Bitcoin Nears $90,000 as Steak ’n Shake Adds $5M In BTC To Strategic Reserve

Bitcoin rose above $89,000 but remained largely rangebound, as investors balanced a weaker dollar and gold prices against caution ahead of a key US Federal Reserve policy decision due later in the day.

BTC price rose over 1% in the last 24 hours to trade at $89,080 as of 03:12 a.m. EST, with an intraday high of $89,394, and is trading between $87,300 and $89,500. The surge is in line with the broader crypto market, which has risen by over 1% to a market capitalization of $3.1 trillion.

The price-to-trading-volume ratio has also soared over 9% to $44 billion, signaling a recent rise in market activity as interest picks up.

Such interest is from Steak n’ Shake, which added $5 million in Bitcoin tokens to its Strategic reserve.

Steak ‘n Shake Adds $5M in Bitcoin to Reserve

The fast-food restaurant chain Steak n’ Shake added $5 million worth of BTC to its Strategic Bitcoin Reserve, which is in line with its pledge to funnel all sales made in BTC straight into the fund.

After the recent purchase, the company now holds $15 million, equivalent to roughly $167.7 BTC, following a $10 million increase announced on January 18.

However, it is not clear how much BTC the company holds, nor whether the amount reflects price appreciation, customer payments, or additional treasury purchases.

According to the company, it aims to improve food quality, which drives same-store sales and, in turn, SBR growth, transforming the chain through financial technology.

This comes as Bitcoin adoption has continued to ramp up among public companies over the past twelve months. According to data from BitcoinTreasuries.Net, approximately 1.13 million BTC are held by public treasuries.

Bitcoin Remains Rangebound Amid Fed Caution

Bitcoin continues to be supported by a broad dollar weakness after US President Donald Trump played down concerns about its slide.

The dollar hit a four-year low, while gold extended a blistering rally to fresh record highs above $5,200 an ounce, reinforcing demand for alternative stores of value.

Even with these tailwinds, the top cryptocurrency continues to struggle to sustain a decisive breakout, trading in a narrow band between $88,000 and $89,000.

Positioning remains light as traders await clarity from the Fed, with risk appetite constrained by uncertainty over the near-term path of US interest rates.

At the conclusion of the Fed policy meeting later today, investors are closely watching the accompanying statement and Chair Jerome Powell’s remarks for signals on when rate cuts might begin.

