El Salvador Adds Bitcoin During Market Weakness as Accumulation Continues

El Salvador has continued adding to its Bitcoin reserves despite ongoing market weakness, with on-chain data showing another 1 BTC inflow to government-controlled wallets within the past 12 hours.

The latest transfer comes as Bitcoin trades under pressure, reinforcing the country’s consistent accumulation pattern rather than reactive positioning.

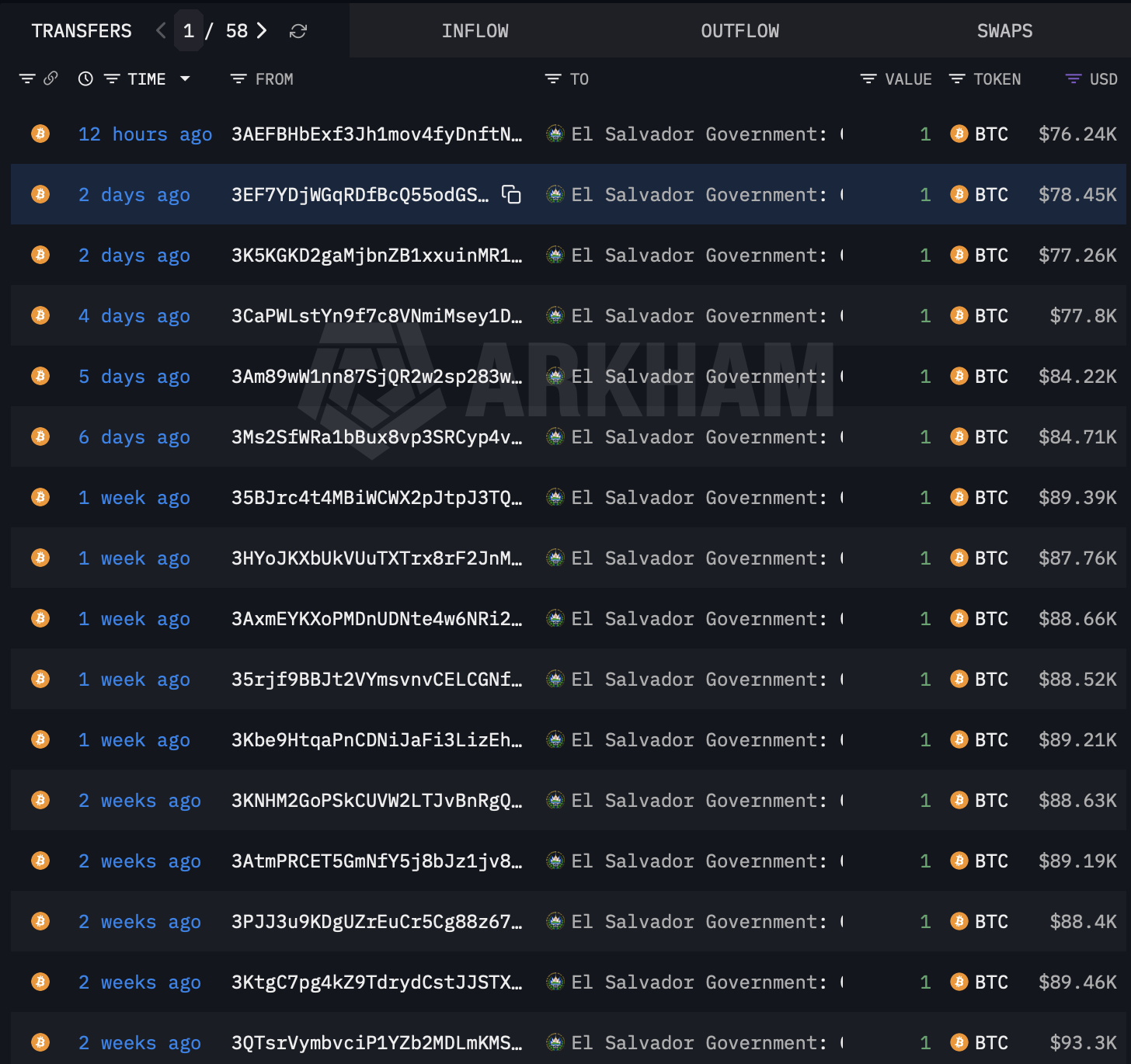

Data visible from Arkham tracking indicates that the El Salvador government has maintained a steady cadence of small, regular Bitcoin purchases over recent weeks. These additions have occurred across varying price levels, suggesting a rules-based approach rather than attempts to time short-term market moves.

On-Chain Activity: Consistent 1 BTC Inflows

The transfer log shows multiple 1 BTC inflows to wallets labeled under the El Salvador Government, occurring repeatedly over the past two weeks. Individual transactions were recorded at differing price points, ranging roughly from the mid-$70,000s to the high-$80,000s, based on the USD values displayed alongside each transfer.

Source: https://intel.arkm.com/explorer/entity/el-salvador

Source: https://intel.arkm.com/explorer/entity/el-salvador

The most recent inflow, recorded around 12 hours ago, added 1 BTC valued near $76,000, continuing a pattern that includes similar purchases made two days ago, four days ago, and extending back more than a week. There are no visible large outbound transfers, indicating that these movements represent accumulation rather than internal reshuffling.

Treasury Overview: Holdings Continue to Climb

According to the treasury dashboard shown, El Salvador’s total Bitcoin holdings now stand at approximately 7,552.37 BTC, valued at roughly $577 million at current prices.

- 7-day change: +8 BTC

- 30-day change: +31 BTC

The balance history chart shows a clear stair-step pattern, with each increment corresponding to a +1 BTC addition. The latest update on February 3, 2026, confirms another increase in total reserves, bringing holdings to 7,552.374 BTC.

Source: https://bitcoin.gob.sv/wallet/ONBTC

Source: https://bitcoin.gob.sv/wallet/ONBTC

This steady progression highlights a long-term accumulation strategy rather than sporadic or event-driven purchases.

Strategic Context: Accumulation Through Volatility

The timing of these additions is notable given broader market conditions. Bitcoin has recently traded below key psychological levels, and sentiment across crypto markets remains cautious. Despite this backdrop, El Salvador has continued to add exposure incrementally, maintaining the same purchase size regardless of short-term price fluctuations.

The consistency of the inflows suggests a strategy focused on long-term reserve building rather than responding to volatility or headline-driven market swings.

Conclusion

El Salvador’s latest Bitcoin purchase reinforces its ongoing accumulation strategy, with small, regular inflows continuing even as market conditions remain uncertain. With total holdings now above 7,550 BTC, the country’s approach remains unchanged—steady additions, transparent on-chain activity, and no visible signs of distribution.

For now, the data points to persistence rather than opportunism, with El Salvador maintaining its Bitcoin exposure through both rising and falling market phases.

The post El Salvador Adds Bitcoin During Market Weakness as Accumulation Continues appeared first on ETHNews.

You May Also Like

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto

Fed Lowers Rates By 25bps: How Bitcoin And Crypto Prices Responded And What’s Next