👨🏿🚀TechCabal Daily – It’s here: The Builders’ List 2025

TGITEOTY. But this isn’t goodbye.

Your favourite newsletter, TC Daily, is wrapping up for the year today. But not without a bang.

We have spent the last twelve months tracking every move in the African tech ecosystem, and now we want to see how much of that story you actually digested. We created a special quiz to help you check exactly how engaged you were with us this year. By taking it, you can find out how many thousands of words you read and just how active you were in our community.

Play our little game here and brag to your friends.

If you are looking for things to do during the slow days ahead, we suggest you take the time to rest, explore new places, and definitely go see James Cameron’s new Avatar: Fire and Ash movie.

Thank you for being part of our journey this year. TC Daily returns in January 2026.

- We’ve launched the Builders’ List!

- Quick Fire

with Justice Eziefule

with Justice Eziefule - Who secured the bag?

- World Wide Web 3

- Job Openings

It’s here: The Builders’ List 2025

Image Source: TechCabal

Image Source: TechCabal

Yesterday, we talked about the momentum of 2025: the raises, the acquisitions, and the quiet resilience that defined the rebound. We promised to show you the people behind those headlines.

The wait is over. The Builders’ List 2025 is live.

Explore the Builders’ List.

From 600 to 49

We began this journey in August with a longlist of over 500 names representing every corner of the African tech ecosystem. The TechCabal newsroom applied a rigorous rubric to find the individuals who didn’t just participate in the year but defined it through specific milestones and measurable impact.

Now, we have presented the final 49.

This is not a list of the loudest voices; it is a definitive record of the people, operators, innovators, enablers, connectors, and keepers who created durable value when it mattered most.

A new way to see the ecosystem

We designed the 2025 microsite to be more than a gallery of names. It is an archive of the year’s progress:

- Filter by category: See the Keepers safeguarding policy or the Operators scaling systems in real-time.

- Human stories: Read snapshots that focus on substance over hype, what they actually built, not just their titles.

- The 2025 lens: Every builder included has a concrete achievement or inflection point tied specifically to this year.

Beyond the headlines

Whether it is the product thinkers shaping what comes next or the connectors catalysing collaboration across borders, these 49 individuals represent the full spectrum of African brilliance.

The list is now yours to explore. We hope it surprises you, validates your own work, and changes how you see the future of technology on the continent.

Powering African Businesses Through the Busiest Season of the Year.

Your peak season needs fast and reliable payments. Collect, pay, and settle across Africa in the right currencies without delays. Create your Fincra account in 3 minutes.

Features

Quick Fire  with Justice Eziefule

with Justice Eziefule

Image: Justice Eziefule

Image: Justice Eziefule

Justice Eziefule is the co-founder of Metastable Labs and one of the builders behind Liquid, a decentralised lending protocol for prediction markets. His path into tech has been shaped by bold career pivots: from walking away from a hairdressing apprenticeship at 19 to taking an unpaid internship at OlotuSquare instead of a traditional corporate placement. That choice led him to Rivers State Tech Creek, where he became an SQL instructor and set the foundation for a career defined by risk-taking and independent thinking.

- Explain your job to a five-year-old.

Imagine you have a big box of Lego, and you can build anything you want with it. My job is like that, but instead of Lego pieces, I use code to build things on phones and computers.

I also help run the team that decides what we should build, kind of like being the person who says, “Let’s go outside and play,” and then helps everyone choose teams and what game to play.

So I’m both someone who creates things and someone who leads the building of new ideas, making sure everything works so people can use it every day.

- What’s the hardest trade-off you’ve had to make while building a prediction-market lending protocol?

We originally built Liquid as an insurance product for prediction markets. After announcing it on X and spending weeks testing the math, we realized the economics were broken. High premiums were too expensive for traders, but lower premiums caused liquidity providers to lose money and created bad debt.

After a month of work, it was clear the model was unviable. However, during that process, we stumbled upon a way to solve the gap-risk problem that previously made leverage in prediction markets impossible. We chose to abandon our initial work and pivot toward this breakthrough. That decision formed the foundation for the lending layer Liquid is today.

