Best Cheap Crypto to Buy Now in February: VeChain and Polygon Forge On, While DeepSnitch AI Anticipates Post-Launch Moonshot

As January turns to February, Nubank has picked up conditional approval from the US Office of the Comptroller of the Currency to form a national bank. This will allow it to offer deposits, lending, and digital asset custody in the US.

At the same time, Trump named Kevin Warsh as his choice to replace Jerome Powell at the Fed, teeing up a confirmation fight that could influence how digital assets fit into monetary policy.

This is the context to keep in mind when determining the best cheap crypto to buy now, and aiming for early-stage tokens is wise right now, as large caps adjust to new rules. Affordable crypto investments still ahead of exchange listings have room to run, and more specifically, DeepSnitch AI is a token with moonshot potential this 2026, on the back of its sharp utility.

Having raised $1.4 million, it’s risen 150% from its original price and is now at $0.03755, with tools shipped, staking live, and a launch coming up quickly.

Institutional crypto infrastructure scales under federal oversight

Nubank securing approval for a US national bank charter is adding another major fintech name to the regulatory fold. It follows similar green lights for Circle and Ripple in December, while the OCC has also cleared BitGo, Fidelity Digital Assets, and Paxos to convert into national trust banks. All in all, digital asset firms are being pulled directly into the US banking framework, so they’re not lurking on the periphery.

And Trump’s choice of Kevin Warsh for Fed chair is another related twist. Warsh, who served on the Federal Reserve Board from 2006 to 2011, has been notably more open to Bitcoin than Jerome Powell. In a July discussion at the Hoover Institution, he dismissed the idea that Bitcoin undermines central bank authority, instead framing it as a form of market discipline rather than a threat.

With all this in mind, determining the best cheap crypto to buy now requires looking to early-stage opportunities gearing up for explosive growth, and that growth will need to be in response to institutional infrastructure’s scaling up.

Intelligence platforms meet established ecosystems

- DeepSnitch AI is the intelligence edge with 1000x potential in 2026

The real gap between retail and whales is not capital on its own. Whales see information first, retail sees it once the trade is already crowded. DeepSnitch AI is designed to change that, and among the best cheap crypto to buy now, it offers a low entry price paired with working infrastructure.

It’s rare that a platform can so deftly prove that its tools are worth the hype, but DeepSnitch AI has shipped them already, so it’s cleared that hurdle exceptionally. The platform runs through five “snitches,” AI agents that function as a single intelligence layer.

Among them, SnitchFeed flags tokens and alerts as they develop, while AuditSnitch checks contracts for common traps like honeypots, tax abuse, or ownership control issues, returning simple verdicts.

All the data comes back in plain language, so decisions don’t require deep technical digging. With these snitches working in unison come launch, the system will turn research into a fast, repeatable habit rather than guesswork.

Dynamic uncapped staking is already live, with rewards scaling as participation grows, and early holders are already taste-testing these tools.

DeepSnitch AI is priced at $0.03755 and positioned as a moonshot token for 2026, with launch approaching and a major team update expected soon. This is a rare token among the best cheap crypto to buy now, due to its combined early-stage pricing and razor-sharp utility, developed by expert on-chain analysts who know exactly what tools need to be put in traders’ hands.

- VeChain: Enterprise adoption with uncertain price action

VeChain’s currently trading around $0.009, and the enterprise narrative remains strong, particularly around supply chain management. Its price action is looking a little less steady, though forecasts point to around $0.012 by the end of the year.

Long-term models get messier, showing a drop to $0.003 by 2030 (down over 60%) before recovering to $0.012 again by 2040.

