Solana Price Prediction: SOL Eyes a Rebound to $138 as Institutional Demand Steadies

Highlights:

- Solana price trades well above $125, as its daily trading volume spikes 44%.

- The institutional demand for Solana remains steady following the consecutive eight-week ETF inflows.

- The technical outlook signals SOL could rebound to $138 zone, if Solana breaks through $130 resistance.

Solana (SOL) price is trading above $125 on Monday, showing a 2% increase over the past 24hours. The daily trading volume has notably soared 44% to $2.87 billion, indicating heightened trading activity. The ETFs have continued to flow into the high-speed blockchain, week after week, and big wallet investors are making huge orders in the spot market. In the meantime, data in the derivatives markets show that the demand is surging, as the funding rate has flipped positive.

The institutional demand for Solana has been stable despite the recent increase in volatility in the cryptocurrency market. According to Sosovalue data, the amount of money that was deposited into the Solana-oriented US spot ETFs totalled $66.55 million in the last week, the highest amount in December thus far.

Total SOL Spot ETF Newflow: SoSoValue

Total SOL Spot ETF Newflow: SoSoValue

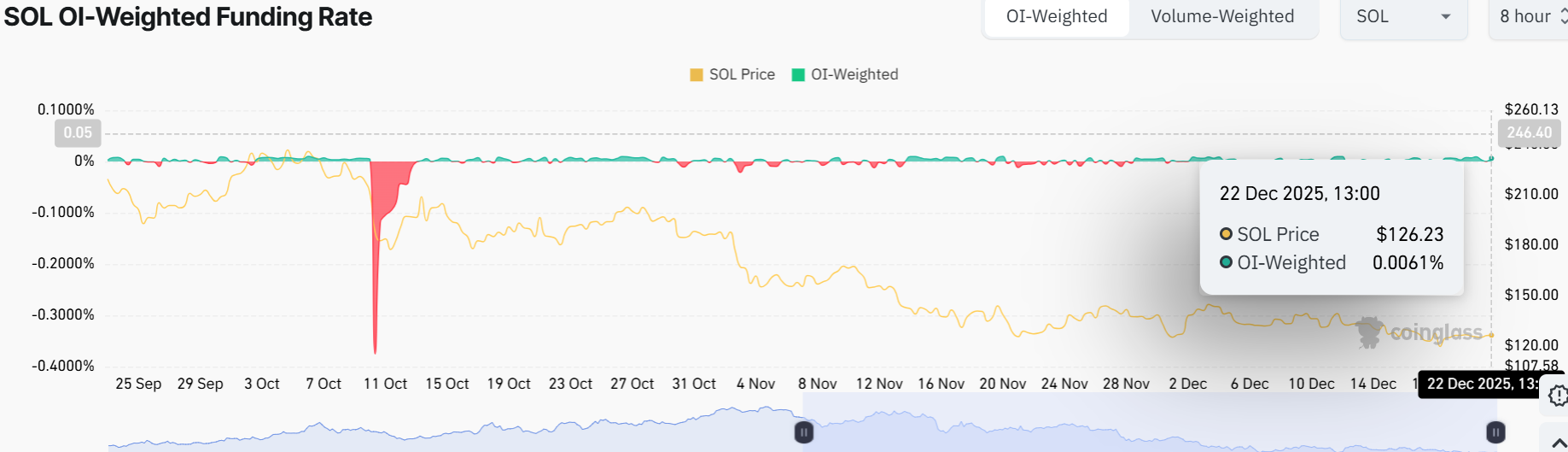

On the other hand, the coinglass OI-Weighted Funding rate figures show a bullish trend. The number of traders who bet that the Solana price will decrease is less than the number of traders who bet that it will increase.

SOL OI-Weighted Funding Rate: CoinGlass

SOL OI-Weighted Funding Rate: CoinGlass

The metric is now positive and is at 0.0061% on Monday, indicating that the longs are paying the shorts. In many cases, the Solana price jumps upwards when the funding rates revert from a negative value to a positive one.

SOL Could a Rebound to $138

The Solana price action recently dipped below the key support levels on both the 50-day and 200-day Simple Moving Averages (SMAs). The 50-day SMA sits at $138, while the 200-day SMA is at $174. The SOL price chart also shows that a falling channel pattern has formed, a classic bullish reversal setup, if SOL flips above $130.

The RSI (Relative Strength Index) is below the 50-neutral territory at 43.25, suggesting that sellers have been in charge. However, the conditions are ripe for a bounce if buyers step in. The MACD indicator is positive, a signal that the current trend is calling for buyers to rally behind SOL, as momentum builds.

SOL/USD 1-day chart: TradingView

SOL/USD 1-day chart: TradingView

To turn positive, Solana’s price must reclaim the 50-day and 200-day moving averages. If buyers manage to push the price above $130, it could see SOL eye a rebound to $138 soon, which coincides with the 50-day SMA. According to popular analyst Ali Martinez, the resistance trendline around $125 is the key decision for SOL. Since SOL has steadied above it, a rebound to $138 could be imminent.

In the meantime, the immediate support is found near $120. If Solana’s price falls further and doesn’t hold above this area, traders might look for a new base before buyers return. On the upside, any strong move above $130 by institutional buyers could quickly flip the technical picture and send the Solana price towards $138 immediate resistance zone.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Robert W. Baird & Co. Discloses Core AI Design Parameters and Launches Public Testing of Baird NEUROFORGE™ Equity AI

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council