NEAR Is Now Live on Solana as “Attention Is All You Need” Post Goes Viral

The NEAR token is now available for trading on Solana, powered by NEAR Intents and Orb Markets. This integration comes one day after Solana’s “Attention is All You Need” post that went viral, featuring Jensen Huang and Illia Polosukhin.

On December 18, Solana’s official account on X announced NEAR going live on its network. NEAR Protocol’s official account quoted the announcement, mentioning this integration is powered by NEAR Intents and Orb Markets. NEAR Intents is a cross-chain protocol that achieved significant volume and revenue growth in 2025, while Orb Markets is an innovative Solana explorer built by Helius Labs.

Mert, founder and CEO of Helius Labs, celebrated the integration, mentioning he tried to buy NEAR “two days ago” after a post where he praised NEAR’s development team, but it was not available on Solana at that time. “A million markets in your pockets,” he described Solana, followed by a new post showing his Solana wallet with ZEC, NEAR, SOL, and McDonald’s xStock, saying, “crazy you can hold all this on a single Solana private key.”

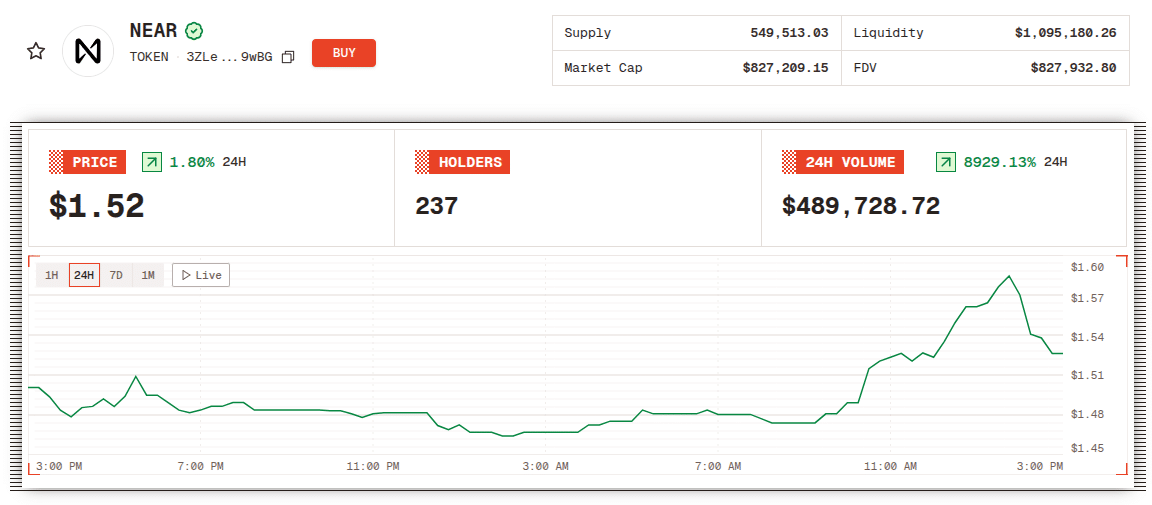

NEAR on Solana can be visualized on Orbs via the wrapped token address 3ZLekZYq2qkZiSpnSvabjit34tUkjSwD1JFuW9as9wBG, currently trading at $1.52, according to Orbs.

NEAR token address visualization, as of December 18, 2025 | Source: Orbs Market

Solana and NEAR Collaboration: Attention Is All You Need

Everything started gaining traction on December 16, when Mert posted that “NEAR is a top 2-3 underrated team in crypto,” comparing its technical talent to Solana, in particular tracing a parallel between Illia Polosukhin, NEAR co-founder, and Anatoly Yakovenko, Solana co-founder.

Other prominent figures connected to Solana joined Mert. For example, Double Zero’s co-founder and former Strategy lead at Solana, Austin Federa, praised both NEAR Intents and NEAR’s AI products, also bringing Illia’s name to the table.

On December 17, Alex Svanevik, CEO of NansenAI, said he “just bought some NEAR,” adding that he “can’t take missing out on another ZEC,” in reference to Mert’s role in pushing Zcash’s privacy and ZEC price through continuous support and active posting on X, as Coinspeaker reported before its remarkable rally.

Then, Solana’s official account posted a photo of Jensen Huang, Nvidia’s CEO, touching Illia’s arm in a conference panel, with the caption “Attention is All You Need.” Illia is the co-author of Attention is All You Need, the revolutionary 2017 Google paper that introduced the transformer architecture, the core tech behind the AI boom—called the “T” in “ChatGPT.”

This post got a response from Polosukhin, sharing an old picture of him listening to Yakovenko’s explanation in front of a whiteboard, suggesting the two founders and projects have maintained a good relationship for years.

As things develop, Solana and NEAR break a paradigm of hostile competition in crypto, opening the doors for an era of collaboration in endeavors that are mutually beneficial, with the notion of the chains and infrastructures abstracted to the end user, who can access both assets and ecosystems natively in their wallets of choice.

nextThe post NEAR Is Now Live on Solana as “Attention Is All You Need” Post Goes Viral appeared first on Coinspeaker.

You May Also Like

Bitcoin Has Taken Gold’s Role In Today’s World, Eric Trump Says

Tether CEO: AI Bubble Poses Biggest Risk to Bitcoin in 2026