Anthropic’s Claude AI Predicts the Price of SOL, XRP, and SUI by the End of 2025

Anthropic’s Claude AI, widely regarded for its conservative and transparent analytical style, has released forward-looking price projections for Solana (SOL), Ripple’s XRP, and Sui (SUI) as 2025 draws to a close.

According to the model, all three assets are entering a period of heightened volatility, with the potential for sharp price movements beginning around Christmas and extending into early 2026, a window historically marked by thin liquidity and exaggerated market reactions.

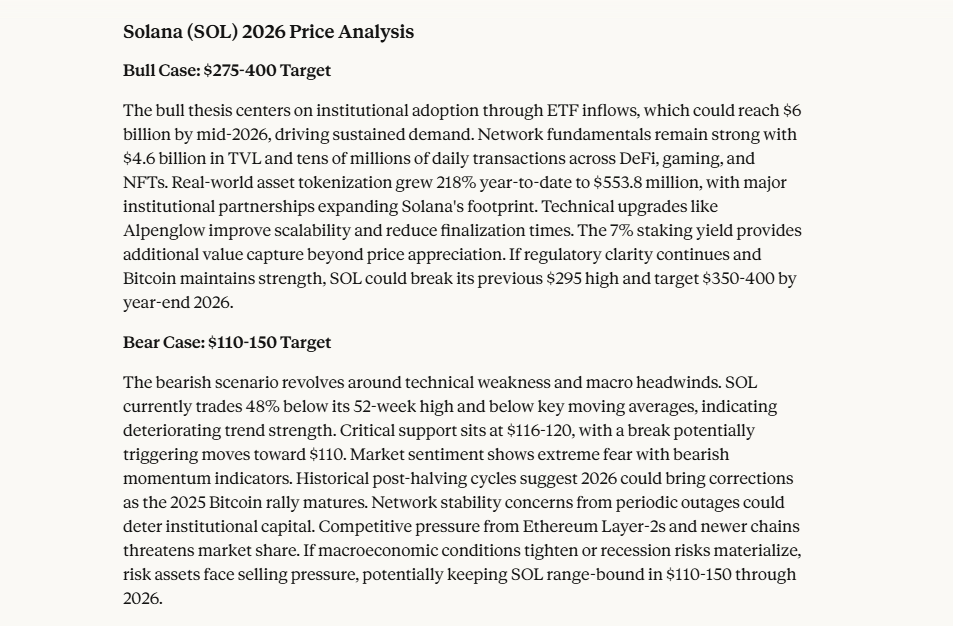

Claude AI Projects SOL $275–$400 Bull Case vs $110–$150 Bear Range

Claude AI’s bullish outlook for Solana aligns closely with projections from Bitwise and other institutional analysts who expect SOL to set new all-time highs by 2026, with upside targets ranging between $275 and $400.

This thesis is anchored on three core drivers: accelerating ETF adoption, improving technical infrastructure, and growing real-world asset tokenization.

Source: Claude AI

Source: Claude AI

By mid-2025, Solana-linked ETFs had already attracted more than $2 billion in inflows, with JPMorgan estimating that figure could reach $6 billion by mid-2026.

On-chain fundamentals further reinforce this optimism, as Solana’s total value locked surged to $4.6 billion, while the network processes tens of millions of daily transactions across DeFi, gaming, and NFT ecosystems.

However, Claude’s bearish scenario highlights technical fragility and macro risks. Key support at $116–120 remains critical, with a breakdown potentially opening a move toward $110–150.

Claude AI Says XRP Targets $5–$8 Upside With $1.40–$2.15 Downside Risk

Claude AI identifies regulatory clarity and ETF-driven institutional demand as the backbone of XRP’s bullish case.

Following Ripple’s settlement with the SEC, XRP ETFs reportedly attracted over $1 billion within weeks, with projections of $4–8 billion in inflows by late 2026.

This surge has removed roughly 15% of the circulating supply from exchanges, introducing structural scarcity.

The launch of Ripple’s RLUSD stablecoin adds another layer, as increased stablecoin activity could drive XRP liquidity demand.

Tokenized real-world assets on the XRP Ledger reached $394.6 million, while Ripple has stated ambitions to capture 14% of SWIFT’s $20+ trillion payment volume over the next five years.

Under supportive macro conditions and continued regulatory clarity, Claude projects XRP could reach $5–8 by the end of 2026.

The bearish outlook, however, centers on declining on-chain usage. Monthly transaction volumes have trended downward for two years, raising doubts about XRP’s role as a bridge currency.

Competition from stablecoins like USDC and high-performance chains such as Solana and Cardano further pressures adoption.

XRP remains 48% below its July 2025 high of $3.66, and failure to break resistance near $2.35 could see it consolidate between $1.40 and $2.15 through 2026.

Anthropic’s Claude AI Says SUI Targets $4–$7 Growth Despite $1.10–$1.70 Consolidation Risk

Claude AI assigns SUI a bullish target range of $4–7, driven by explosive DeFi growth and rising institutional interest.

Sui’s TVL has surged from $25 million at launch to over $2.6 billion, making it the fastest-growing non-EVM Layer-1.

Daily DEX volumes reached $367.9 million, while stablecoin market capitalization surpassed $415 million following native USDC integration.

Institutional momentum is building, with Grayscale launching SUI Trust products and 21Shares filing for a spot ETF.

Still, SUI trades 67% below its $4.33 all-time high and below its 200-day moving average, signaling technical damage.

Despite strong ecosystem metrics, price weakness reflects investor caution. Claude’s bearish scenario places SUI in a $1.10–1.70 consolidation range if macro conditions deteriorate post-2025.

Maxi Doge (MAXI) Presale Draws $4.4M in Early Capital

While Claude’s analysis focuses on large-cap assets, early-stage presales can offer asymmetric upside.

Maxi Doge ($MAXI) has raised nearly $4.4 million and positions itself as a next-generation Dogecoin alternative on Ethereum’s proof-of-stake network.

The presale offers staking rewards of up to 71% APY, with the token currently priced at $0.0002745 ahead of scheduled stage increases.

To get into the presale, visit the official presale website and stay updated through Maxi Doge’s official X and Telegram channels.

Visit the Official Maxi Doge Website HereYou May Also Like

Shiba Inu Price Stalls Near Lows – What Could Matter in 2026 For SHIB To Takeoff?

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets