Bitcoin Price To Crash Below $70K as Japan Rate Hike Looms

The post Bitcoin Price To Crash Below $70K as Japan Rate Hike Looms appeared first on Coinpedia Fintech News

Bitcoin, which is already struggling to regain its strength around $100K, is facing immense pressure as the Bank of Japan (BOJ) prepares for a key interest rate decision.

In the past, whenever the BOJ hiked its rate, BTC price fell by 25%, and with another hike expected, top crypto experts are warning BTC could fall toward $70,000, a decline of nearly 28%.

Here’s what is coming.

Japan To Hike Interest Rate By 25bps

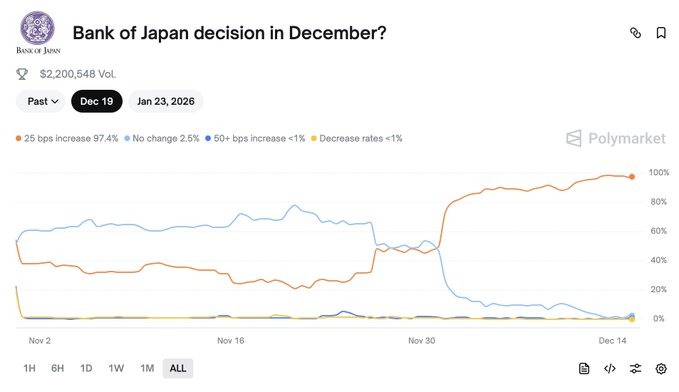

On Dec 19, the Bank of Japan is holding a key policy meeting and is widely expected to raise interest rates by 25 basis points. Even prediction platform Polymarket currently shows a 98% chance of a rate hike on December 19.

Some experts believe the move could be even stronger, with expectations that the BOJ may hike rates by up to 75 basis points.

While it may seem like a local decision, Japan plays a major role in global finance. The country holds over $1.1 trillion in U.S. Treasury bonds, making it the largest foreign holder.

When Japan changes interest rates, it impacts global money flows, bond yields, and risky assets like stocks and cryptocurrencies.

Bitcoin Price To Drop To $70K

History shows a clear pattern. Each time Japan has raised interest rates, Bitcoin has fallen soon after.

- In March 2024, when the rate hike occurred, Bitcoin fell around 23%

- Similarly, in July, when the 2024 rate hike was announced, Bitcoin dropped roughly 26%

- And this year, in January 2025, when the rate hike occurred, Bitcoin slid about 31%

If this trend repeats, Top crypto analysts Merlijn The Trader warn that Bitcoin could fall another 20–30%, pushing prices below $70,000 after December 19.

Rising Japan Bond Yields Added Fuel To the Fire

This time, the pressure on the crypto market is not just from a possible rate hike, but from rising Japanese bond yields, which recently hit 2.94%, the highest since 1998.

For years, traders borrowed cheap Japanese yen to invest in higher-return assets like crypto. Now, as Japan’s bond yields rise, this strategy is becoming expensive. Traders are closing positions, which leads to selling, liquidations, and sudden market drops.

As a result, Japanese investors may start moving money back home. Some models suggest up to $500 billion could leave global markets over the next 18 months, pushing U.S. borrowing costs higher even without a Fed rate hike.

Crypto Market Already Struggling

As of now, Bitcoin is currently trading near $90,000, down nearly 30% from its recent peak around $126,000. The overall crypto market is also struggling, with total market value falling from $4.1 trillion to roughly $3.05 trillion.

Major altcoins like XRP, Solana, and Cardano are all down by 40% from their October high. While some memecoin have even seen 60% to 70% drop.

You May Also Like

WIF Price Prediction: Targeting $0.48 Recovery Within 2 Weeks as MACD Shows Bullish Divergence

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!