Bitcoin (BTC) Price Prediction: Bernstein Warns of Possible $60K Drop as Bear Market Fears Grow

TLDR

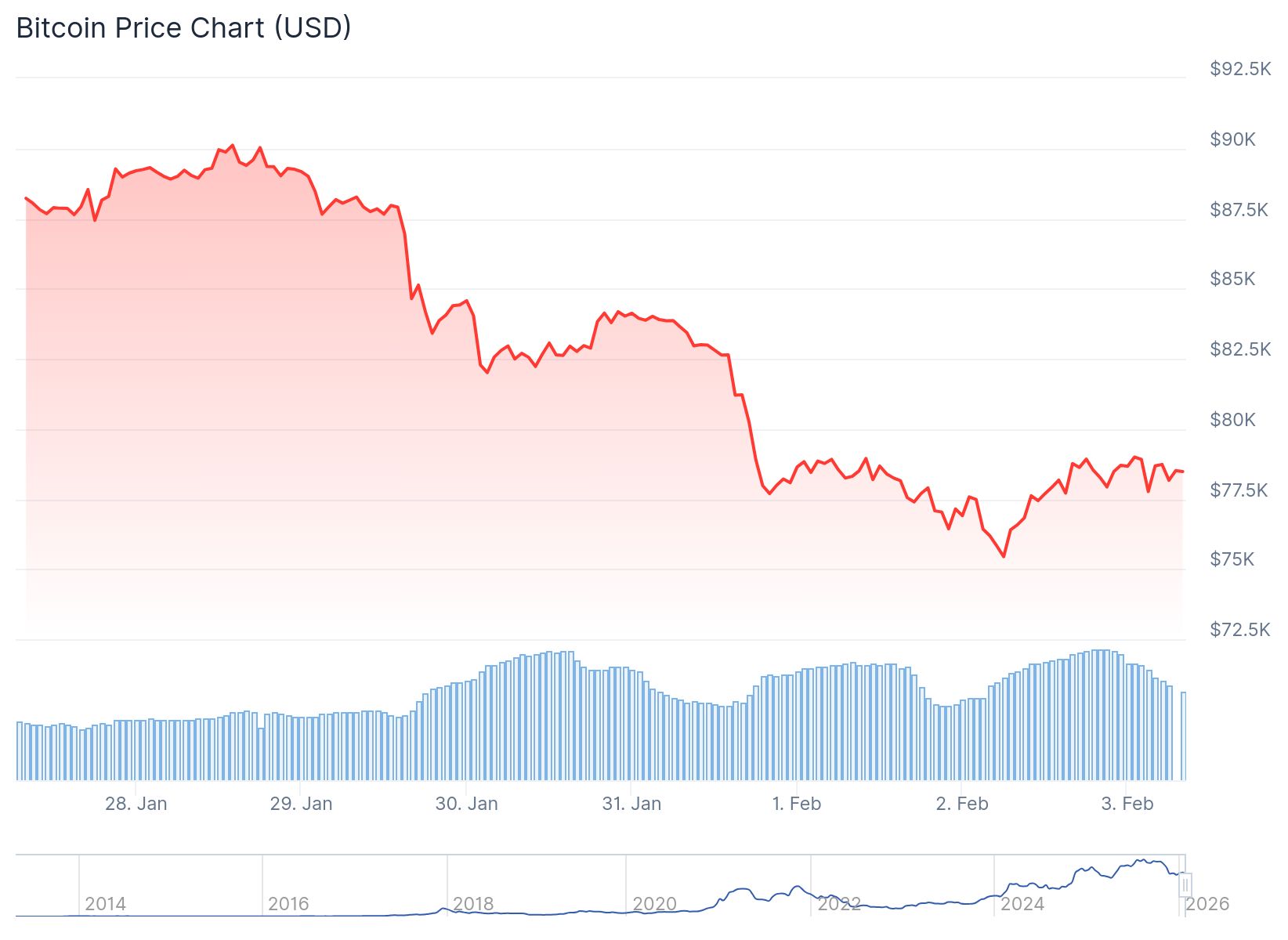

- Bitcoin dropped to around $74,000 over the weekend, roughly 40% below its all-time highs, before recovering to $78,244

