Game, Set, Match: Nexo’s Powerful Move as Official Australian Open Crypto Partner

BitcoinWorld

Game, Set, Match: Nexo’s Powerful Move as Official Australian Open Crypto Partner

In a powerful move that serves an ace for crypto adoption, Nexo has volleyed into the mainstream sports arena. The leading cryptocurrency lending platform has secured a multi-year deal to become the official crypto partner of the Australian Open. This partnership represents a significant milestone, signaling how digital assets are gaining a formidable foothold in global culture and commerce.

Why is the Nexo Australian Open Partnership a Game-Changer?

This deal is more than just another sponsorship. It strategically places a crypto brand at the heart of one of the world’s most-watched sporting events. The Australian Open attracts millions of global viewers, offering Nexo unparalleled visibility. Therefore, this partnership acts as a massive educational and onboarding tool, introducing complex financial concepts to a broad, engaged audience in a familiar setting.

What Does the Nexo Australian Open Deal Involve?

According to reports, the multi-year agreement grants Nexo prominent branding rights. A key feature will be the ‘Nexo Coaches Pod,’ a branded on-court coaching zone in major stadiums. This visible integration does two things:

- Builds Trust: Association with a prestigious, established event like the Australian Open lends credibility and legitimacy to the Nexo brand.

- Drives Awareness: It puts cryptocurrency directly in front of sports fans who may not yet be crypto natives, demystifying the space.

How Do Crypto and Sports Partnerships Like This Benefit Adoption?

The fusion of crypto and sports is a winning strategy for mainstream adoption. Sports partnerships provide a trusted framework. When fans see a respected brand like Nexo alongside their favorite athletes and tournaments, it reduces perceived risk and complexity. Moreover, these deals often come with fan engagement activations, which can simplify the first steps into cryptocurrency for newcomers.

What Challenges Does the Nexo Australian Open Partnership Face?

While promising, this venture is not without its challenges. The crypto market remains volatile, and regulatory landscapes are still evolving. Nexo must ensure its messaging is clear, compliant, and focuses on security and education to align with the family-friendly, professional image of the Australian Open. Navigating these aspects successfully will be crucial for the partnership’s long-term impact.

What’s the Future for Crypto in Major Sports?

The Nexo Australian Open deal is part of a larger trend. From stadium naming rights to fan tokens and athlete endorsements, cryptocurrency is becoming embedded in the sports ecosystem. This partnership sets a precedent, suggesting that future collaborations will focus on deeper utility—like using crypto for ticketing, merchandise, or exclusive fan experiences—rather than just surface-level branding.

In conclusion, Nexo’s partnership with the Australian Open is a masterstroke. It transcends traditional advertising by integrating crypto into a cultural pillar. This move not only boosts brand recognition for Nexo but also serves as a powerful catalyst for the entire industry, demonstrating that digital finance and elite sports are now playing on the same court. The game for mainstream crypto adoption has officially entered a new set.

Frequently Asked Questions (FAQs)

What does Nexo do as a company?

Nexo is a leading cryptocurrency financial services platform. It primarily offers crypto-backed loans, allowing users to borrow cash or stablecoins using their digital assets as collateral, as well as interest-earning accounts.

How long is the Nexo and Australian Open partnership?

The deal is reported as a “multi-year” partnership, though the exact number of years has not been publicly disclosed. This indicates a long-term commitment from both parties.

What is the ‘Nexo Coaches Pod’?

The Nexo Coaches Pod is a branded on-court area at the Australian Open where coaches can consult with players during matches. It serves as a primary physical branding element for Nexo during the tournament broadcasts.

Why would a tennis tournament partner with a crypto company?

Tournaments seek innovative and forward-thinking partners to enhance their brand and secure funding. Crypto companies like Nexo offer new revenue streams and help modernize the event’s appeal to a younger, tech-savvy demographic.

Is this the first major crypto partnership in tennis?

While one of the most prominent, it’s not the first. Other crypto exchanges and platforms have sponsored tournaments and individual players, but the scale of this deal with a Grand Slam is particularly significant.

Does this mean I can buy tickets with crypto for the Australian Open?

The current partnership is focused on branding and awareness. While it could pave the way for future utility like crypto payments, such features are not part of the initial announcement.

Found this insight into the merging worlds of finance and sports compelling? Share this article on social media to spark a conversation about the future of crypto adoption!

