Unlock Yield: Upshift, Clearstar & Flare Launch New earnXRP Product

BitcoinWorld

Unlock Yield: Upshift, Clearstar & Flare Launch New earnXRP Product

For XRP holders seeking more than just price appreciation, a new opportunity has arrived. A strategic collaboration between Upshift, Clearstar, and Flare has resulted in the launch of earnXRP, a dedicated platform designed to put your XRP to work. This product directly addresses the growing demand for yield-generating options within the XRP ecosystem, often referred to as XRPFi.

What Exactly Is The New earnXRP Product?

The core innovation of earnXRP is its streamlined approach to generating returns. According to a report by The Block, it operates on its own dedicated Layer 1 blockchain network, which is specifically optimized for XRPFi applications. The process is elegantly simple for users: you deposit a wrapped version of XRP called FXRP (from the Flare network) into a single, unified vault.

From there, the platform’s smart contracts take over. Your pooled capital is automatically deployed across a curated selection of on-chain strategies. The ultimate goal? To generate passive returns that are paid out to you, denominated in XRP. This removes the complexity of manually navigating multiple protocols.

How Does earnXRP Generate Yield for You?

Understanding the mechanism is key to seeing the value. The earnXRP network acts as a sophisticated capital allocator. Instead of you picking individual strategies, the platform diversifies the deposited FXRP across various DeFi activities that are proven to generate yield.

- Automated Strategy Deployment: Your assets are spread across different protocols to optimize returns and manage risk.

- XRP-Denominated Returns: All profits are accrued and distributed in XRP, simplifying your portfolio tracking.

- Single Vault Simplicity: You make one deposit into the earnXRP vault, and the system handles the rest.

This model is powerful because it leverages the collective capital of all users to access opportunities that might require larger minimums or deeper technical knowledge individually.

Why Is This Launch Significant for the XRP Community?

The arrival of earnXRP is more than just another product; it’s a signal of maturation for the XRP ecosystem. For years, the conversation around XRP largely centered on payments and cross-border transfers. Now, with focused platforms like this, the narrative expands to include decentralized finance and capital efficiency.

This launch by Upshift, Clearstar, and Flare provides a legitimate, structured avenue for yield. It answers a clear community demand and could potentially attract a new segment of yield-seeking investors to XRP. The dedicated Layer 1 also suggests a long-term commitment to building out a robust XRPFi infrastructure.

What Should Potential Users Consider?

While the promise of passive earnXRP yield is compelling, a prudent approach is essential. As with any DeFi product, users must acknowledge the inherent smart contract risks associated with the underlying strategies. The returns are not guaranteed and will fluctuate based on market conditions and protocol performance.

Furthermore, using the product requires interacting with the Flare network to obtain FXRP, adding a step for those holding native XRP on other ledgers. Therefore, conducting your own research, starting with small amounts, and ensuring you understand the bridging process are critical first steps.

Conclusion: A New Chapter for XRP Utility

The collaboration between Upshift, Clearstar, and Flare marks a pivotal step in evolving XRP’s utility beyond transactional use. The earnXRP product successfully lowers the barrier to entry for XRP holders to participate in decentralized finance and earn yield on their holdings. By automating complex strategy deployment and offering returns in native XRP, it provides a much-needed and user-friendly service. As the XRPFi landscape grows, tools like this will be crucial in unlocking the full potential of the XRP ecosystem for its community.

Frequently Asked Questions (FAQs)

Q: Do I need to hold native XRP to use earnXRP?

A: You need to hold FXRP, which is a wrapped representation of XRP on the Flare network. You can bridge your native XRP to FXRP to participate.

Q: Is my XRP locked when using earnXRP?

A: Yes, when you deposit FXRP into the vault, it is deployed into on-chain strategies. You will need to withdraw it to regain full, liquid control of your assets.

Q: What are the risks of using earnXRP?

A> The primary risks include smart contract vulnerabilities in the earnXRP vault or the underlying strategies it uses, and market risks associated with the yield-generating activities (like impermanent loss in liquidity pools).

Q: How are the yields generated?

A: Yields are generated automatically by the platform deploying the pooled FXRP into various on-chain DeFi activities, which could include lending, liquidity provision, or staking on supported protocols.

Q: Who is behind the earnXRP product?

A: It is a joint launch by three entities: Upshift, Clearstar, and the Flare network team, combining expertise in blockchain infrastructure and financial products.

Found this guide to the new earnXRP yield product helpful? Share it with other XRP enthusiasts in your network! Spreading knowledge helps the entire community make informed decisions in the fast-moving world of crypto and DeFi.

To learn more about the latest trends in decentralized finance and yield generation, explore our article on key developments shaping the future of passive crypto income strategies.

This post Unlock Yield: Upshift, Clearstar & Flare Launch New earnXRP Product first appeared on BitcoinWorld.

You May Also Like

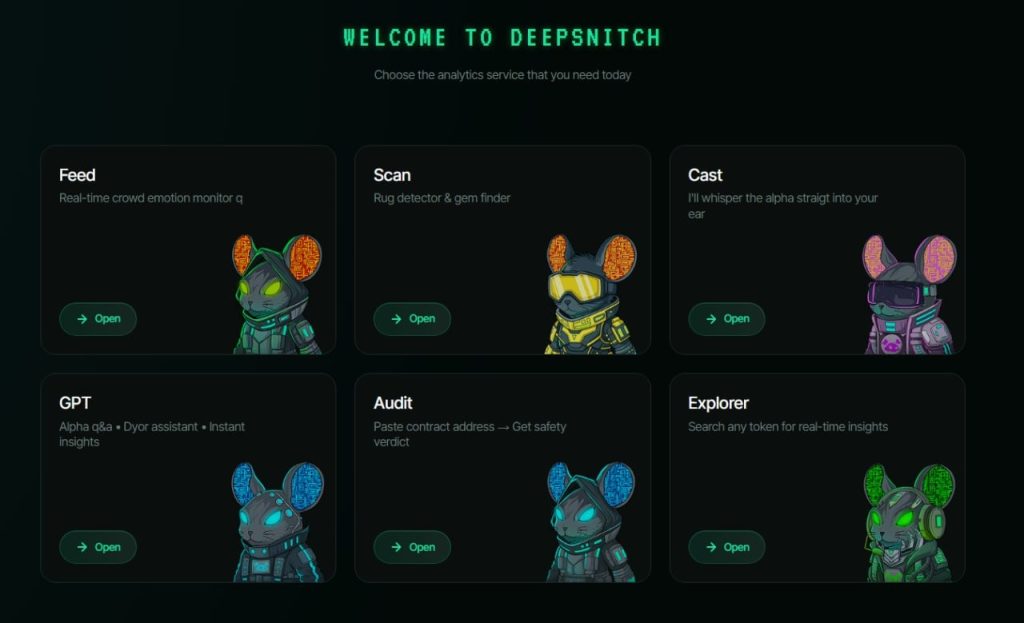

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24