Solana (SOL) Bears Press On: Will It Hold Its Ground or Bounce Back?

- Solana slipped to $121 following a 2% drop.

- $20.07 million in SOL liquidations occurred.

Red dominates the crypto market as the bearish momentum shows no signs of easing. With the fear still intact, all major assets are losing momentum, moving toward their previous lows. The largest assets, Bitcoin (BTC) and Ethereum (ETH), hover on the downside. Meanwhile, Solana (SOL) has posted a 2.95% loss after a series of key retests.

The asset opened the day trading at a high range of $125.40. After it bounced between certain support and resistance levels, the bearish shift happened, and SOL slipped to a low of $121.82. Should the selling pressure increase, the asset may face additional losses. As per CMC data, Solana currently trades at $121.81.

Besides, the market cap likely stays at $68.34 billion, with the daily trading volume of Solana having dropped briefly, reaching the $3.09 billion mark. The Coinglass data has reported that the market has witnessed an event of liquidation of $20.07 million worth of Solana within the last 24 hours.

Will Solana Slide Further in the Coming Sessions?

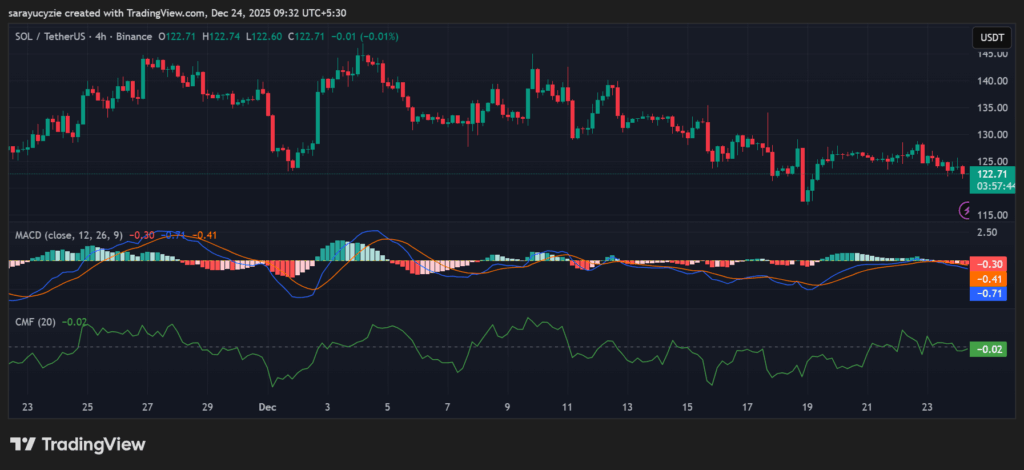

The 4-hour trading chart shows Solana’s bearish presence, and it might fall toward the support at around $120.36. A plunge below this range could accelerate the bearish correction and trigger the death cross to emerge. Eventually, it would send the price below the $119.51 mark.

On the upside, assuming an uptrend forms, the asset’s price could climb and bring in a test at the $122.64 resistance. Overcoming this level might strengthen the bullish pressure, leading to the formation of the golden cross, and the Solana price potentially rises to the $123.49 zone.

Solana’s technical analysis demonstrates the downtrend, with the Moving Average Convergence Divergence (MACD) line and the signal line found below the zero line. It indicates bearish momentum, and a bullish crossover in this zone could be weak unless it moves back above zero.

SOL chart (Source: TradingView)

SOL chart (Source: TradingView)

Moreover, the Chaikin Money Flow (CMF) indicator value at -0.02 suggests slight selling pressure in the SOL market. The capital is flowing out of the asset, but the move is weak, not aggressive. A deeper negative value might signal a stronger bearish momentum.

The Bull Bear Power (BBP) reading of -3.85 exhibits strong bearish dominance. The sellers are firmly in control, with the price trading below the recent highs. Unless it starts moving back toward zero, the downtrend is likely to persist. Furthermore, Solana’s current market sentiment is bearish as the daily Relative Strength Index (RSI) stays at 37.06. Notably, the asset may approach the oversold territory, below 30.

Top Updated Crypto News

Bitcoin Never Hit $100K in Real Terms Despite $126K Peak

You May Also Like

BitGo expands its presence in Europe

Unleashing A New Era Of Seller Empowerment