Pump.fun CEO to Call Low-Cap Gem to Test New ‘Callouts’ Feature — Is a 100x Incoming?

Pump.fun has rolled out a new social feature that is already stirring debate across Solana’s meme coin scene, after founder Alon Cohen said he would personally use it to “call” a low market cap token as a live test.

The update arrives at a time when interest in ultra-low-cap launches remains high, even as volatility, account security concerns, and past pump-and-dump episodes continue to shape user behavior.

On Tuesday, Pump.fun announced that “callouts” are now live inside its mobile app, with a feature that allows users to alert all of their followers about a specific coin through push notifications.

Each account can make one call every six hours, and users are ranked on a global leaderboard that tracks activity and engagement.

Pump.fun Callouts Draw Attention and Questions

Users who actively make calls are ranked on a global leaderboard, adding a competitive layer that ties visibility to engagement.

Pump.fun says the feature is meant to help surface coins earlier in their lifecycle, particularly within its bonding curve system, where prices rise as demand increases.

Shortly after the launch, Cohen said the mobile app would become a major focus for Pump.fun in the coming months.

He also warned users to follow only his verified Pump.fun account, “alonalon,” amid concerns about impersonation.

According to on-chain data visible on the platform, the account holds just over $112,000 in assets, including SOL and several meme tokens, has more than 11,500 followers, follows no other users, and has never launched a coin.

The announcement immediately triggered speculation among traders, with some framing the test call as a potential catalyst for outsized gains.

A high-profile callout, especially from the platform’s founder, can therefore draw attention and liquidity very quickly, even if only briefly.

At the same time, some traders are questioning whether the account could be compromised or whether the test call might resemble past influencer-driven pumps.

Those concerns are rooted in recent history, as Pump.fun’s main X account was hacked in February 2025 and used to promote fake tokens.

Later that year, Cohen’s personal X account was temporarily suspended alongside the project account before being restored, although that incident was attributed to platform enforcement rather than a confirmed hack.

However, there is no public record of Cohen’s Pump.fun account being compromised.

Speculation Stays Hot as Pump.fun Rebuilds Its Meme Economy

Pump.fun’s callout feature also arrives alongside deeper structural changes to the platform.

In recent days, the company rolled out new creator tools and shifted away from its previous dynamic fee model, allowing token creators to now split fees across multiple wallets, transfer ownership after launch, and revoke update authority to signal long-term commitment.

The changes followed internal findings that earlier fee mechanics encouraged mass token creation without sustaining trading activity. The new direction places more emphasis on market participation and creator accountability.

Despite the risks, usage data shows Pump.fun remains one of the most active meme coin launchpads in crypto.

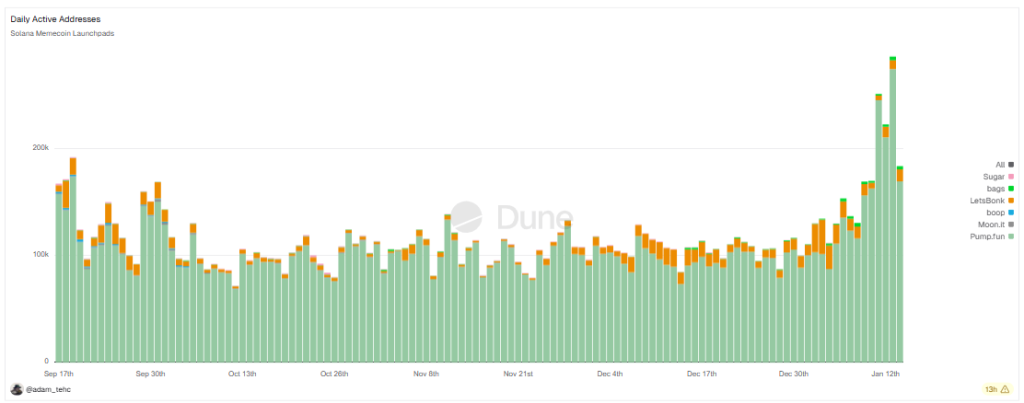

In the past 24 hours alone, over 30,000 new tokens were launched, with just over 200 reaching graduation. Trading volume during that period exceeded $113 million, and daily active wallets have roughly doubled over the past week, pointing to renewed speculative interest.

Source: Dune/adam_tehc

Source: Dune/adam_tehc

The Pump.fun token itself has seen mixed market conditions, as its token PUMP is currently trading around $0.0027, down about 7% on the day and roughly 69% below its all-time high.

Trading volume for the token has also declined modestly over the last 24 hours, reflecting broader cooldowns across the meme coin market.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

XRPL Validator Reveals Why He Just Vetoed New Amendment