Analysts: This Is The Key Step for Bitcoin to Break $90K

Bitcoin (CRYPTO: BTC) whispered toward a key milestone in a cautious pre-FOMC session, but failed to clear the near-term overhead at $90,000 as traders weighed macro signals and sector-specific dynamics. The market’s pulse suggested a potential revival if the BTC/USD pair can convincingly reclaim the $93,000 level, a threshold that would pivot sentiment toward a possible upside breakout. While spot ETFs have cooled their selling pressure, on-chain data and institutional behavior remain a deciding factor for the next leg higher. This mix of technical resistance and evolving demand conditions frames the immediate risk-reward for traders heading into the Federal Reserve’s policy decision window.

Bitcoin’s current drift sits within a defined range. The asset has traded between approximately $86,000 and $90,000 in recent sessions, a corridor that analysts say has persisted since mid-January. The broader chart setup points to a battleground just above the 50-day simple moving average at $90,000 and beneath a ceiling near the 100-day SMA around $94,000. In practical terms, a clean close and hold above $93,000 would shift the narrative, signaling that the long-downward sequence could be easing and that demand may re-enter in a more sustained fashion. As market observers have noted, several on-chain indicators and veteran voices have begun to frame the next move as a test of whether bulls can convert resistance into a new base of support.

Additionally, a macro backdrop dominated by liquidity considerations and policy uncertainty continues to color price action. The immediate overshoot risk remains tethered to the pace at which institutional buyers and related products return to the market. The ETF narrative—long a source of both enthusiasm and apprehension for the space—has shown signs of stabilization on the selling side, but meaningful upside hinges on renewed inflows rather than mere price speculation. In other words, a shift from a liquidity-driven pause to an actual revival in demand could be the catalyst that lifts Bitcoin from a prolonged consolidation phase toward a fresh up-leg.

From a purely technical vantage point, the market has been watching for a decisive break above the moving averages, a pattern that historically precedes more aggressive upside. A number of analysts emphasized that reclaiming the $93,000 threshold would be important for shifting momentum back into the bullish camp. A sustained push beyond that zone could unlock the possibility of retesting higher resistance near $98,000, a scenario that would mark a meaningful reset of the corrective phase that has characterized the last several weeks. In this context, traders are paying close attention to how the order book shapes up around the critical level, and whether a liquidity cluster could form around the mid-$93,000s on the path to higher levels.

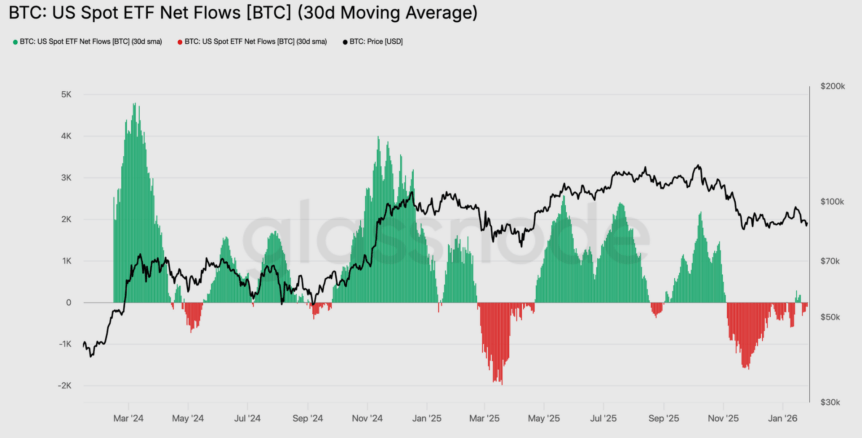

On-chain and macro-derived signals echo a similar sentiment: a return of genuine institutional demand would likely be a decisive inflection point for BTC’s trajectory. Glassnode recently highlighted that US spot Bitcoin flows are stabilizing, with the 30-day moving average drifting toward neutral after a period of persistent outflows. The message from the on-chain data provider is clear: if flows can re-accelerate into positive territory, a renewed trend continuation would gain credibility. Yet, the current data also underscores that the market remains more reliant on spot holder conviction than on ETF-driven demand, a nuance that shapes how investors interpret near-term risk and reward.

