Bitcoin Hyper Presale Hits $10.8M After $150K in Whale Buys

A new crypto project, Bitcoin Hyper ($HYPER), is taking center stage with one of the most talked-about crypto presales in 2025.

In just a short time, it has raised more than $10.8M at a token price of $0.012765.

And the buzz isn’t just from retail buyers. Whales have piled in, with $150K worth of buys from ten big players in just seven days.

For a project that promises to supercharge Bitcoin itself, it’s no wonder investors are calling Bitcoin Hyper one of the best presale tokens this year.

The Problem: Bitcoin’s Growing Pains

Bitcoin is the biggest name in crypto. It is the most secure blockchain, the most trusted brand, and still the number one digital asset by market cap. But it was never designed for the demands of today’s world.

Transactions on Bitcoin can take minutes to confirm. During times of high demand, fees have shot up to $30 or even $50 per transfer.

Imagine trying to send $20 worth of Bitcoin and watching half of it vanish into fees – that’s the reality during congestion.

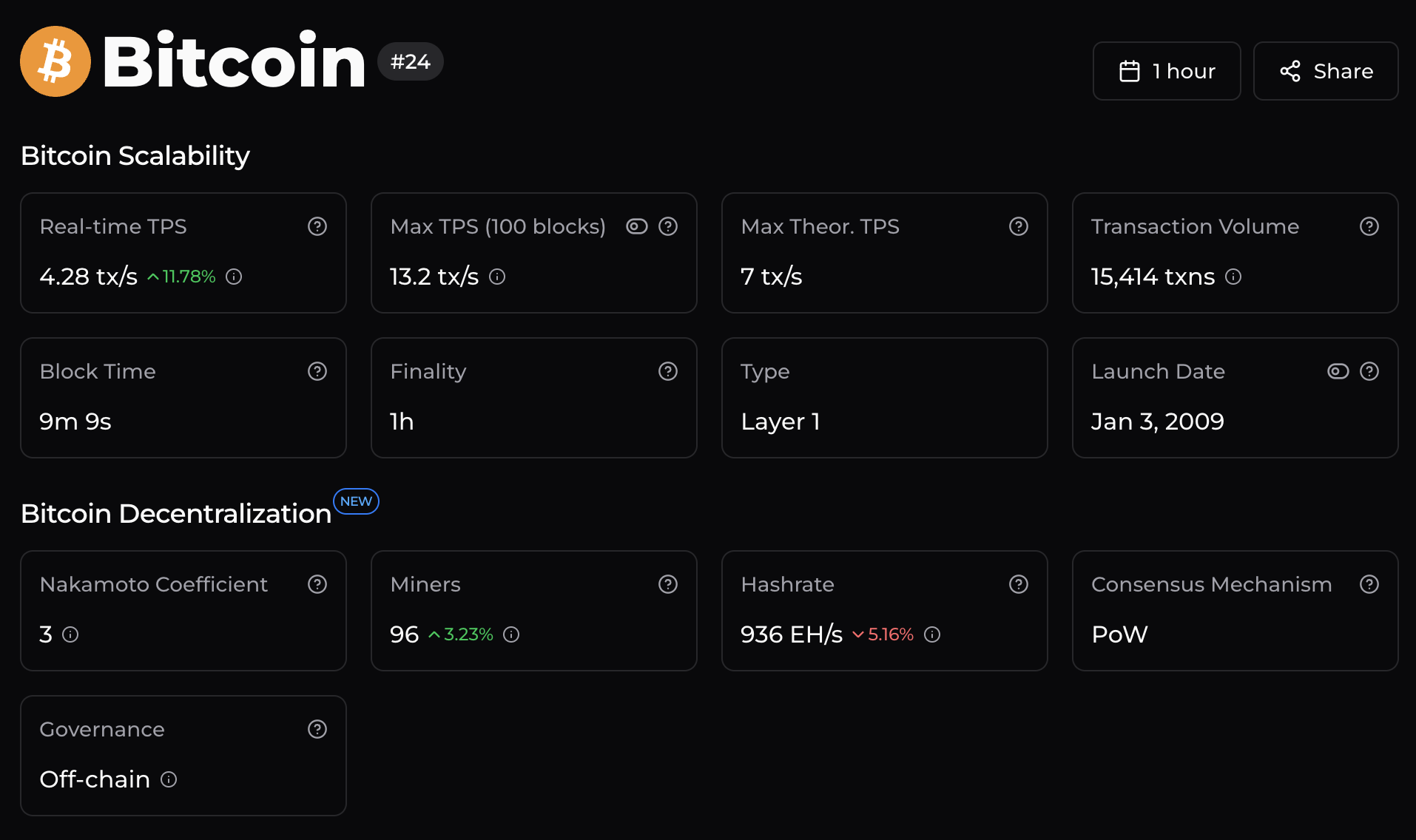

On top of that, Bitcoin can only handle around seven transactions per second. Compare that with Visa, which averages about 65K transactions per second in daily use.

Source: Chainspect

That gap makes it hard for Bitcoin to function as a payment system for billions of people, like TradFi systems do.

Another issue is programmability.

Unlike Ethereum or Solana, Bitcoin can’t run smart contracts natively. Developers who want to build decentralized apps have to rely on clunky workarounds or other blockchains.

That’s why Bitcoin has been sidelined from the rise of DeFi, NFT markets, and even meme coins. It remains digital gold, but not digital cash.

The Solution: Bitcoin Hyper ($HYPER) Steps In

Bitcoin Hyper ($HYPER) was built to fix Bitcoin’s problems.