To learn more about the latest trends in cryptocurrency institutional adoption, explore our article on key developments shaping the crypto landscape and its integration into traditional sectors.

This post Game, Set, Match: Nexo’s Powerful Move as Official Australian Open Crypto Partner first appeared on BitcoinWorld.

You May Also Like

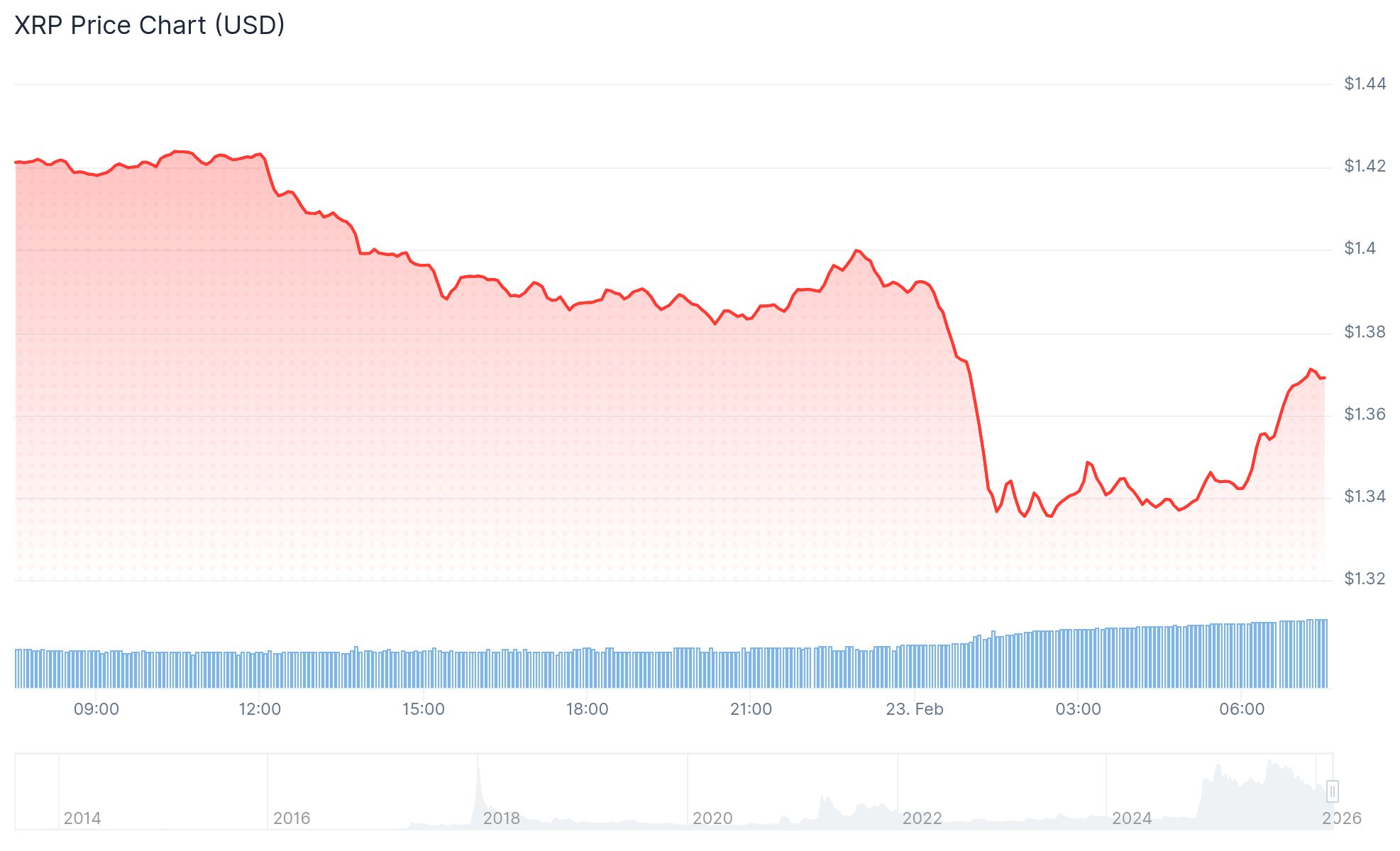

XRP Price Crashed 69% From its Peak

XRP Price: Falls to $1.33 as Realized Losses Hit 39-Month High – Watch These Levels