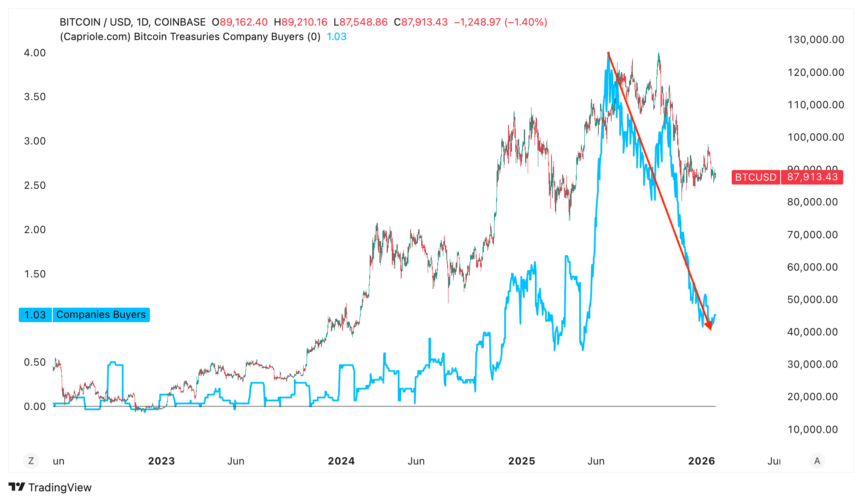

The ETF angle has also carried important nuance. After a stretch of heavy outflows, industry data suggest that the selling pressure may be abating, but the pace and durability of any re-entry are not guaranteed. Capriole Investments provided a cautionary counterpoint by illustrating a reduced cadence of Bitcoin treasury purchases among corporate buyers, suggesting that institutional demand remains uneven at best. The spotlight, therefore, remains squarely on two fronts: a potential reawakening of ETF inflows and a broader unwinding of corporate treasuries’ caution.

BTC/USD three-day chart. Source: JelleAmong notable developments, a major corporate event stands out. Michael Saylor’s Strategy represents the most sizable known corporate Bitcoin treasury, and its recent activity drew attention to how much weight corporate balance sheets still carry in the market. The firm disclosed a fresh purchase of 2,932 BTC for about $264.1 million, lifting its total holdings to 712,647 BTC, with an average cost basis around $76,037 per coin. The move suggests that, despite broader selling fatigue at the retail and institutional levels, there remains a segment of the market that sees long-term value in accumulating BTC on weakness. The impact of these macro and micro dynamics continues to reverberate through the market’s risk channels, reinforcing the idea that the path of least resistance could shift if liquidity conditions improve and institutional appetite returns.

Meanwhile, analysts have continued to weigh the likelihood of a breakout in the context of liquidity and how the market behaves around critical levels. A prominent line of thought is that if Bitcoin can clear the $93,000 area decisively, the ensuing momentum could carry prices toward the $98,000 resistance zone, and perhaps beyond, as the downward bias loosens. Yet, until such a breakout is confirmed with a daily close above the level, the market remains vulnerable to protective selling and profit-taking, especially in the event of unexpected macro shifts or changes in forward guidance.

In short, the balance of factors remains finely poised. Bullish momentum could reassert itself if fresh capital inflows return to spot markets and ETFs, while a failure to sustain above the threshold could prolong the current consolidation. The narrative thus hinges on a combination of price action above key moving averages, on-chain flow dynamics, and institutional participation that could tilt the odds in favor of a sustained rally rather than a reversion to the lower end of the trading range.

Bitcoin ETF outflows diminish

One of the most closely watched catalysts for a renewed price push has been the ebb and flow of ETF demand. Following a period of notable outflows from spot Bitcoin ETFs, data suggest that selling pressure may be easing. Glassnode’s latest insights point to a stabilization in US spot Bitcoin flows, with the 30-day average inching toward neutral territory after a stretch of sustained outflows. This shift, while modest, could lay the groundwork for a more constructive backdrop if it translates into actual inflows and renewed demand for physical BTC exposure.

That said, the broader takeaway from on-chain analytics remains nuanced. The same data set stresses that the BTC market has leaned more on holders’ conviction rather than fresh ETF-driven demand in recent weeks. In practical terms, investors watching this space would benefit from distinguishing between a temporary stabilization in flows and a material reacceleration that would underpin a sustainable rally. If flows do re-accelerate into positive territory, the case for continued momentum would strengthen, potentially lifting prices through the $90,000 barrier and toward the higher end of the immediate range.