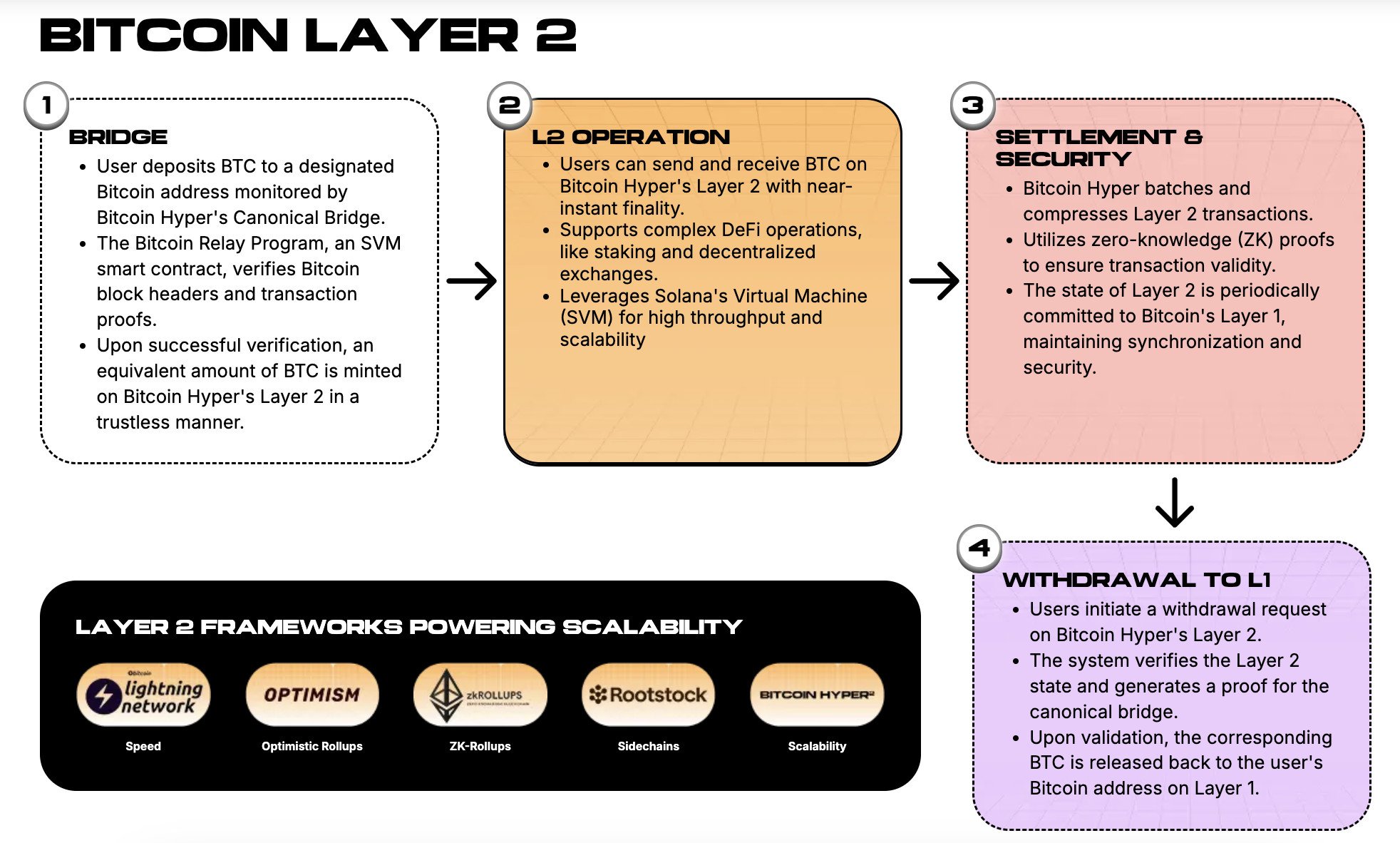

It delivers a fast, scalable, DeFi-compatible Layer 2 with direct settlement on Bitcoin’s main network. At its core is the Canonical Bridge.

This system lets anyone lock up their $BTC on the Bitcoin base layer and mint wrapped Bitcoin (WBTC) on Bitcoin Hyper’s Layer 2.

That WBTC can then be used for instant payments, DeFi protocols, gaming, or even launching new crypto meme coins on the new chain.

When you want your $BTC back, you burn the wrapped tokens and unlock your original Bitcoin.

What makes Bitcoin Hyper unique is the technology under the hood. It integrates the Solana Virtual Machine (SVM), which means it can run Solana programs directly.

Developers who already know Solana can bring their apps into Bitcoin’s ecosystem without starting from scratch.

Think of it like adding a rocket booster to Bitcoin’s reliable but slow engine. The result is near-instant transactions, very low fees, and scalable smart contracts – all anchored to Bitcoin’s security.

This could change Bitcoin’s place in the market.

Instead of being limited to a store of value, it could also become the backbone of everyday payments and programmable money. That would be a massive shift for the biggest crypto of them all.

Learn more on Bitcoin Hyper’s website.

Why Investors Are Buying $HYPER

The $HYPER presale momentum proves that people see the project’s potential.

More than $10.8M has already been raised, with each $HYPER token priced at $0.012765.

But the bigger story is the whales. In the past week alone, there have been ten whale buys totaling $150K, on top of single transactions of $161K and $100K earlier in the month.

