Ripple Unveils ‘Institutional DeFi’ Roadmap For The XRP Ledger

Ripple on Thursday published an “Institutional DeFi” roadmap for the XRP Ledger (XRPL), positioning XRP as a protocol-level settlement and liquidity primitive across payments, FX, collateral workflows, and on-ledger credit. The company’s pitch is straightforward: compliance tooling and asset-layer primitives are already live on mainnet, with lending, privacy, and permissioned market infrastructure slated to round out a more institution-friendly stack over the coming quarters.

The Institutional DeFi Roadmap For The XRP Ledger

In its post, Ripple framed the roadmap as an evolution from a fast settlement network into something closer to a full financial operating environment for regulated workflows. The blog argues that with “native onchain privacy, permissioned markets, and institutional lending” expected “in the coming months,” XRPL is aiming to become “an end-to-end operating system for real-world finance,” with institutions able to run compliant processes without pushing additional complexity onto end users.

RippleX summarized the roadmap in a companion post, saying XRP sits “at the center of settlement, FX, collateral, and onchain credit,” and that 2026 focus areas include lending, privacy, and permissioned on-chain markets.

The roadmap leans heavily on the idea that XRP demand can be driven both directly and indirectly. Directly, Ripple points to new functionality that could increase transaction volume and asset issuance, raising demand for network resources. Indirectly, it highlights XRP’s role in base-layer mechanics such as reserve requirements, transaction fees (which burn XRP), and bridging in FX and lending flows.

Ripple organizes this into three institutional pillars: payments/FX, collateral/liquidity, and credit/financing. On payments and FX, it emphasizes “Permissioned Domains,” where access is gated via “Credentials” (e.g., KYC/AML attestations), and a planned Permissioned DEX that would extend XRPL’s existing exchange rails into controlled, regulated contexts for secondary markets in FX, stablecoins, and tokenized assets. In those permissioned market flows, Ripple says XRP functions as an auto-bridge asset between tokens and stablecoins, while each transaction consumes fees paid in XRP.

On collateral and liquidity, Ripple spotlights Token Escrow and Batch Transactions as building blocks for conditional settlement and atomic delivery-versus-payment workflows, alongside the Multi-Purpose Token (MPT) standard, which it describes as a way to embed metadata and restrictions for complex instruments without custom contracts. The thesis here is that tokenized collateral issuance, escrowed settlement, and DvP-style flows expand on-ledger activity that still depends on XRP reserves and fees at the protocol layer.

The most explicit “institutional DeFi” expansion comes in credit. Ripple says XRPL v3.1.0 will introduce native on-ledger credit markets via a lending stack built around Single-Asset Vaults and the XLS-66 Lending Protocol, designed for fixed-term, underwritten loans with repayment automation. Underwriting and risk management remain off-chain, while the loan contracts and mechanics live on-ledger.

What Ripple Says Is Next

Ripple’s post distinguishes between primitives already available and a near-term pipeline. Live today, it lists MPT, Credentials, Permissioned Domains, transaction “Simulate” tooling for preflight-style risk reduction, “Deep Freeze” controls for issuers, Token Escrow and Batch Transactions, plus an XRPL EVM sidechain bridged via Axelar for Solidity-based deployments that tap XRPL liquidity and identity features.

On the roadmap, Ripple highlights a Permissioned DEX targeted for Q2, the XLS-65/66 lending protocol for later in 2026, “Confidential Transfers” for MPTs using zero-knowledge proofs in Q1, and “Smart Escrows” and MPT DEX integration in Q2—alongside an “Institutional DeFi Portal” intended to bundle tokenization, lending, and payments exploration in one place.

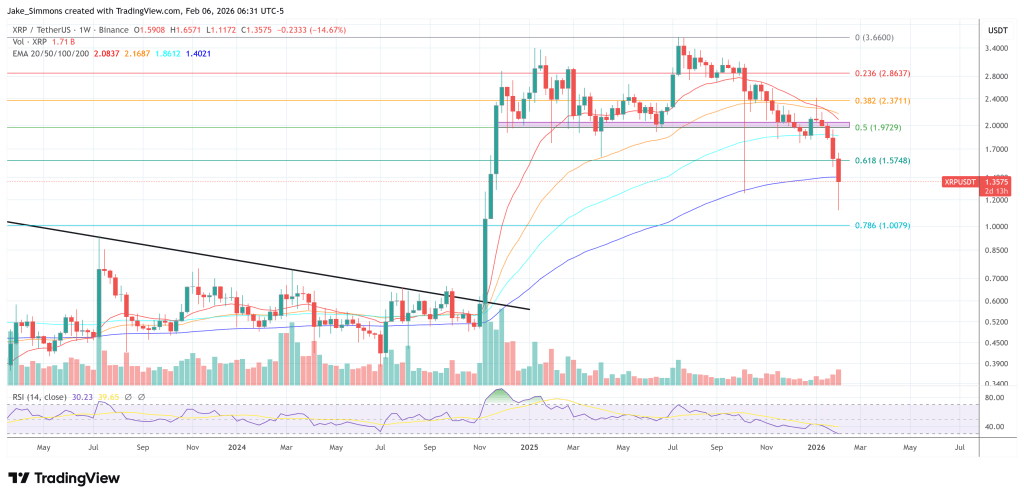

At press time, XRP traded at $1.35.

You May Also Like

Mystake Review 2023 – Unveil the Gaming Experience

Fed Decides On Interest Rates Today—Here’s What To Watch For