Bitcoin Hashrate Cools After Record as Difficulty Bites

Four days ago, Bitcoin’s hashrate hit an all-time high of 976 exahash per second (EH/s), but it has since cooled, settling in the 900 EH/s range.

Mining Metrics Flash Mixed Signals as Block Times Stretch to 11:04

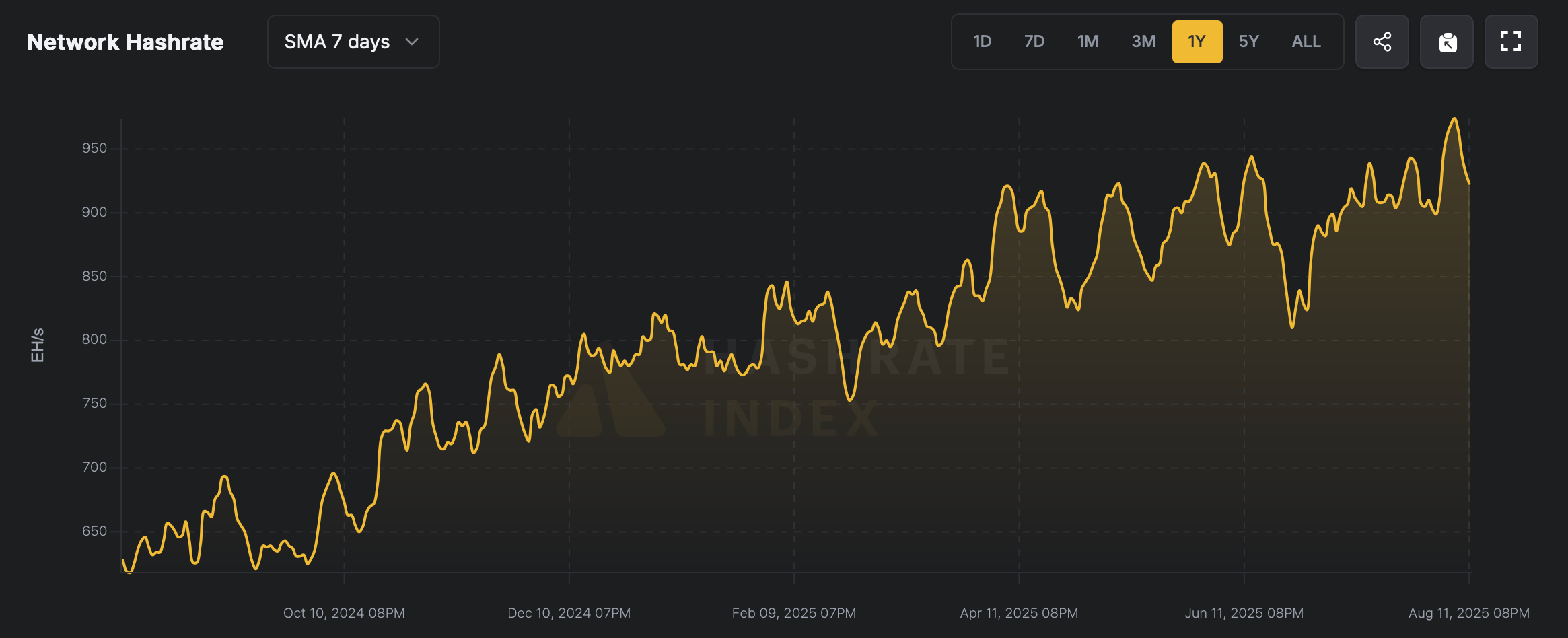

On Aug. 8, 2025, the network’s computing power reached a whopping 976 EH/s based on the seven-day simple moving average (SMA). As of today, the hashrate sits near 900 EH/s—down 76 EH/s over four days—coinciding with a 1.42% difficulty increase at block height 909216. Notably, the estimated revenue for 1 petahash per second (PH/s) of SHA256 output is higher.

Bitcoin total hashrate using the seven-day SMA and one-year timeframe via hashrateindex.com stats.

Bitcoin total hashrate using the seven-day SMA and one-year timeframe via hashrateindex.com stats.