Big money is clearly betting that this Layer 2 will take off.

For buyers, $HYPER offers more than hype. The token powers the entire network. It is used for transaction fees, staking rewards, unlocking premium dApps, and developer grants. Governance is also planned once the DAO launches.

Staking is already live, with a jaw-dropping 101% annual yield for early participants.

The numbers behind the opportunity are staggering. The Bitcoin payments market is projected to reach $3.7T by 2031.

If Bitcoin Hyper captures even a fraction of that, it could make $HYPER one of the best altcoins of the decade.

Add in the fact that it is already listed in Best Wallet’s curated ‘Upcoming Tokens’ section, and you can see why it’s being hyped as one of the best presale opportunities of 2025.

Join $HYPER’s presale to support the project.

Bitcoin Hyper’s Big Moment

Bitcoin Hyper ($HYPER) is going viral for good reason. It tackles Bitcoin’s biggest weaknesses while unlocking new ways to use the world’s most trusted crypto.

With $10.8M raised in presale, whales piling in with six-figure buys, and a technology stack built for speed, scale, and usability, $HYPER looks set to become one of the hottest new crypto launches this year.

For investors searching the altcoin market, this is a project worth watching closely.

This article is for informational purposes only and not financial advice. Always do your own research (DYOR) before investing in crypto.

You May Also Like

Tom Lee’s BitMine Hits 7-Month Stock Low as Ethereum Paper Losses Reach $8 Billion

MYX Finance price surges again as funding rate points to a crash