- Prediction markets are still early in Africa; why do you think Liquid can scale when the underlying market is still building (early) momentum?

We designed Liquid for a global ecosystem, so our growth isn’t limited by the maturity of any single region. However, we see Africa—and Nigeria specifically—as a massive opportunity. Nigeria is already a top-five crypto market globally, and users here adopt new financial tools far more quickly than traditional markets expect.

Even though prediction markets are in their early stages, the behavior we see in Africa—comfort with volatility and familiarity with crypto primitives—makes the continent a natural early adopter base for us. By building for a global audience while leveraging a region that embraces innovation this rapidly, we can scale Liquid long before the broader market reaches traditional maturity.

Enjoy smooth payments while you’re home this Detty December

Coming home for Detty December? Enjoy smooth payments every day with your Paga US account. Transfer to any bank instantly. Don’t miss out, get started now.

Insights

Funding Tracker

Image Source: Success Sotonwa for TechCabal Insights

Image Source: Success Sotonwa for TechCabal Insights

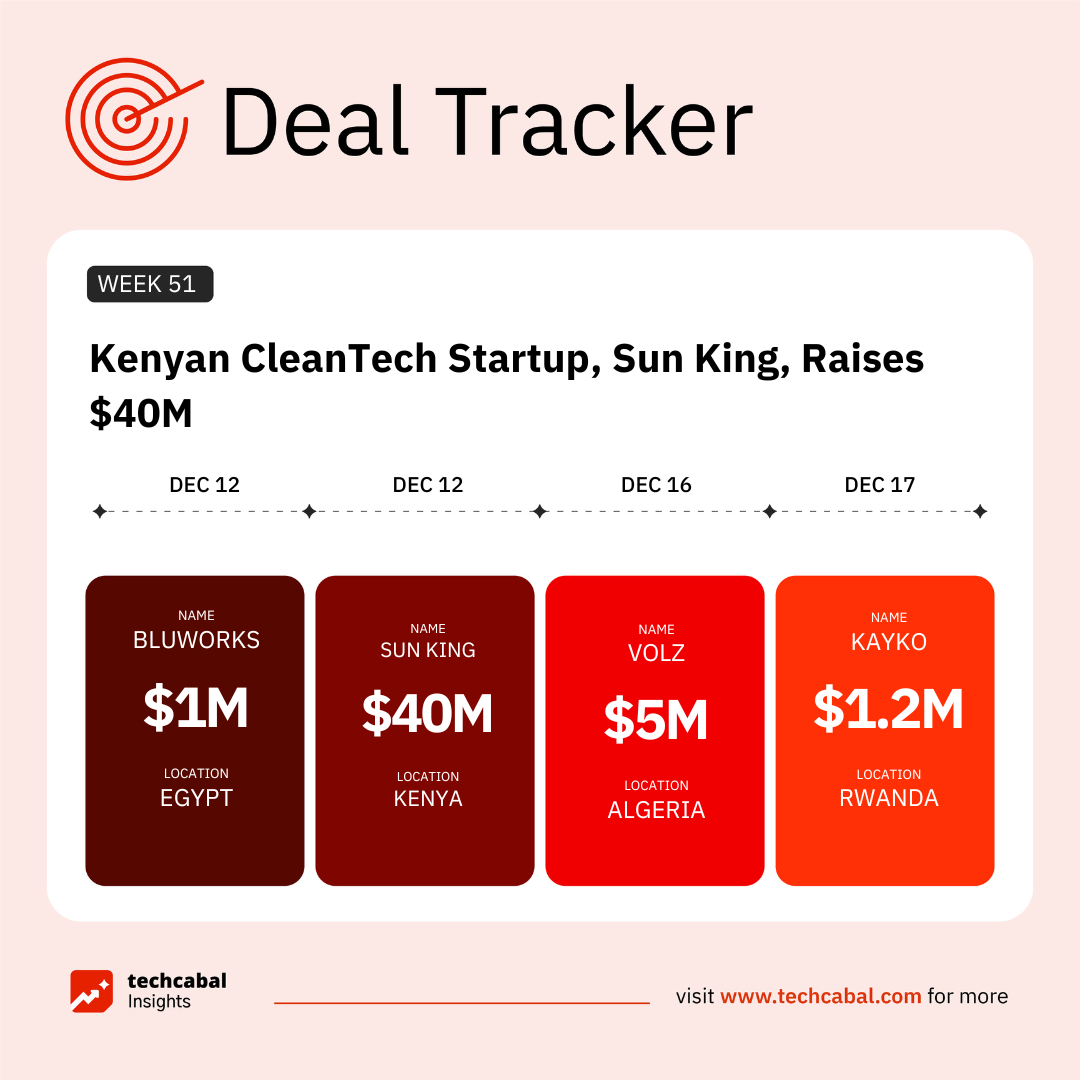

Sun King, a Kenyan cleantech startup, raised $40 million in equity investment from Lightrock. (Dec 12)

Here are the other deals for the week:

- Gigmile, a Nigerian fintech startup, secured an undisclosed funding from Yango Group’s Yango Ventures. (Dec 12)

- Bluworks, an Egyptian HRTech startup, raised $1 million in seed funding. The round was led by A15, Enza Capital, and Beltone Venture Capital, with participation from Acasia Ventures and strategic angel investors. (Dec 12)

- iVoiceUp, an Egyptian AI startup, secured an undisclosed funding from A15, a Cairo Venture Firm. (Dec 15)

- Volz, an Algerian traveltech startup, raised $5 million in a funding round led by a group of private investors, headed by Tell Group, a financial services company, with participation from Groupe Industriel Babahoum Algérie (GIBA). (Dec 16)

- Bildup, a Nigerian AI startup, raised $400,000 in an angel investor round, backed by a group of undisclosed investors. (Dec 17)

