Is Shiba Inu About to Repeat Its Bearish Playbook Again This Month?

- Shiba Inu continues bearish December pattern with 14.15% decline this month.

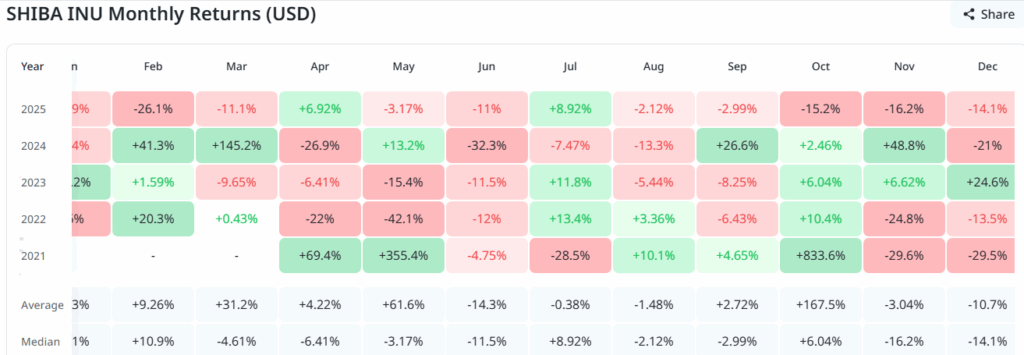

- Historical data shows SHIB closed negative in four of five recent Decembers.

- Token needs 16.64% rally to close positive with only five days remaining.

Shiba Inu is on track to repeat its bearish December performance as the month draws to a close. With only five days remaining in December 2025, the meme coin has declined 14.15% and shows limited signs of recovery. The pattern reinforces historical trends that have seen SHIB struggle during the year’s final month.

The fourth quarter of 2025 has proven difficult for Shiba Inu holders amid broader cryptocurrency market weakness. This downward pressure extended into December, with the token losing value consistently throughout the month. Historical data reveals December has frequently been an unfavorable period for SHIB price action.

Historical December performance shows consistent losses

December 2021 saw Shiba Inu close down 29.5% as investors took profits following the 2021 bull run. The token had achieved massive gains earlier in the year, prompting holders to exit positions during the final month.

December 2022 brought another 13.5% decline. The FTX exchange collapse in November triggered widespread panic across crypto markets, with billions wiped from total market capitalization. SHIB continued declining through December as investors reduced risk exposure.

December 2023 provided the only exception to this bearish pattern. Shiba Inu closed that month with a 24.6% gain, delivering double-digit returns that defied the historical trend. Many investors anticipated this positive performance would continue into the following year.

Instead, December 2024 reversed course with a 21% decline. Investors locked in gains after SHIB rallied to $0.000033 during the post-election surge earlier that month. Profit-taking pressure overwhelmed buying demand as the year concluded.

Current month mirrors bearish December trend

December 2025 is following the established pattern of negative performance. Shiba Inu opened the month trading at $0.000008385 and has already fallen close to 14%.

For SHIB to finish December in positive territory, the price must climb to at least $0.0000084 within the remaining five days. This would require a rally of approximately 16.64% from current levels.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Liquidity Boost Stabilizes Solana-Based Stablecoin USX After Market Drop