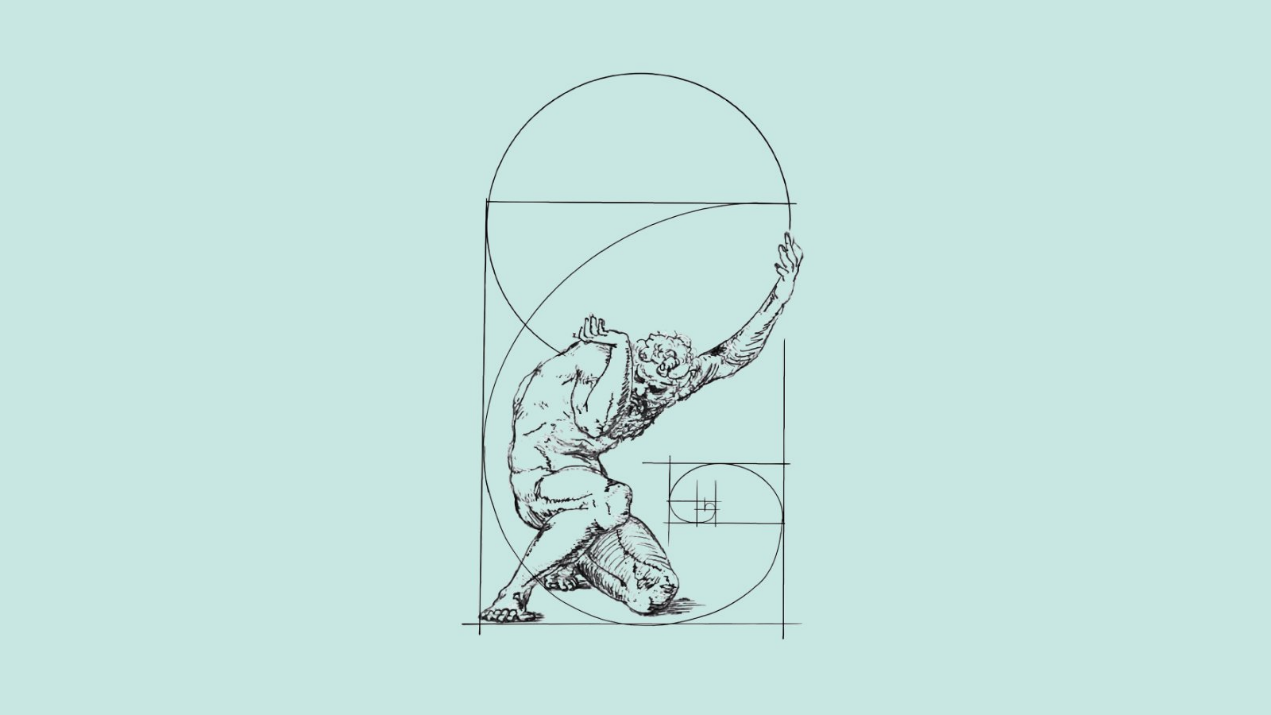

Just like the spine supports the human body, HyperLend is the backbone of the Hyperliquid ecosystem, integrating lending, innovative solutions, and liquidity optimization into a single framework. HyperLend is not just built for today's DeFi users, but is setting a new standard that prioritizes user needs, maximizes efficiency, and ensures transparency. This article will explore how HyperLend is purposefully reshaping the DeFi landscape.

Cervical vertebra: borrowing

Just like the cervical vertebrae represent the most important part of the human spine, supporting the human head and enabling movement, lending is also the core of any on-chain ecosystem. In many networks, lending seems to be a common accessible service, but in Hyperlend, lending is the lifeblood of sustainable growth. Hyperlend aims to become the largest money market on HyperEVM, providing the best borrowing rates and unlocking deep liquidity for every user. By focusing first on the fundamentals of lending, users are enabled to achieve maximum efficiency on HyperEVM.

The Thoracic Spine: A Game Changer

Hyperlend did not simply copy the model of other projects, but was built specifically for the Hyperliquid ecosystem. During the development process, the team will provide liquidity for many assets, and the risk management team will minimize risks.

The Hyperliquid Provider (HLP) vault <> LIQUID developed by Hyperlend is a key innovation that turns users' yield deposits into collateralized assets. By depositing stablecoins into the vault, users can gain exposure to the Hyperliquid L1 DEX market-making engine and earn stable, non-inflationary returns directly from real transactions.

This approach is not just about getting yield, but unlocking a sustainable cycle strategy on top of it. Lend stable funds, reinvest in the vault, and then compound the returns. Imagine that you can create a special strategy on top of the cycle of the HLP vault that manages the risk for you. In addition, what if HyperLend's HLP vault does not have a 4-day withdrawal period? This will all be launched in due course.

Lumbar Spine: Dynamic Benefit Opportunities

HyperLend will launch with eight-digit liquidity, ensuring market depth and the lowest borrowing rates on the HyperEVM. This large capital base not only benefits borrowers, but also allows users to retain assets while leveraging them for additional yield opportunities.

Instead of selling tokens, users can use them as collateral, freeing up capital to reinvest or explore other avenues of growth.

HyperLend will also explore various market-making strategies for managed vaults, each offering its own yield strategy. Whether users prefer a continuous, conservative yield strategy or a more dynamic, high-yield strategy. By combining deep liquidity, competitive interest rates, and a variety of yield options, HyperLend sets a new standard for what the next generation of lending platforms can offer.

Sacrum: Why HyperLend ?

We are now at the base of the human spine. While everyone is talking about the next big narrative that will change the future, HyperLend has spent the past 6 months developing products that are designed to serve more people. HyperLend also provides practical solutions, transparent operations, and a commitment to improvement to the community. HyperLend's goal is simple: to build a protocol that users can trust and rely on in the long term. Whether users want to borrow or lend, or just explore the possibilities of DeFi.

The new pillar of HyperEVM

Imagine a DeFi environment where lending truly meets your needs and the ecosystem is designed for your growth. This is what HyperLend does, treating lending as an important "cervical vertebra" of on-chain finance, allowing users to obtain market depth, recyclable liquidity and sustainable returns through innovations such as liquid HLP vaults. Whether you want to reinvest your earnings at a lower lending rate, or just explore possible new innovations, HyperLend is providing support.

Related reading: Spot seat auction price hits new high, could Hyperliquid become a new option for listing coins?

You May Also Like

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release

Trump foe devises plan to starve him of what he 'craves' most