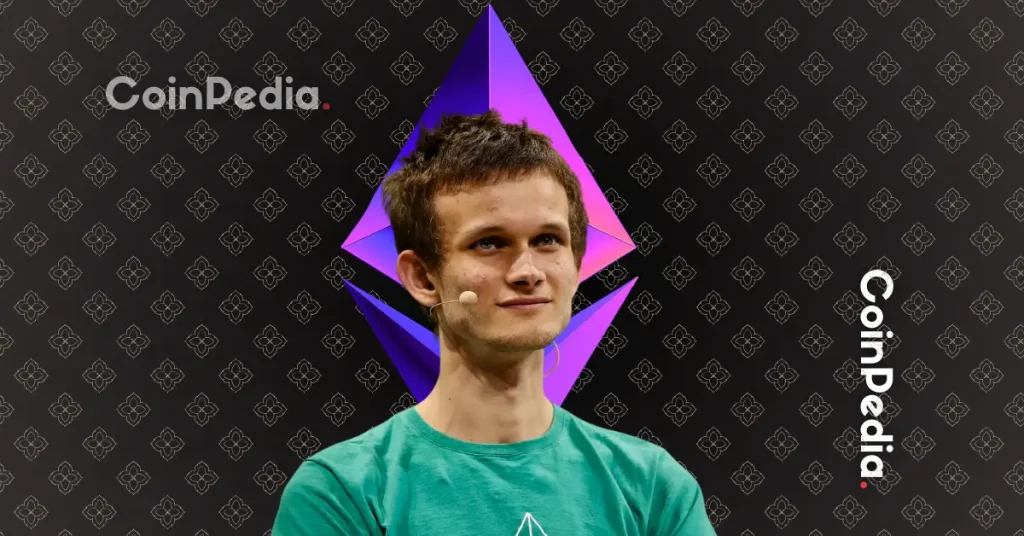

Can Prediction Markets Turn Dangerous? Vitalik Buterin Weighs In

The post Can Prediction Markets Turn Dangerous? Vitalik Buterin Weighs In appeared first on Coinpedia Fintech News

Ethereum co-founder Vitalik Buterin is weighing in on a growing debate surrounding prediction markets, drawing a clear line between what he views as useful and what he considers dangerous.

The discussion unfolded after Buterin defended prediction markets as a better way to measure uncertainty than social media or even traditional financial markets. His core argument: prediction markets reward accuracy, not loud opinions.

Why Vitalik Says Prediction Markets Get a Bad Rap

Critics often argue that prediction markets could incentivize harmful behavior by allowing people to profit from disasters. Buterin pushed back, saying those risks already exist, and at much larger scale, in traditional markets.

“Many of the downsides of PMs are replicated by regular stock markets,” he said, noting that equities and other financial instruments offer far more liquidity for anyone trying to profit from chaos.

In contrast, prediction markets force people to back their beliefs with money. Over time, wrong views get filtered out. Prices reflect probabilities, not certainty – something Buterin says helps him personally stay calm when headlines turn sensational.

- Also Read :

- “XRP’s Strength Isn’t Wall Street, But Its Community” Says Mike Novogratz

- ,

Will Markets Shape Reality?

The debate intensified after a user suggested that highly liquid prediction markets could eventually stop predicting outcomes and start shaping them. With enough capital, they argued, markets could “program reality to follow the market.”

Buterin didn’t agree and said that future worries him.

Where Vitalik Draws the Line

According to Buterin, markets that shape reality tend to benefit large players over small ones. Governments, corporations, and whales can move outcomes, but regular users can’t. That imbalance already exists in traditional finance, and it’s often harmful.

Prediction markets, he argued, are safer precisely because they’re smaller.

Their size limits their influence. Prices stay bounded between 0 and 1, reducing bubbles, manipulation, and “greater fool” dynamics.

“They are much less dominated by reflexivity effects,” he said, calling them “healthier” than regular markets.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

While any market can create incentives to profit from negative events, the limited scale of prediction markets means they are less likely to reward widespread harmful actions. Large players like corporations or governments have far more power in traditional markets to exploit such opportunities.

Individual users and small-scale traders benefit by accessing a platform where accurate information and careful analysis are rewarded. Unlike in conventional finance, outcomes are less dominated by whales or institutional investors, giving ordinary participants a more level playing field.

If a prediction market becomes extremely liquid or large, it could gain the capacity to influence the real world, rather than just forecast it. This scenario could favor those with substantial capital, creating the same power imbalances seen in traditional financial systems.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Ozak AI’s $5M Presale Momentum Points Toward a Powerful Post-Listing Breakout — Forecasts Show $5–$10 Targets Within Reach