Ethereum (ETH) Reclaims $3K Level, Bitcoin (BTC) Nears $90K: Market Watch

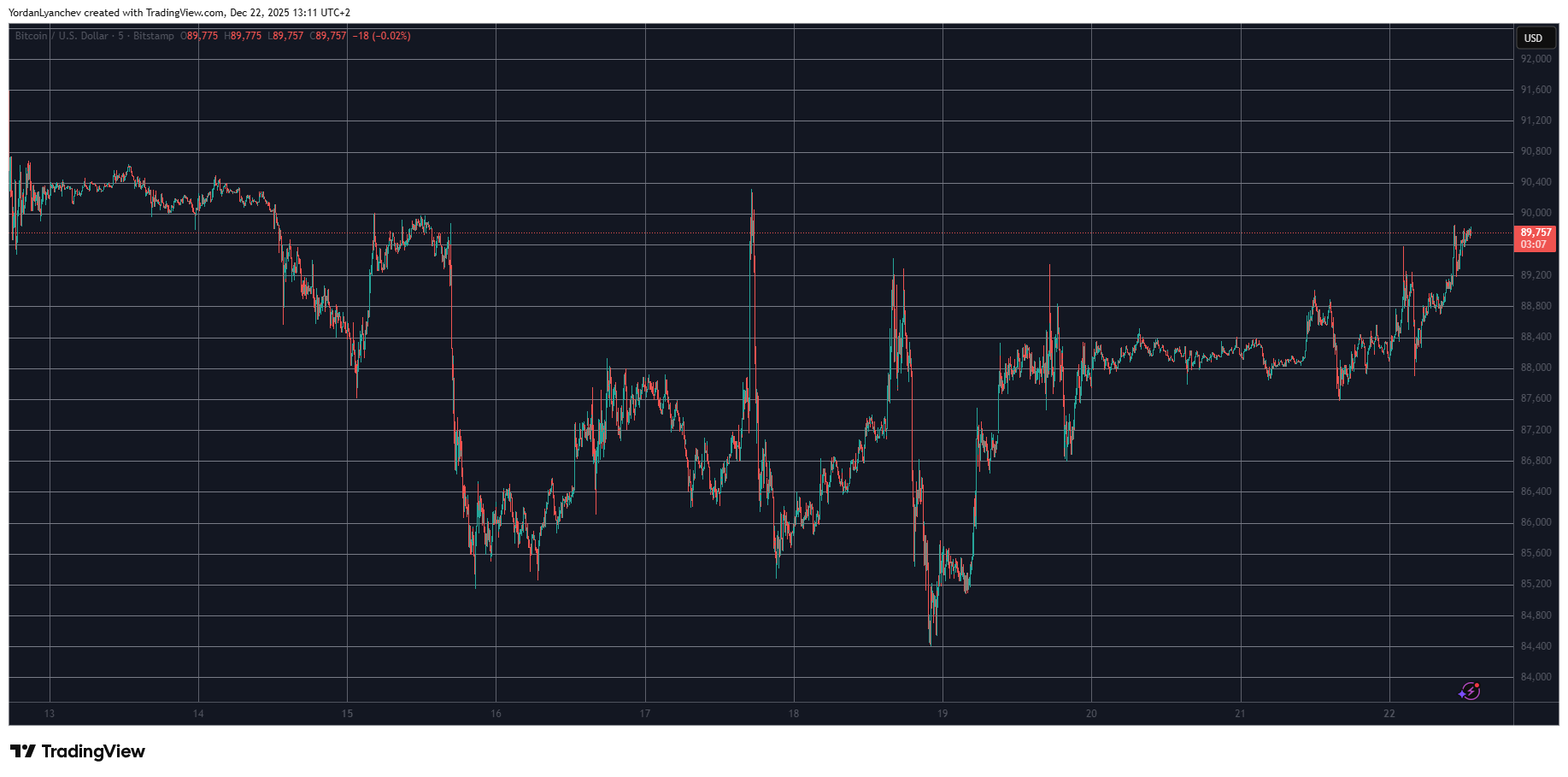

Bitcoin’s price has finally shown more sustainable signs of a minor recovery as the asset neared $90,000 for the first time since the pump-and-dump last Wednesday.

Most larger-cap altcoins have charted small gains as well, with ETH reclaiming the coveted $3,000 line, while BNB has remained firm above $860.

BTC Eyes $90K Rebound

The previous business week didn’t disappoint those who anticipated a volatile trading period, as BTC dumped by several grand on Monday from $90,000 to under $85,500. It skyrocketed on Wednesday back to just over $90,000, where it was immediately rejected and driven south to under $85,500 once again.

More fluctuations came on Thursday when the US CPI numbers came out. As they were much better than expected, BTC jumped immediately but was stopped at $89,500, and the subsequent rejection was quite painful. The asset plunged to $84,500 to mark a multi-week low.

The bulls finally stepped up at this point and helped BTC recover to $88,000, where it spent most of the next few days. The weekend was quite uneventful as well, and bitcoin started to climb gradually on Monday morning, nearing $90,000 for the first time in several days.

Its market capitalization has risen to almost $1.8 trillion on CG, while its dominance over the alts has increased to 57.5%.

BTCUSD Dec 22. Source: TradingView

BTCUSD Dec 22. Source: TradingView

ETH Above $3K

Ethereum dumped to $2,800 during the most recent correction last week, but it reacted well and quickly reclaimed the $2,900 mark. After a few unsuccessful attempts to surge past $3,000, it managed to do so earlier today.

Binance Coin has increased by a similar percentage since yesterday and sits well above $860. SOL, TRX, DOGE, LINK, and ZEC are also slightly in the green, while HYPE has jumped by 4%. NIGHT continues its run and has soared by 13% to $0.10.

AAVE and CC have dumped the most over the past 24 hours. The former has slumped by 11%, while the latter is down by 21%.

The total crypto market cap has risen by $30 billion in a day and is up to $3.120 trillion on CG.

Cryptocurrency Market Overview Dec 22 Daily. Source: QuantifyCrypto

Cryptocurrency Market Overview Dec 22 Daily. Source: QuantifyCrypto

The post Ethereum (ETH) Reclaims $3K Level, Bitcoin (BTC) Nears $90K: Market Watch appeared first on CryptoPotato.

You May Also Like

Robert W. Baird & Co. Discloses Core AI Design Parameters and Launches Public Testing of Baird NEUROFORGE™ Equity AI

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council