Which Crypto Exchanges Dominated Spot Trading in 2025?

Binance remained the largest centralized cryptocurrency exchange in December 2025, according to new data published by CoinGecko.

Despite a sharp month-over-month slowdown in activity, Binance closed the year with a 38.3% share of global spot trading volume, maintaining its dominant position among centralized exchanges.

The data, drawn from CoinGecko’s 2025 Annual Crypto Industry Report, highlights how leadership at the top of the CEX landscape persisted even as overall trading conditions softened toward year-end.

December Slowdown Does Not Disrupt Market Leadership

While Binance retained the top spot, its spot trading volume declined 40.6% from November, falling to approximately $361.8 billion in December. The drop mirrors a broader contraction in centralized exchange activity during the final month of the year, rather than a Binance-specific loss of competitiveness.

Even with that decline, Binance’s share remained substantially larger than any single competitor, underscoring the exchange’s continued centrality to global spot liquidity.

Source: https://www.coingecko.com/research/publications/centralized-crypto-exchanges-market-share

Source: https://www.coingecko.com/research/publications/centralized-crypto-exchanges-market-share

Monthly CEX Volumes Show Cyclical Activity in 2025

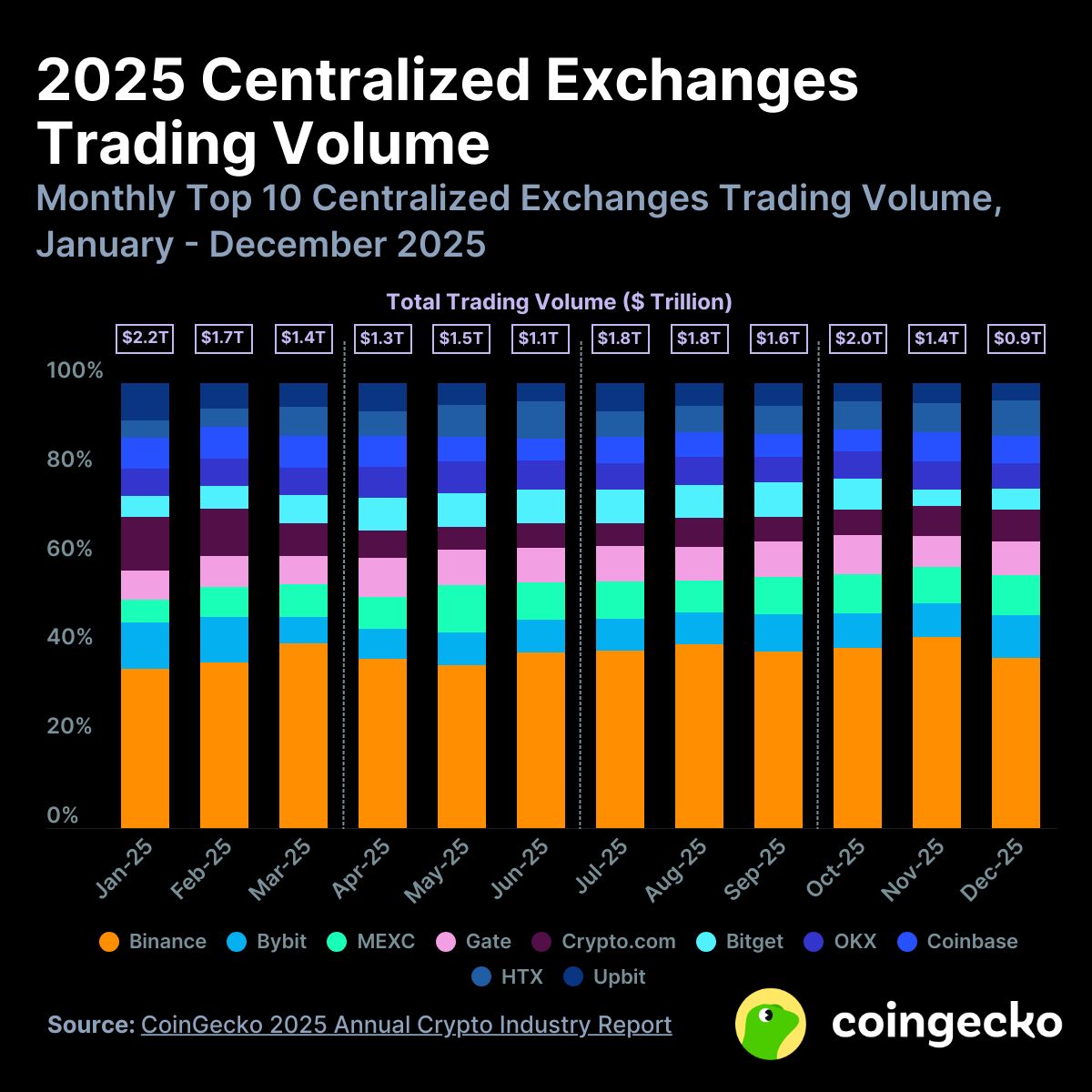

CoinGecko’s chart of monthly top-10 centralized exchange volumes from January to December 2025 shows clear fluctuations in aggregate trading activity. Total monthly volume peaked at around $2.2 trillion in January, softened through the spring, rebounded during mid-year, and then eased again into December, where total volume fell below $1 trillion.

Across this period, Binance consistently accounted for the largest portion of activity each month. Other major platforms, including Bybit, OKX, Coinbase, Upbit, and HTX, retained meaningful shares, but none approached Binance’s scale on a sustained basis.

Competitive Landscape Remains Concentrated

The stacked volume distribution highlights a structurally concentrated CEX market. While secondary exchanges collectively represent a significant share, leadership remains anchored to a small number of large platforms. Binance’s ability to hold nearly two-fifths of global spot volume in a weaker month illustrates how entrenched its position remains, even as market participation ebbs and flows.

Market Takeaway

CoinGecko’s December 2025 data confirms that Binance continues to anchor centralized exchange liquidity, despite a notable late-year decline in spot volumes. The broader picture suggests cooling trading activity across the sector rather than a reshuffling of exchange leadership. As market conditions evolve in 2026, shifts in volume will be closely watched, but for now, Binance’s dominance among CEXs remains intact.

The post Which Crypto Exchanges Dominated Spot Trading in 2025? appeared first on ETHNews.

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

Why This New Trending Meme Coin Is Being Dubbed The New PEPE After Record Presale