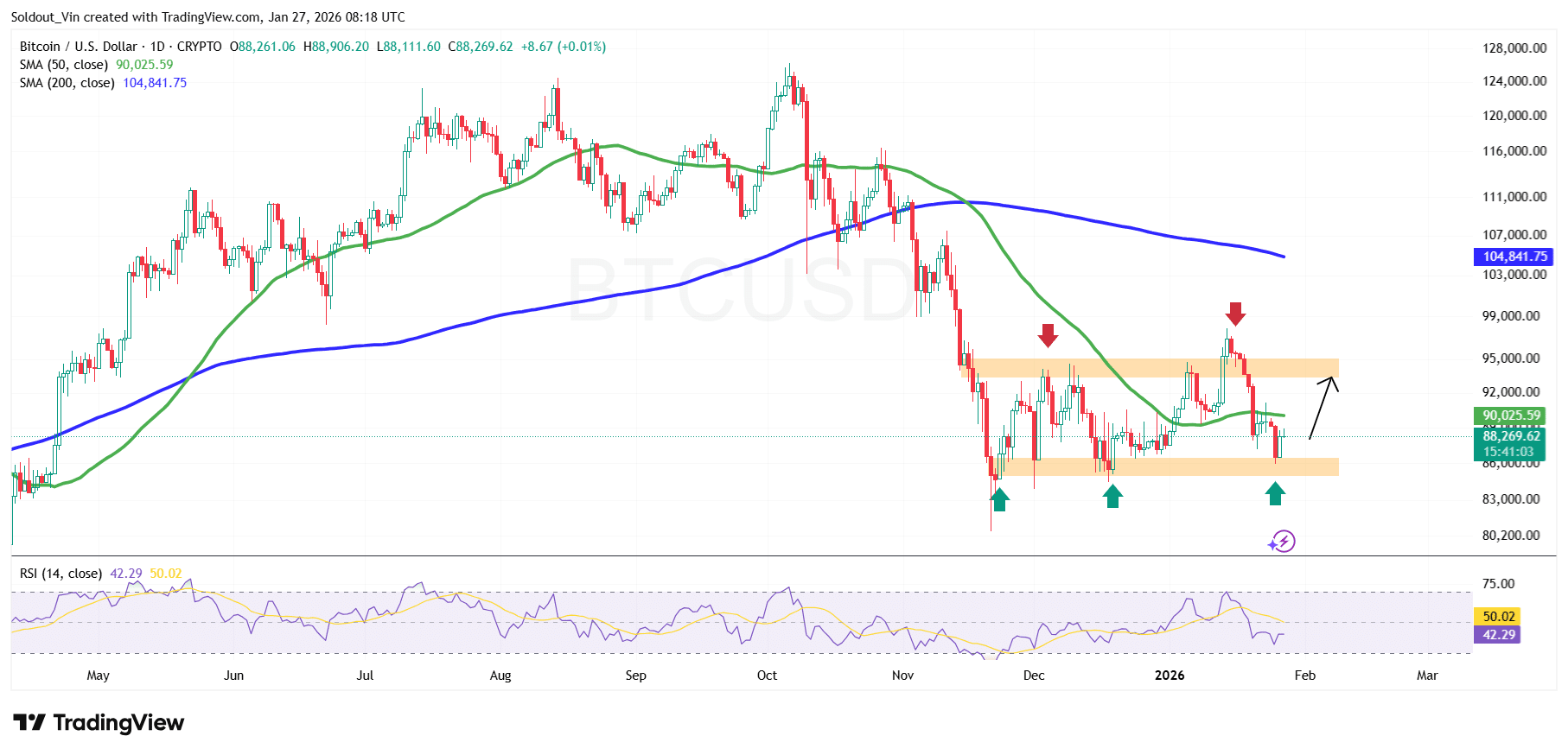

Bitcoin Price Signals Range Stabilization Below Key Resistance

The Bitcoin price shows signs of short-term stabilization after a corrective move, consolidating near a major support zone around $85,000–$86,000.

The daily chart indicates BTC is attempting to build a base following a rejection from the $97,800 region and a strong sell-off that pushed price below key moving averages.

Multiple bounces from the lower support zone confirm strong buying interest near $84,000–$86,000, while repeated rejections near $93,000–$95,000 indicate sellers remain active overhead. Such behavior could only occur as the price searches for direction.

Key resistance lies in the $93,000–$95,000 zone, which aligns with the 0.236 Fibonacci retracement and the declining 50-day SMA ($89,971), adding confluence and strengthening this barrier.

A sustained break above this region could allow Bitcoin to move toward the next resistance near $100,000–$103,000, where the 200-day SMA and higher Fibonacci levels come into play.

BTC/USD Chart Analysis Source: TradingView

BTC/USD Chart Analysis Source: TradingView

BTC Investors Remain Cautious Below $90,000

The Relative Strength Index (RSI) on the daily chart is hovering around 45–48, reflecting neutral-to-bearish momentum. This level suggests neither side has firm control, consistent with the ongoing consolidation.

The price of Bitcoin is in a critical decision zone, where upcoming sessions will likely determine whether the range moves higher or lower. Investors will not pay attention to price movement around the $89,000–$90,000 area or to reactions at range boundaries for any directional clues.

If BTC’s price maintains its current support and momentum improves, buyers could push it towards the $93,000-$100,000 region, which could then become the next resistance level.

However, key historical data shows that BTC has typically dropped after every FOMC meeting, keeping investors on edge.

Related News:

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

BNB Chain Takes Lead in RWA Tokenization, Expert Sees BNB Rally to $1,300

Read the full article at coingape.com.