- Bernstein analysts predict Bitcoin could fall to $60,000 in the first half of 2026 before establishing a stronger base

- Spot Bitcoin ETFs ended a four-day outflow streak with $561.9 million in net inflows on Monday, the largest since January 14

- Trump’s nomination of Kevin Warsh as Federal Reserve chair is weighing on crypto markets due to his hawkish monetary policy stance

- About $1.6 billion in leveraged crypto positions were liquidated as prices fell, with $111 billion wiped from total market cap

Bitcoin experienced intense volatility over the weekend as prices plunged to approximately $74,000. The world’s largest cryptocurrency has since recovered to trade around $78,244.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The drop represents nearly a 40% decline from Bitcoin’s all-time highs. The sell-off triggered widespread liquidations across the digital asset market.

Investment firm Bernstein released analysis suggesting Bitcoin remains in a “short-term crypto bear cycle.” The analysts led by Gautam Chhugani predict the downturn could last several more months.

Bernstein expects Bitcoin may find support near $60,000 in the first half of 2026. This price level aligns with Bitcoin’s previous cycle highs.

Roughly $111 billion was erased from the total cryptocurrency market capitalization in 24 hours. Data from Coinglass shows approximately $1.6 billion in leveraged positions were liquidated as prices fell.

Thinning liquidity during weekend trading sessions made the sell-off worse. Stop-loss orders and margin calls accelerated the decline as prices dropped through key levels.

Fed Nomination Impacts Market Sentiment

President Donald Trump’s nomination of Kevin Warsh as Federal Reserve chair has created uncertainty in crypto markets. Warsh previously served as a Federal Reserve governor and is known for hawkish views on monetary policy.

His stance on inflation control and balance-sheet discipline suggests tighter financial conditions ahead. Cryptocurrencies typically perform better during periods of abundant liquidity and lower interest rates.

David Scutt, market analyst at StoneX Group, noted that Warsh’s past criticism of quantitative easing triggered immediate selling. Trades that benefited from currency debasement concerns unwound quickly.

Despite the bearish near-term outlook, Bernstein sees structural changes supporting Bitcoin long-term. The analysts pointed to spot Bitcoin ETFs, which now manage approximately $165 billion in assets.

Corporate Bitcoin treasuries have also grown substantially. Strategy has accumulated about $3.8 billion worth of Bitcoin year-to-date.

ETF Inflows Signal Renewed Interest

U.S. spot Bitcoin ETFs recorded $561.9 million in net inflows on Monday, February 3. The inflows ended a four-day streak of outflows.

Fidelity’s FBTC led with $153.4 million in inflows. BlackRock’s IBIT followed with $142 million.

Bitwise’s BITB saw $96.5 million in net inflows. Funds from Grayscale, Ark & 21Shares, VanEck, Invesco, and WisdomTree also posted gains.

Vincent Liu, CIO at Kronos Research, described the inflows as a sign of conviction among large investors. He said allocators are using regulated ETFs to scale exposure as part of portfolio rebalancing.

The previous two weeks saw substantial ETF outflows totaling nearly $3 billion combined. Tim Sun, senior researcher at HashKey Group, attributed earlier withdrawals to narrowing arbitrage opportunities.

Sun said Bitcoin testing support levels twice in a short period allowed the market to price in pessimistic expectations. Some medium and long-term investors now view current prices as attractive entry points.

Bitcoin’s market cap has fallen to just 4% of gold’s market cap, a two-year low. Central banks from China and India have pushed gold’s share of global reserves to around 29% by late 2025.

The post Bitcoin (BTC) Price Prediction: Bernstein Warns of Possible $60K Drop as Bear Market Fears Grow appeared first on CoinCentral.

You May Also Like

What is the best front-office digital software for insurance companies in 2026?

Vitalik Buterin Says Ethereum Scaling Should Move From L2s