Coinbase Flags Early Signs of Altcoin Season, With Ethereum at Core of Momentum

Coinbase believes crypto markets may be on the cusp of a full-scale altcoin season, with institutional demand for Ethereum playing a central role and a potential Federal Reserve rate cut in September setting the stage for retail inflows.

In its August research outlook published Thursday, the exchange said the market has largely followed the path it predicted earlier this year, when it expected new highs in the second half of 2025. Stronger-than-anticipated macro conditions and clearer regulatory frameworks have helped fuel that momentum.

Bitcoin’s market dominance has slipped from 65% in May to about 59% in August. Coinbase said the decline points to the early stages of capital rotation into altcoins. At the same time, altcoin market capitalization has jumped more than 50% since July to $1.4 trillion.

ETH Market Cap Jumps 50% Since July on Treasury Buys

The Altcoin Season Index, a metric that tracks whether alts are outperforming Bitcoin, remains in the low 40s, below the 75 threshold that signals a full rotation. Still, Coinbase noted that conditions are aligning for a broader rally as September approaches.

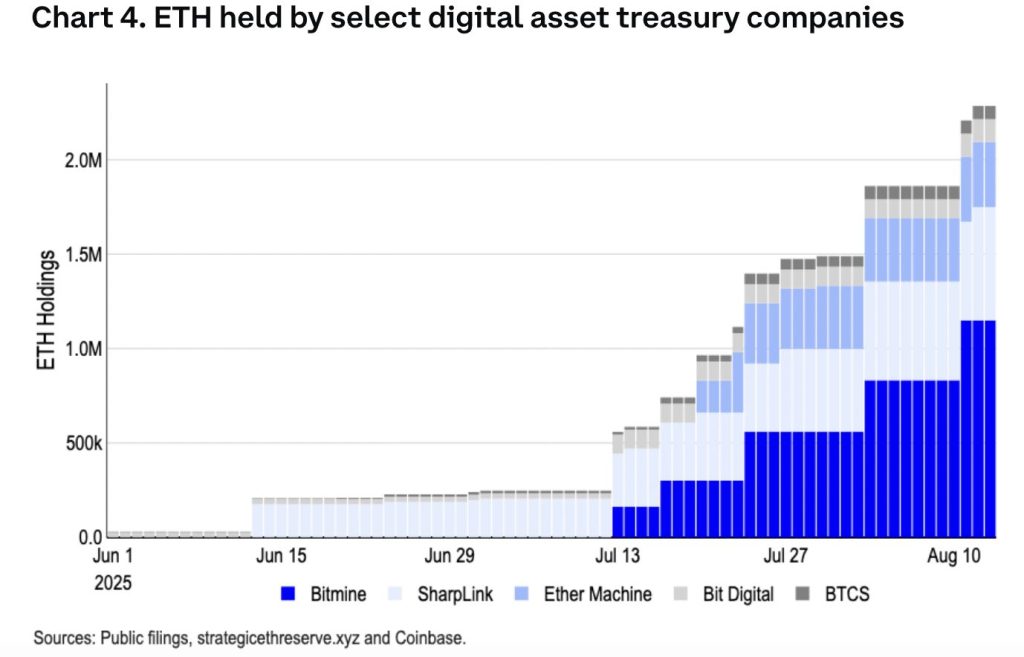

Ethereum has been the main beneficiary of this shift. Its market cap has grown 50% since early July, powered by demand from digital asset treasuries and a growing narrative around stablecoins and real-world assets.

Bitmine Immersion Technologies alone has acquired 1.2m ETH after raising $20b, with capacity to purchase $24.5b worth. The firm has overtaken Sharplink Gaming, the former leader among Ethereum-focused treasuries. Together, top institutional holders now control nearly 3 million ETH, about 2% of the supply.

Source: Coinbase

Tokens linked closely to Ethereum, including Arbitrum, Ethena, Lido DAO and Optimism, have all moved in step with ETH. Of these, only Lido has rallied sharply, gaining 58% this month.

Coinbase said Lido’s rise reflected both its exposure to ETH and a US SEC staff statement earlier in August that liquid staking tokens are not securities under certain conditions.

Alt Season Not Fully Here, But Conditions Are Building

While institutional flows dominate the ETH story, Coinbase said retail capital is also waiting to move. More than $7.2 trillion currently sits in US money market funds, the largest stockpile on record.

These balances represent what the firm called “missed opportunity costs” caused by high traditional valuations, trade uncertainties and lingering doubts about growth. It expects the upcoming Fed cuts to reduce the appeal of money market funds and redirect capital into crypto and other risk assets.

The firm’s liquidity index, which tracks stablecoin issuance, trading volumes, orderbook depth and free float, has also begun to recover after six months of decline. Coinbase said this is an early sign that liquidity is returning to the crypto market.

“Our 3Q25 outlook remains constructive, though our view on an altcoin season has evolved,” the report said. “The recent decrease in Bitcoin dominance suggests an early rotation of capital into altcoins rather than a full-scale altcoin season at this stage.

With the Fed expected to ease in September and the SEC signaling flexibility around some token models, Coinbase said the conditions for a deeper altcoin season are beginning to fall into place.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

Outlook remains cautious – TD Securities