XRP ETFs Attract Global Pension Funds And Insurers, Canary CEO Reveals

Canary Capital CEO Steven McClurg says the investor mix showing up in XRP ETFs is broader and more institutional than the market tends to assume, with interest coming from pension funds and insurance allocators who prefer a regulated, brokerage-native wrapper over the operational burden of spot.

“Usually when you launch a new ETF that hasn’t been in the market before, it’s usually retail adoption that happens first. So we’ve seen a lot of impact from the retail audience in the first week or two. And then we started getting calls from pension funds and insurance companies globally,” McClurg revealed.

He added: “And that’s the second market segment that we market to at Canary. But we’re seeing a lot of interest there. XRP is truly an asset that most of Wall Street and most of the global capital markets get. It’s easy to understand. It’s the rails for the financial system. So, of course, they’re very interested. But those are the two segments that we’ve seen a lot of interest from.”

Why XRP ETFs Are So Successful

McClurg made the comments in a Wealthion podcast interview with CoinFund President Chris Perkins, discussing Canary’s strategy in crypto ETFs and why single-asset products like XRP can pull demand from both US and international channels. The throughline was familiar to anyone who has watched ETFs reshape other markets: access and execution matter, and they often matter more than ideology.

“A lot of our clients are retail,” McClurg said, estimating “probably 20 to 30%” of flows are coming from retail channels based on visible brokerage activity. The larger share, he added, is currently coming from faster trading-oriented capital. “It’s probably about 70% — I don’t want to call it institutional, but it’s probably 70% fast money at the moment.”

Even so, McClurg’s view is that the stable end state for products like an XRP ETF is the advisor and allocator channel that already lives inside the ETF ecosystem. “ETFs are going to be probably primarily used by financial advisors,” he said. “Because they’re simple, they’re clean, they can hold them in their accounts, they can explain it.”

For crypto, he argued, the problem is not subtle.“Most of retail is trading crypto on an exchange and they’re getting charged massive fees,” he said. “We’re talking $100 a trade. Plus the spread.”

His point was not that ETFs are free, but that the ETF wrapper can compress costs and friction, particularly for investors who do not want to operate in exchange-native workflows. “When you think about an ETF… you’ve already won by buying an ETF when you’re talking about pennies spread… and then you’re only paying a 1% management fee,” he said.

McClurg also addressed a factor that tends to drive ETF flows in crypto regardless of narrative: basis. He argued the spot/futures spread can act as a lever for ETF demand, and by extension a source of incremental spot pressure when the trade is attractive.

“The basis trade is really what’s driving crypto ETFs at the moment,” he said, adding that outflows in bitcoin spot ETFs have, at times, coincided with the collapse of that spread. For XRP specifically, he suggested the dynamic has been supportive since launch.

“We’ve benefited from launching XRP,” he said, “because there’s a great basis trade there.” He went further, claiming the product has seen consistent net buying even as broader markets softened.

McClurg also highlighted the success of all spot XRP ETFs in the US. “Ever since the launch, even at a down market, there’s not been a single day of outflows,” McClurg said.

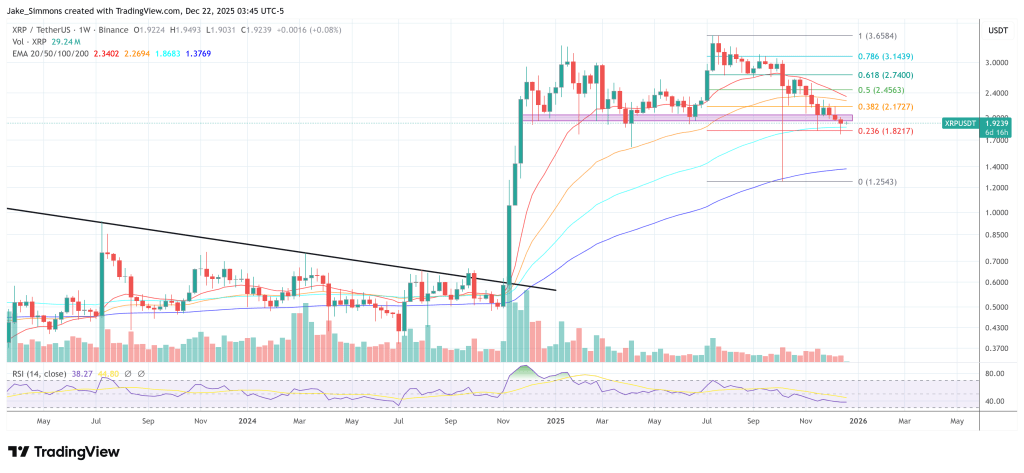

At press time, XRP traded at $1.92.

You May Also Like

The Channel Factories We’ve Been Waiting For

Nasdaq-listed iPower reaches $30 million convertible note financing agreement to launch DAT strategy.