Strongest PMI Since 2022 Meets Crypto’s Sharpest Spot Volume Drop – Analysts Eye Bitcoin Upside

U.S. manufacturing expanded for the first time in over two years as the ISM Manufacturing PMI hit 52.6 in January (the strongest reading since 2022), while Bitcoin, trading near $78,000, entered its fifth consecutive month of correction amid collapsing spot demand.

The macro rebound has ignited a fierce debate among crypto analysts over whether this shift will reignite a bull run or arrive too late to halt the market’s structural weakening.

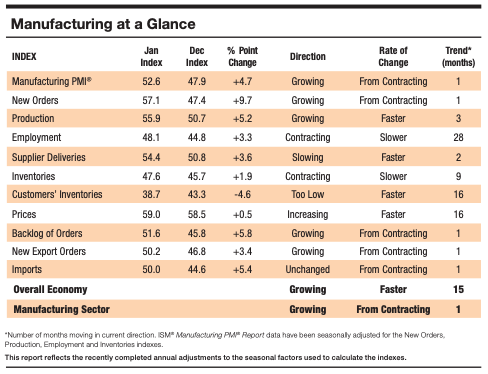

New Orders surged to 57.1, and Production climbed to 55.9, snapping 26 consecutive months of manufacturing contraction and landing the PMI at its highest in 40 months.

Source: ISMWorld

Source: ISMWorld

Meanwhile, $2.56 billion in crypto liquidations and spot volumes at their lowest since 2024 is hinting at a possible drained out liquidity, as the total crypto market cap sank to $2.58 trillion.

Manufacturing Rebound Ends a Historic Drought

U.S. Commerce Secretary Howard Lutnick credited the expansion directly to trade policy, framing it as validation of the administration’s tariff strategy.

“For the first time in over two years the United States has delivered manufacturing expansion, all thanks to President Trump’s trade policies,” he stated, adding that “tariffs are working as we said.“

The sub-indices reinforced the optimism. Production reached its highest since February 2022, Backlogs of Orders expanded to 51.6, and nine of eighteen manufacturing industries reported growth, with the Prices Index holding at 59%.

New Export Orders crossed into expansion at 50.2 for the first time since December, deepening the recovery signal across the sector.

Economist James E. Thorne firmly rejected inflation fears surrounding the data. “Expanding the Supply Side of the economy is NOT inflationary,” he wrote, a stance supported by Truflation’s real-time U.S. CPI reading of 0.95%, well below the 2% target.

Spot Demand Collapse Raises Alarm Bells

CryptoQuant analyst Darkfost flagged a dramatic retreat in spot activity since October, with Binance volumes tumbling from nearly $200 billion to $104 billion.

“The current environment remains uncertain and does not encourage risk-taking,” he wrote, warning that a durable recovery requires spot volumes to return.

Speaking with Cryptonews, SwapSpace CBDO Vasily Shilov sharpened the picture with exchange flow data, noting that “the volume of Bitcoin transferred to exchanges has fallen to around $10 billion per month” against “$50–80 billion” at past price peaks.

SwapSpace data also showed weekend exchange volumes surging 43% above typical benchmarks amid thin liquidity

He attributed the weakness to a demand vacuum compounded by geopolitical pressure around Iran.

On-chain metrics deepened the concern. CryptoQuant’s Supply in Loss rose sharply to 44%, a pattern historically associated with early bear-market phases rather than healthy pullbacks.

The Puell Multiple also remained in its discount zone for the third consecutive month, with miner reserves at roughly 1.8 million BTC under mounting revenue pressure as smaller operators begin to capitulate.

Bulls and Bears Clash Over the ISM Signal

Joe Burnett, VP of Bitcoin Strategy at Strive, framed the PMI breakout as a historic catalyst.

“Past breakouts in 2013, 2016, and 2020 served as key catalysts for Bitcoin’s major bull runs,” he wrote.

Analyst Benjamin Cowen pushed back sharply, citing 2014 ( when the ISM climbed from 52.5 to 55.7 while Bitcoin dropped from $737 to $302), and cautioned that “Bitcoin is not the economy.“

Leo Lanza countered Cowen directly, arguing the real trigger is not ISM hovering above 50, but specifically crossing back above 50 after prolonged contraction, which is the exact pattern now in play.

Analyst Jesse Eckel built on that thesis, declaring that “every single crypto bull run ever — 2013, 2017 and 2021 — happened when the ISM moved up above 50,” and adding that “our dot com moment is still firmly ahead of us.“

Shilov, however, closed with a measured warning, projecting a near-term dip below $70,000 before any sustained recovery materializes.

The worst case, he cautioned, could drag total crypto market cap toward $1.8–2.0 trillion, making ETF flows, corporate holder decisions, and the evolving geopolitical landscape the defining forces shaping Bitcoin’s path forward.

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?