Red alert: Shiba Inu price to crash as weighted funding rate sinks

Shiba Inu price has entered into a bear market after falling by 20% from its highest level this month, and is at risk of more downside after forming a risky pattern and as its funding rate slips.

- Shiba Inu price has dropped into a bear market this year.

- The coin has formed a head-and-shoulders pattern.

- SHIB’s funding rate has crashed to its lowest level in months.

Shiba Inu (SHIB) coin dropped by 3.65% on Monday, Aug. 19, and reached a low of $0.00001263. Its plunge coincided with the broader crypto market crash as Bitcoin (BTC) and most altcoins dived.

Shiba Inu price at risk as funding rate dives

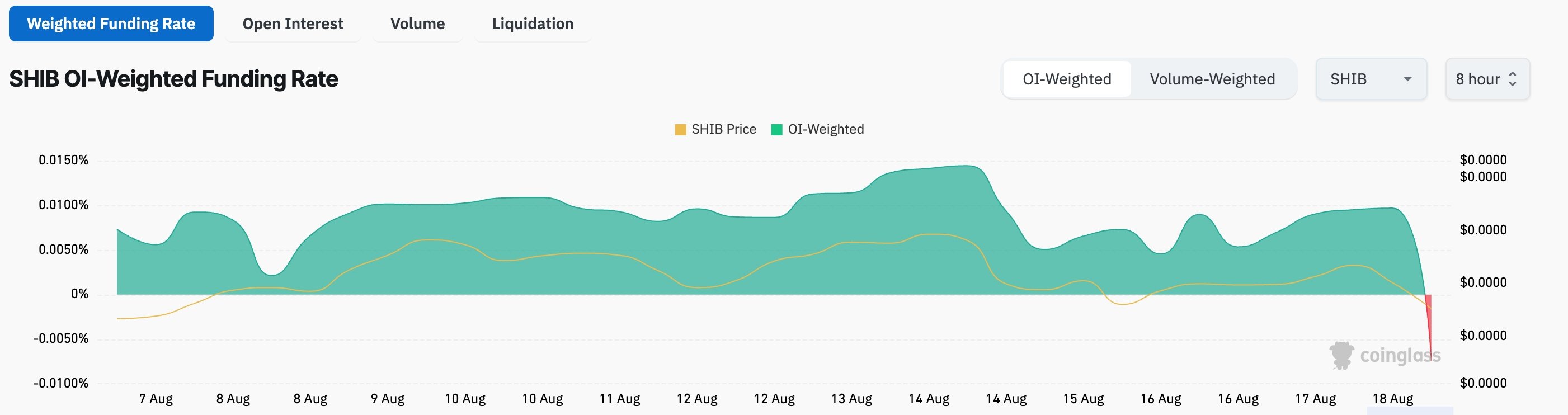

The SHIB coin token faces substantial risks that could drag it lower in the near term. CoinGlass data shows that the futures funding rate has dropped to minus 0.0074%, its lowest level in months.

The funding rate is a small fee or rebate in perpetual futures that helps to balance the spot and the futures prices. In a negative funding rate situation, short-sellers pay longs, which is a sign that they expect the future price to be lower than the spot price.

Shiba Inu funding rate | Source: CoinGlass

Shiba Inu funding rate | Source: CoinGlass

Additional data shows that investors are dumping their SHIB coins as the supply on exchanges jumped on Monday. Investors moved tokens worth over $1.15 million for the first time in over two weeks.

There are signs that whales and smart money investors are no longer interested in Shiba Inu. Their holdings have remained intact at 61.7 billion since Aug. 6. Whale holdings have also been stagnant at 45 billion this month.

There are also signs that the daily volume of SHIB dropped to $204 million, much lower than other tokens like Pepe, Dogwifhat, and Floki.

SHIB price technical analysis

The daily timeframe chart shows that the Shiba Inu price has remained below the 50-day and 200-day Exponential Moving Averages, a sign that bears are in control.

SHIB price has also formed a head-and-shoulders pattern, a popular bearish reversal pattern. The right and left shoulders are at $0.00015, and the neckline is at $0.00001027.

The Relative Strength Index has moved below the neutral point at 50, while the MACD is stuck at zero. Therefore, the token will likely have a bearish breakout, with the initial target being the neckline at $0.00001027. A drop below that level will point to more downside.

You May Also Like

XRPR and DOJE ETFs debut on American Cboe exchange

Over 60% of crypto press releases linked to high-risk or scam projects: Report