- Kayko, a Rwandan fintech startup, raised $1.2 million in a seed funding round. The round was led by Burrow Capital, the Luxembourg Development Agency (LuxDev), Hanga Ignite, and develoPPP Ventures. (Dec 17)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go,what is the future of digital health in Nigeria? Find out here.

Send money smarter with Zap by Paystack

Get live downtime updates so you can send money at the right time. Download Zap on iOS and Android to get started.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| Bitcoin | $87,075 |

+ 0.82% |

– 3.51% |

| Ether | $2,921 |

+ 3.41% |

– 3.06% |

| Yooldo | $0.4046 |

– 1.27% |

+ 19.84% |

| Solana | $122.63 |

– 3.70% |

– 9.65% |

* Data as of 06.45 AM WAT, December 19, 2025.

Get tickets to experience Motherland this Detty December!

The Motherland journey begins on December 18 and 19. Two full days of exploring, tasting, shopping, connecting, and celebrating. From chef showcases to panels, curated marketplaces, fashion showcases, and evening parties, Motherland is a world of its own with something for everyone. You’ll need an Experience Pass to enter! December 20 is the grand finale with your favorite artists closing out the festival in a big way. You don’t want to miss a thing! Get your tickets →.

Job Openings

- VertoFX —Customer Experience Analyst, Reconciliation Associate — Hybrid (Nairobi, Kenya)

- VertoFX —Sales Director, Risk & Compliance Officer — Hybrid (Cape Town, South Africa)

- Deel —Senior Risk Analyst — Remote (Nigeria)

- Migo —Growth & Product Marketing Analyst — Lagos, Nigeria

- Piggyvest —Product Marketing & Communications Lead — Lagos, Nigeria

- Big Cabal Media —Senior Financial Analyst, Junior Sales Analyst — Hybrid (Lagos, Nigeria)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

- How we selected our inaugural Builders’ List

- Why a high-profile discrimination case against Kuda was dismissed

- 12 African startups and tech companies that cut workforce in 2025

- The “anti-Shein” bandwagon gains momentum

- It’s the great AGI rebrand

Written by: Zia Yusuf, Emmanuel Nwosu, and Success Sotonwa

Edited by: Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

You May Also Like

‘One Battle After Another’ Becomes One Of This Decade’s Best-Reviewed Movies

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council