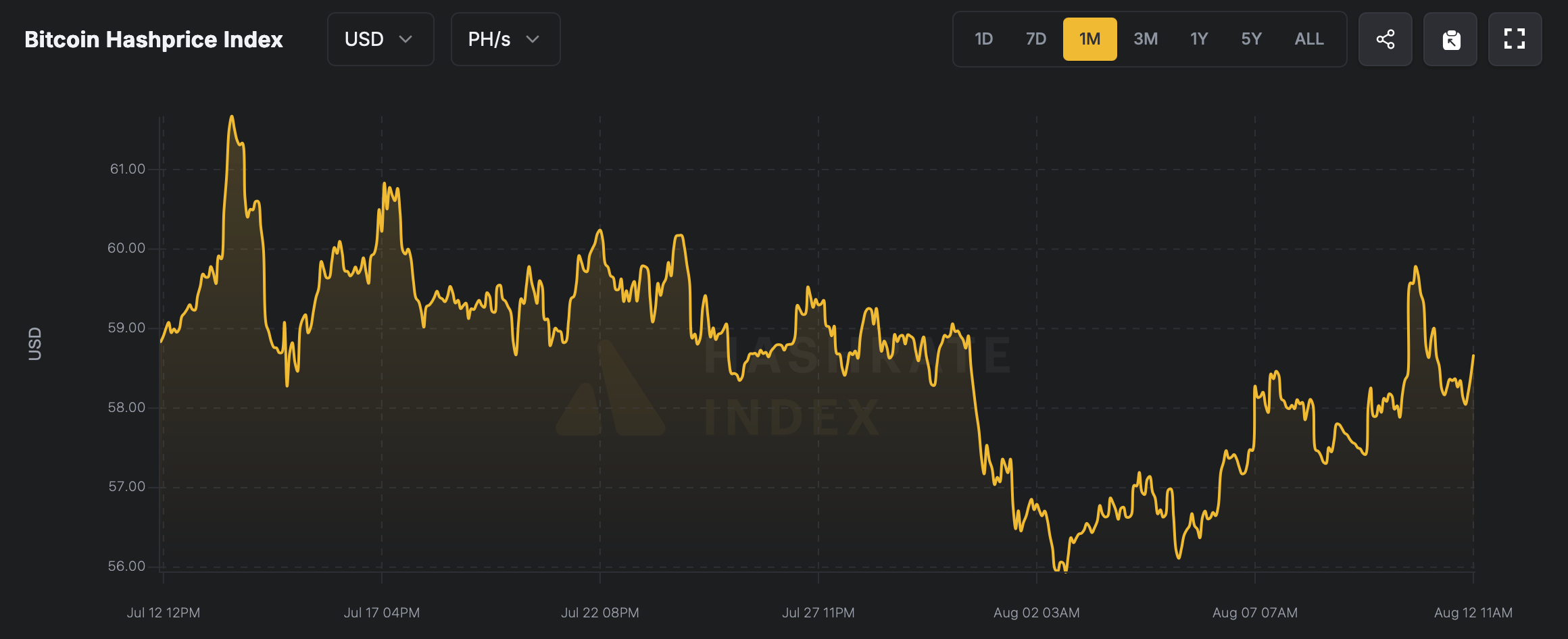

At that time, the estimated hashprice was $57.30 per PH/s, and today it’s 2.55% higher at $58.76, according to hashrateindex.com stats. Yesterday, as BTC pushed past the $120,000 range, the hashprice climbed to $59.78 per petahash. The current revenue remains 4.72% below its July 14 mark, when the hashprice reached $61.67. The increase in network difficulty appears to be the culprit pushing the hashrate lower.

Bitcoin hashprice over the last 30 days via hashrateindex.com.

Bitcoin hashprice over the last 30 days via hashrateindex.com.

With a lower hashrate, block intervals are running slower than the 10-minute target. As of 1:20 p.m. Eastern on Tuesday afternoon, the average block time is 11 minutes, 4 seconds. Slower intervals could set up a downward adjustment at the next difficulty retarget on Aug. 24, 2025. With more than 1,500 blocks left and projections subject to change, an estimated 9.64% cut to mining difficulty is on the table, at least for now.

A softer difficulty setting would ease pressure and could entice sidelined rigs back online, stabilizing block cadence. If price momentum holds, rising unit revenue could offset weaker output and steady participation; if it fades, consolidation among operators may quicken. Currently, the five leading mining pools by blocks mined are Foundry, Antpool, Viabtc, F2pool, and Spider Pool. Combined, the collection of entities control 78.39% of the total hashrate.

You May Also Like

Best Sit and Go Poker Sites – Where to Play SNG Poker Tournaments in 2025

SOL Moves Sideways While Ozak AI Token Targets Life-Changing Gains for Presale Investors