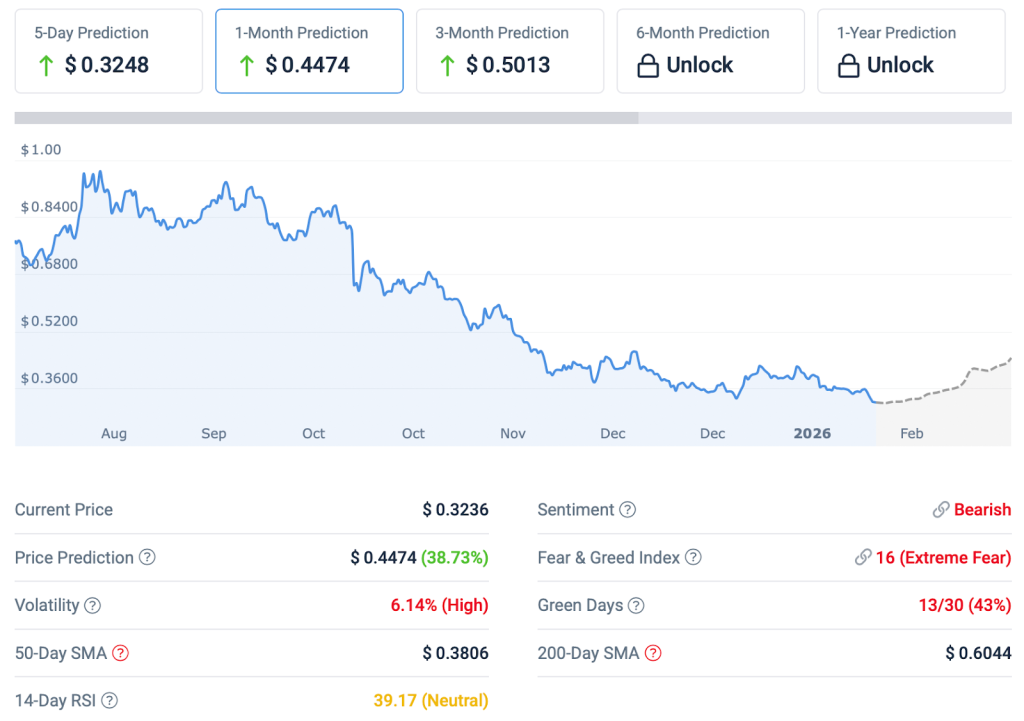

- Polygon’s solid growth trajectory

Polygon is priced at around $0.11 as of 30 January, and it’s looking stronger on the charts.

Analysts forecast around $0.26 by year-end, which would put it at roughly 130% growth. And if the ecosystem continues expanding, that number could stay steady or see a slight uptick over the next five years.

POL offers solid, affordable crypto investment potential with utility to rely on, but its market cap and slower growth pace don’t quite compare to the kind of parabolic offerings presales can pull.

Final reflection

When you’re deciding on the best cheap crypto to buy now, established tokens hoping for modest gains won’t usher in major gains. But finding low entry price tokens positioned to explode before the broader market catches on is the way to rewards, especially if you can balance the risk with the reliability of utility, which DeepSnitch AI is doing better than any other presale token right now.

With the imminent launch approaching and early 2026 shaping up as DeepSnitch AI’s moonshot quarter, the access asymmetry rewarding early holders is abundantly clear.

For now, you can also use bonus codes for larger purchases. Code DSNTVIP300 takes a $30,000 buy from roughly 800,000 DSNT to around 3.2 million tokens. That’s a 300% bonus that layers on top of dynamic staking APR, rewards that scale upward automatically as participation increases.

To put that in perspective, should the platform’s 1000x potential even partially materialize and DSNT reaches $5, that’s $16 million from a single position.

The compounding advantage combines live tools already shipping in presale with uncapped staking that grows stronger as the ecosystem expands. Timing is everything with this token, so buying now is best to get in ahead of launch.

You get involved in the presale and its pricing at DeepSnitch AI, and if you want further updates, stay connected via X and Telegram.

FAQs

What is the best cheap crypto to buy now?

DeepSnitch AI offers strong moonshot potential at $0.03755 with live tools, imminent launch creating holder advantages, and about 150% gains already demonstrated in presale.

Which low-cost crypto has the most potential?

If you’re looking for accessible entry points, DeepSnitch AI is likely the best cheap crypto to buy now, combining demonstrable utility with presale pricing and live platform access, positioning it for 100x upside once exchange liquidity arrives.

What are good, cheap altcoins to invest in?

As the best cheap crypto to buy now, DeepSnitch AI benefits from proprietary AI agents, a launch window just days away, and presale access that rewards early buyers before the major announcement.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Best Cheap Crypto to Buy Now in February: VeChain and Polygon Forge On, While DeepSnitch AI Anticipates Post-Launch Moonshot appeared first on CaptainAltcoin.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

United States Building Permits Change dipped from previous -2.8% to -3.7% in August