Best Crypto to Buy Now? Avantis Price Prediction

While the broader crypto market has seen a modest rebound today, Avantis (AVNT) is trading near $0.34 after posting a strong weekly gain of nearly 40%. The rally has been supported by rising trading volumes and growing speculative buying interest.

Following a prolonged correction, $AVNT shows signs of trend stabilization, with buyers stepping in around key demand zones. This article explores Avantis’ price outlook and evaluates whether it could rank among the best crypto to buy now.

Avantis Reclaims Momentum Following Sharp Rise in Network Activity

After weeks of subdued trading activity, renewed trader participation has fueled a rebound from recent lows, placing $AVNT in a potential continuation setup if momentum remains intact.

Despite ongoing market manipulation risks, Avantis has preserved a solid total value locked (TVL) alongside rising on-chain activity, pointing to underlying strength.

Data from DeFiLlama shows the network’s TVL has climbed roughly 285% over the past three months, reaching $104 million at the time of writing.

Market capitalization has expanded in step with the latest price move, suggesting that fresh capital inflows are driving the recovery.

As interest grows across major exchanges, traders are closely monitoring key technical levels in search of attractive entry points, keeping Avantis firmly in focus for both short-term trades and longer-term positioning.

Source – Cilinix Crypto YouTube Channel

Avantis Price Prediction

Focusing on Avantis’ price trajectory, current analysis suggests short-term pressure could push the token lower, with a key support zone around $0.31 to $0.32. If this level holds, momentum may resume toward the next target near $0.42.

$AVNT is currently trading below both its 50-day and 200-day simple moving averages, positioned at $0.337 and $0.361, respectively.

Volume trends, combined with technical indicators such as VWAP and open interest, point to elevated volatility, though the broader market setup favors traders prepared to manage these fluctuations.

Continued gains in adoption, along with a decisive break above major resistance levels, could enable Avantis to exit its corrective phase and transition into a more sustained growth trend through 2026.

Best Crypto to Buy Now as Investors Turn to Emerging Presales

For investors looking beyond Avantis, opportunities are available across the broader crypto market, particularly within emerging crypto presales that often offer lower entry prices and greater upside potential.

By diversifying into projects with solid fundamentals and innovative use cases, investors can gain exposure to growth outside established tokens. Below are two new crypto coins that have quickly earned recognition as some of the best crypto to buy now.

Pepenode (PEPENODE)

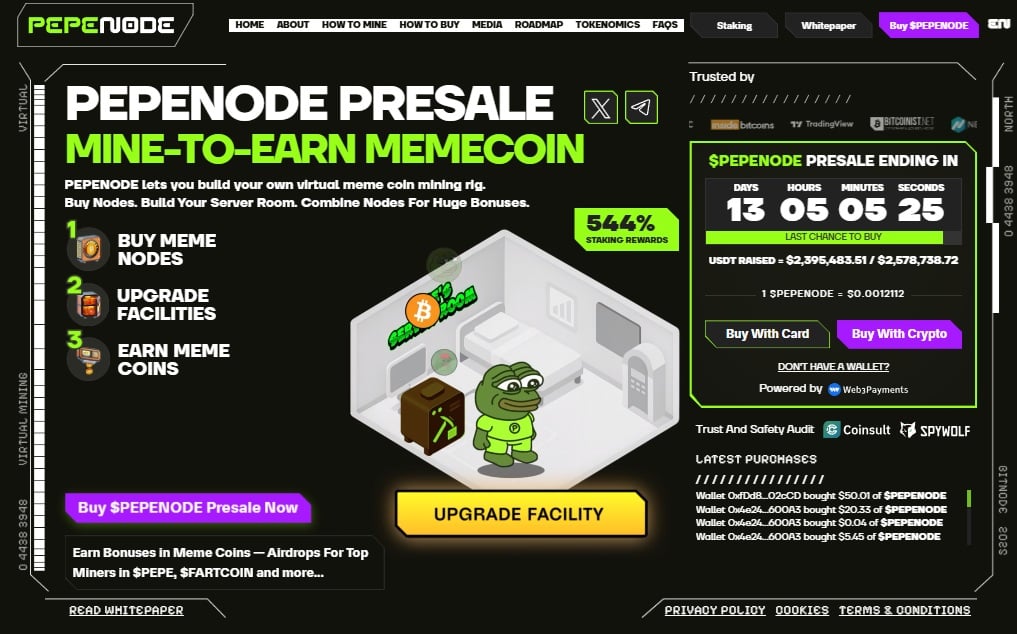

Pepenode is a meme coin project that combines the excitement of crypto with interactive utility, allowing participants to build virtual mining rigs and earn rewards. The platform has already raised nearly $2.4 million, with only 13 days left for investors to join the presale.

Unlike typical presales where tokens sit idle, Pepenode offers a gamified experience where users can upgrade nodes, boost mining power, and compete on leaderboards to earn additional meme coins.

Early supporters are not just acquiring tokens; they are actively contributing to the ecosystem from the start. With features like staking and progressive rewards, the project aims to create both engagement and value for its community.

For those seeking one of the best crypto to buy now, Pepenode presents a unique opportunity to combine fun, strategy, and early-stage investment potential. To take part in the $PEPENODE token presale, visit pepenode.io.

Bitcoin Hyper (HYPER)

Bitcoin Hyper is positioned as a high-utility project aimed at addressing Bitcoin’s long-standing limitations. Developed as a Layer 2 solution, it enables fast, low-cost Bitcoin transactions while maintaining decentralization and security through trustless bridging and zero-knowledge proofs.

The platform allows users to move Bitcoin seamlessly between Layer 1 and Layer 2, unlocking access to DeFi functionalities such as staking, decentralized exchanges, borrowing, and lending.

Despite mixed conditions in the broader market, buyer activity has remained strong. The project’s presale has already raised nearly $30 million, with tokens priced at $0.013485 each, purchasable via bank card or crypto through the Best Wallet app.

The combination of scalability and utility positions Bitcoin Hyper as one of the best crypto presales currently available. As Bitcoin’s role as a store of value grows, Layer 2 solutions like this expand its practical applications.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Coinbase Data Breach Fallout: Former Employee Arrest in India Over Customer Data Case Raises Bitcoin Security Concerns

Burmese war amputees get free 3D-printed prostheses, thanks to Thailand-based group