Capriole Investments’ data adds another layer of caution. It shows a sharp drop in new BTC purchases by treasury holders, suggesting that corporate demand has not yet returned with the vigor seen in some earlier periods. The dynamic is important because it mirrors a broader market reality: even as some retail and high-net-worth participants remain active, the institutional appetite to accumulate BTC on a large scale has shown episodic strength rather than consistent, long-term certainty.

Against this backdrop, the market’s most consequential mover remains the balance between on-chain activity and macro cues. The most meaningful signal would be a sustained shift in institutional demand that drives ETF inflows and a meaningful outflow reversal, catalyzing a fresh wave of buying across the spot market. The past few weeks have underscored how quickly sentiment can pivot on the perception of liquidity and policy guidance, and traders will be watching closely as the market approaches any forward guidance from major central banks.

Spot Bitcoin ETF net flows, 30DMA. Source: Glassnode

Spot Bitcoin ETF net flows, 30DMA. Source: Glassnode

In the sense of on-chain dynamics, the narrative that previously centered on the ETF pipeline now coexists with a broader recognition that corporate balance-sheet decisions, treasury strategies, and large investor psychology will shape the next leg. The broad picture remains that the market is susceptible to a mix of positive catalysts—restored ETF inflows, renewed institutional buying, and a productive macro environment—and negative catalysts, including persistent hedging in derivatives markets and any hawkish pivots in monetary policy. The price path will likely reflect this tug-of-war, with a success or failure to breach the $93,000 barrier serving as a probable inflection point.

Bitcoin treasury companies buyers. Source: Capriole Investments

Bitcoin treasury companies buyers. Source: Capriole Investments

As this dynamic unfolds, the market’s attention remains fixed on whether the liquidity environment improves enough to sustain a rebound, or whether the absence of durable demand caps any upside gains. The implication for market participants is clear: any meaningful move higher will require a confluence of technical breakouts, on-chain confirmation, and genuine institutional interest—not simply a bounce on a short-term trader’s sentiment.

Why it matters

The price action around $90,000 and the critical test at $93,000 have emerged as a deciding moment for market direction. If the market can convert resistance into support, it would validate a shift in momentum and potentially attract new capital from both hedged investors and traditional funds seeking crypto exposure. For traders, the implication is straightforward: a sustained move above $93,000 could open a path toward the mid-$90,000s and possibly higher, while a failure to hold could invite renewed consolidation in the near term. For corporate treasuries and larger players, the ongoing debate is about the sustainability of demand and the durability of ETF inflows, which will shape the tempo of future purchases and risk management strategies.

Investors should also keep a close watch on macro cues that influence liquidity and risk sentiment. The timing of any future Fed communications, as well as changes in the appetite for risk across asset classes, can have cascading effects on how BTC is priced in the near term. The evolving relationship between on-chain data and traditional financial instruments—etfs, equities linked to crypto, and futures markets—will continue to define Bitcoin’s macro narrative. In such an environment, disciplined risk controls and clear scenarios for different price outcomes remain essential for participants navigating this space.

Meanwhile, the narrative around corporate participation remains nuanced. While Strategy’s latest accumulation underscores the willingness of some large holders to build positions on dips, other treasury buyers appear to be more cautious, reflecting a broader market reality: institutional adoption of BTC still hinges on a confluence of favorable liquidity, policy clarity, and demonstrable demand that can sustain price momentum. In the absence of a decisive macro catalyst, traders may gravitate toward ranges, with the critical level at $93,000 acting as the fulcrum for the next leg of the cycle.

What to watch next

- Watch for a weekly close above $93,000 to confirm a momentum shift.

- Monitor ETF inflows and 30-day flow metrics for signs of renewed institutional demand.

- Track corporate treasury activity and major purchases by large holders for evidence of durable demand.

- Observe liquidity conditions in the broader market and any shifts in risk sentiment around FOMC communications.

Sources & verification

- Glassnode insights on US spot Bitcoin flows and 30D moving average trends.

- Capriole Investments data on Bitcoin treasury buyers and corporate purchases.

