Ripple Pushes RLUSD Onto L2 Networks as Regulated Stablecoin Strategy Expands

- RLUSD expands onto Layer 2 networks using Wormhole interoperability

- Ripple strengthens regulated stablecoin access across multichain DeFi ecosystems

- XRP utility grows as RLUSD supports cross-chain liquidity and payments

Market focus has shifted toward Ripple following fresh details around its stablecoin rollout, according to a Ripple update shared publicly. The move places RLUSD into several Layer 2 environments, reinforcing the company’s multichain direction. This development aligns with growing institutional demand for regulated digital dollars across scalable blockchain networks.

Rather than restricting RLUSD to a limited set of chains, Ripple has initiated testing on Optimism, Base, Ink, and Unichain. These Layer 2 networks operate within Ethereum’s ecosystem and prioritize lower transaction costs. Consequently, RLUSD can support onchain activity while maintaining regulatory structure.

Ripple is partnering with Wormhole to support this deployment, according to the same update. Wormhole’s Native Token Transfers standard allows RLUSD to move across chains without synthetic wrapping. This structure enables Ripple to preserve native issuance control while supporting interoperable liquidity.

RLUSD was initially issued on XRP Ledger and Ethereum. However, Layer 2 expansion introduces efficiency that institutional users increasingly require. Optimism also serves as a strategic gateway into interconnected Layer 2 ecosystems, enabling broader access without liquidity fragmentation.

Also Read: Ethereum Surges Above $3,000: Is $8,000 on the Horizon by 2026?

Compliance Remains Central to RLUSD’s Expansion

Ripple continues positioning RLUSD around strict regulatory oversight. The stablecoin operates under a New York Department of Financial Services Trust Company Charter. This framework provides bank-level supervision, which remains uncommon among stablecoin issuers.

Additionally, Ripple has applied for an OCC charter, according to company disclosures. Approval would place RLUSD under both state and federal oversight. No existing stablecoin currently operates under this dual structure.

Beyond U.S. regulation, Ripple continues expanding its compliance footprint globally. RLUSD has received regulatory recognition in jurisdictions including Dubai and Abu Dhabi. These approvals support international usage without introducing regulatory uncertainty.

XRP and RLUSD Gain Shared Utility Across Chains

Ripple is also aligning RLUSD issuance with demand for wrapped XRP. The company prioritizes deploying RLUSD wherever wXRP activity increases. This approach strengthens liquidity across supported networks.

Hex Trust recently announced support for issuing wXRP for cross-chain use. This step allows XRP holders to access DeFi services more easily. As a result, wXRP and RLUSD can function as a primary trading and liquidity pair.

Businesses benefit from this structure through improved support for payments, swaps, and checkout services. Meanwhile, XRP holders gain access to lending, swapping, and yield opportunities where available.

According to Ripple, additional chain deployments remain under review pending regulatory approval. The strategy reflects a controlled expansion model focused on compliance and efficiency. RLUSD’s Layer 2 presence signals Ripple’s effort to bridge institutional standards with onchain infrastructure.

Also Read: Crypto Bloodbath: Bitcoin, Ethereum, XRP, BNB, Solana and Dogecoin Slide

The post Ripple Pushes RLUSD Onto L2 Networks as Regulated Stablecoin Strategy Expands appeared first on 36Crypto.

You May Also Like

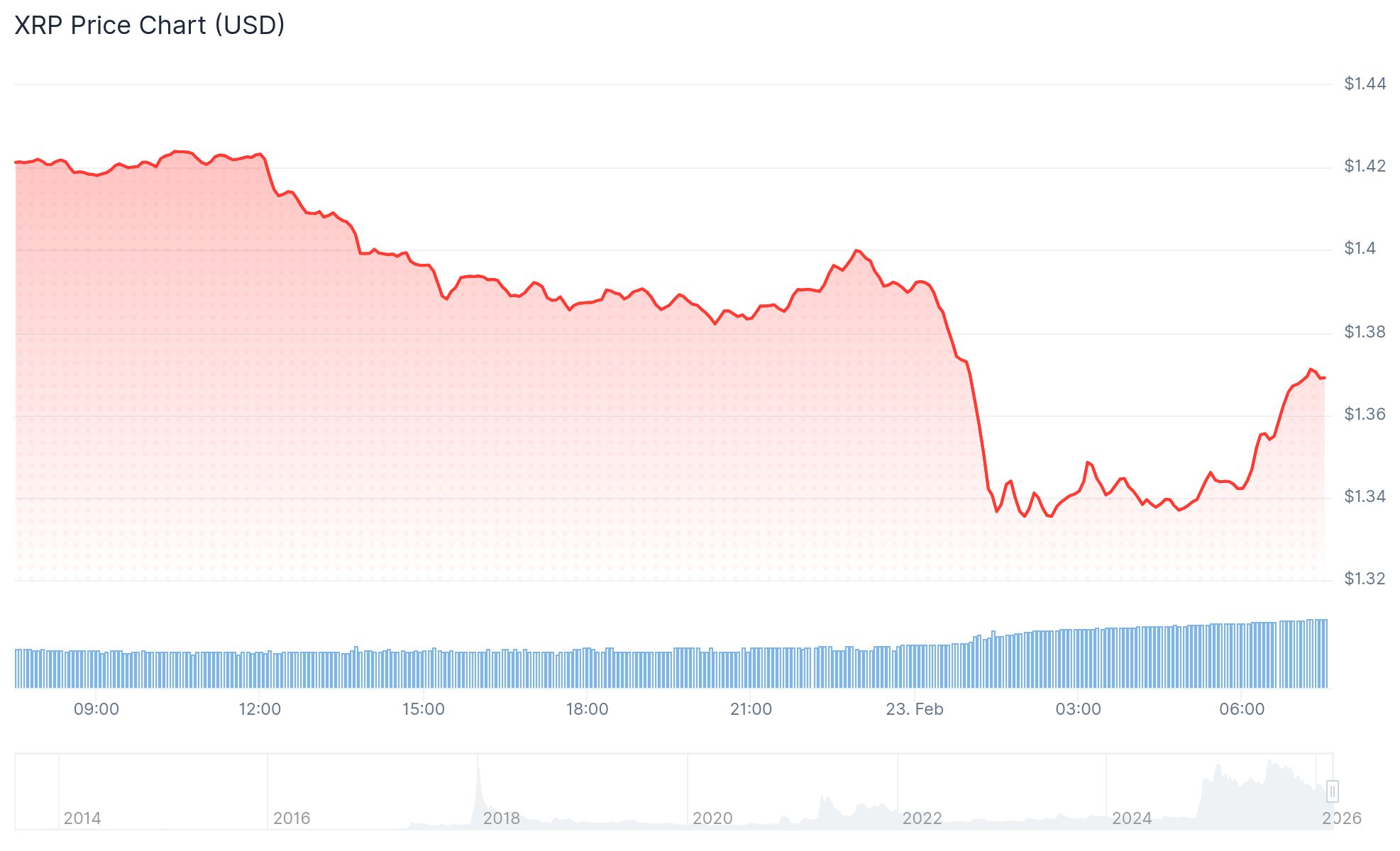

XRP Price Crashed 69% From its Peak

XRP Price: Falls to $1.33 as Realized Losses Hit 39-Month High – Watch These Levels