Dialogue with multiple traders: How far are we from a full-scale alt season?

Author: kkk, rhythm

On August 12, Ethereum broke through $4,700, setting a four-year high. @CryptoHayes, who had taken profits early last week, also bought back Ethereum on August 9; Bitcoin also set a new high, and the total market value of cryptocurrencies rushed to $4.2 trillion, and market sentiment was completely ignited.

Traditional markets were also thriving. The S&P 500 and Nasdaq 100 both hit new records, accelerating global liquidity flows into risky assets. The US dollar index (DXY) fell below 98, further opening the floodgates for capital inflows into the stock and crypto markets. This macroeconomic environment not only solidified the upward trend but also bolstered investor confidence in high-risk assets.

Meanwhile, the market is virtually certain that the Federal Reserve will cut interest rates at its September 17th meeting, with a near-100% probability, lowering the benchmark rate to a range of 4.00%-4.25%. This expectation has provided additional fuel for markets reliant on high liquidity, particularly cryptocurrencies. The wealth effect of the altcoin season is now a hot topic in the market, with the key question being when it will fully take off.

Next, BlockBeats has compiled traders’ views on the upcoming market conditions to provide some direction for your trading this week.

@b66ny

BTC.D has recently shown a clear downward trend, retreating to approximately 57.7% from its previous high. Combined with the trend of ETH.D, I believe this is a typical signal of capital rotation: market capital is beginning to withdraw from relatively stable assets and pursue higher-risk, higher-return assets. Historically, a sustained decline in BTC.D has often been a prerequisite for the start of an altcoin season.

ETH.D not only represents the strength of Ethereum itself but is often viewed as a bellwether for the entire altcoin market. Currently, ETH.D is performing strongly, with its dominance rate rebounding to 14.0%. Furthermore, ETH/BTC has risen over 4% in the past 24 hours, driven by the rapid rise in ETH prices. This indicates a clear trend of capital flowing from Bitcoin to Ethereum.

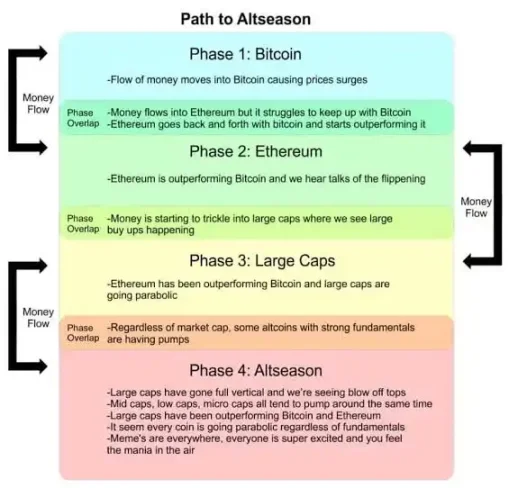

This trend is a classic scenario of capital rotation: in the first stage, BTC stagnated or even fell, and funds began to flow into ETH; the rise of ETH not only boosted market confidence, but also created conditions for more liquidity to be injected into the altcoin market.

Next, OTHERS.D (the market capitalization share of small and medium-sized altcoins excluding top-tier assets like BTC and ETH) deserves attention. Currently, OTHERS.D remains in a prolonged period of sideways trading, having not experienced explosive growth similar to ETH.D. This suggests that capital investment remains concentrated in a few top-tier assets like ETH. While SOL also saw a significant rise today, further confirming signs of capital rotation, it has yet to fully spread to high-risk, small-cap speculative sectors.

Based on the three major indicators, the market is likely in the early stages of rotation:

What has happened: BTC.D went down, and funds overflowed.

What is happening: ETH.D is rising and funds are pouring into ETH.

Not happening yet: OTHERS.D rises, funds spread to small-cap altcoins.

@im_BrokeDoomer

Comparing the market capitalization of altcoins and Bitcoin from 2017 to date shows we are currently at a critical support level at the lower edge of the channel. This level has historically been a sensitive area for capital inflow, often accompanied by a rebound in market sentiment and accelerated market rotation. If this support level is confirmed, the altcoin sector is expected to experience a collective surge, marking the official start of a new altcoin season.

The general process of starting the altcoin season is as follows: Bitcoin (BTC) starts the market → Ethereum (ETH) follows the rise → BTC regains momentum → ETH breaks through the all-time high (ATH) → large-cap altcoins rise → BTC hits a new high → ETH and large-cap altcoins hit new highs → mid-cap altcoins take off → small-cap altcoins explode

We are currently in the third stage, with ETH and large-cap altcoins hitting new highs, and we can expect subsequent explosions in other altcoins.

@ZssBecker

During the previous bull run of 2020, the narratives for most altcoins didn't explode immediately. Instead, they fully took off after ETH prices broke through their all-time highs and tripled. At that point, capital flooded into the new narratives—for example, the gaming sector—driving related tokens up 10, 20, or even 50 times. Sandbox saw an 80-fold surge at one point, and even the most fringe and fringe gaming projects saw gains of more than ten times. This phenomenon didn't truly take hold until the middle and late stages of the bull market, but once it took off, it became a period of concentrated wealth effects.

I believe this scenario will repeat itself in this market cycle. We are still in the first phase of the altcoin season—a period dominated by BTC and ETH. Only after ETH breaks through $5,000 and major altcoins achieve a 2–3x increase will market capital frantically search for the next narrative. The most likely successors will be AI, RWA, and gaming. These three areas have already been effectively penetrated and profitably exploited by the crypto industry, offering strong narratives and high potential returns.

The launch of the last round of the gaming narrative allowed countless people to transform their initial investments of a few thousand dollars into millions of dollars. This time, with larger market capital and a higher risk appetite, the momentum will only intensify once the game begins. For investors, the key isn't to rush into the market now, but to wait patiently and plan ahead. The peak of the altcoin season will truly arrive when the signal for a narrative shift appears.

@lanhubiji

Understanding market structure reveals that an altcoin season is inevitable, but its form may be completely different from the past two cycles. Previously, the number of altcoins was limited, capital was relatively concentrated, and nearly all leading sectors experienced a general rise. Now, with millions of altcoins on the market, competition is extremely fragmented, and it's impossible for capital to cover all targets.

This means that this round of market activity is more likely to see a "localized altcoin season"—funds will be concentrated in a few sectors or individual tokens with strong narratives, strong communities, and strong liquidity, creating a localized frenzy, while the majority of coins will remain ignored by the market. While opportunities still exist for investors, the probability of finding the right target is much lower than in the past, and the current market outlook favors the AI sector.

@joao_wedson

The true altcoin season is far from over. Smart money typically flows from BTC to ETH, then into the top large-cap coins, and finally to small and mid-cap tokens. The current market has only just entered the first half, and the true altcoin frenzy is still on the way, potentially lasting all the way into November. In other words, the current surge is just the appetizer; the true main course has yet to be served.

You May Also Like

Unlocking Massive Value: Curve Finance Revenue Sharing Proposal for CRV Holders

Best Crypto To Buy Now: Pepeto vs BlockDAG, Layer Brett, Remittix, Little Pepe, Compared