- Strategy’s reported purchase of 2,932 BTC for $264.1 million and the resulting holdings update.

- Deribit analysis on options activity and the implications for price action near the $90,000 zone.

- On-chain and social signals referenced by analysts, including posts from CryptoJelleNL and Mark Cullen on X, discussing levels around $93,000.

Market reaction and key details

Bitcoin BTC remained tethered near the $90,000 mark as traders parsed the next move ahead of a pivotal Federal Reserve decision. The path forward hinges on whether the market can reclaim the $93,000 threshold and convert that level into a reliable base of support. The resistance band spanning roughly $90,000 to $94,000 remains a critical obstacle, with the 50-day moving average sitting at $90,000 and the 100-day around $94,000, creating a ceiling that requires a decisive breakout to re-accelerate momentum.

Analysts have highlighted the necessity of flipping the current resistance into support to rekindle the uptrend. A breach above $93,000 would not just be a statistical breakout; it would reframe market psychology, signaling that buyers are reclaiming control after a period of consolidation. The rhetoric around this level has been reinforced by traders who view it as a linchpin—the line in the sand that separates a corrective phase from a new leg higher.

On the other hand, a break below the lower end of the range would likely renew caution. In such a scenario, risk-off behavior could reassert itself, with market participants seeking safety and preserving capital rather than chasing a volatile advance. The current setup underscores a market that remains highly sensitive to macro cues, including policy guidance, liquidity metrics, and the flow of funds into and out of spot exposure via ETFs.

From the technical lens, multiple voices have argued that breaking above the key moving averages would unlock the doors to a rally toward the $98,000 zone and potentially higher. A sustained close above $93,000 would be a meaningful signal that the corrective phase could be ending, paving the way for a retest of higher levels if liquidity conditions cooperate. However, the path is not guaranteed; the market’s reaction to the Fed’s commentary and any accompanying shifts in risk appetite will play a decisive role in determining whether the breakout gains real traction or fades in a shallow pullback.

In parallel, the ETF landscape continues to influence the broader narrative. While ETF outflows have moderated, pointing to a stabilization in selling pressure, the absence of a robust inflow regime keeps the door open for a slower, more arduous ascent rather than a sprint higher. On-chain signals support this cautious view: Glassnode’s observations of stabilising flows suggest that any upside will require renewed conviction from institutions and a reacceleration of positive net inflows, beyond transient price movements.

Corporate activity offers another lens through which to gauge momentum. The latest data from Capriole Investments show a cooling in new BTC acquisitions by corporate treasuries, which contrasts with the earlier surge seen when market risk appetite briefly spiked. Yet, Mavericks of the space, like Strategy—the prolific Bitcoin treasury holder—continue to add significant quantities of BTC to their coffers, a move that could foreshadow a larger, more persistent institutional bid if other large players follow suit. The combination of a large, purposeful buyer on the one hand and a cautious corporate environment on the other paints a nuanced picture of the immediate horizon.

The confluence of on-chain dynamics, ETF flow patterns, and corporate activity will likely determine Bitcoin’s near-term trajectory. A decisive move beyond $93,000 would recalibrate risk and reinvigorate the narrative around a potential run toward higher resistance zones, while a failure to sustain those levels could prolong the current plateau. Traders are thus faced with a fragile balance: keep risk budgets tight in case of a false breakout, or position for a more persistent, multi-week advance should the macro signals align with technical breakout momentum.

In the broader context, the market remains acutely sensitive to liquidity and policy developments. A more accommodative policy stance or a clearer inflation trajectory could bolster risk-seeking behavior across crypto assets, while any tightening signal might retrastrate the price action, favoring cautious positioning and hedging. The interplay between ETF inflows, on-chain flow restoration, and corporate demand is the crucible in which Bitcoin’s next chapter will be forged.

The narrative remains that the path of least resistance depends on two closely linked variables: the sustained presence of genuine demand in traditional financial channels and the ability of BTC to maintain above critical technical thresholds. If both pieces align—flows turning positive and price action decisively clearing the 93k line—the market could shift from a phase of gradual accumulation to a renewed cycle of appreciation. Until then, the market will likely oscillate within the established range as investors await clarity on liquidity and macro policy.

This article was originally published as Analysts: This Is The Key Step for Bitcoin to Break $90K on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm