Ripple Scores Major Victories but XRP’s Price Continues to Fight for Survival at $2

Ripple continues with its impressive 2025, having notched a new major banking partnership in Europe for the first time and gaining a conditional approval from the US OCC to charter a national trust bank.

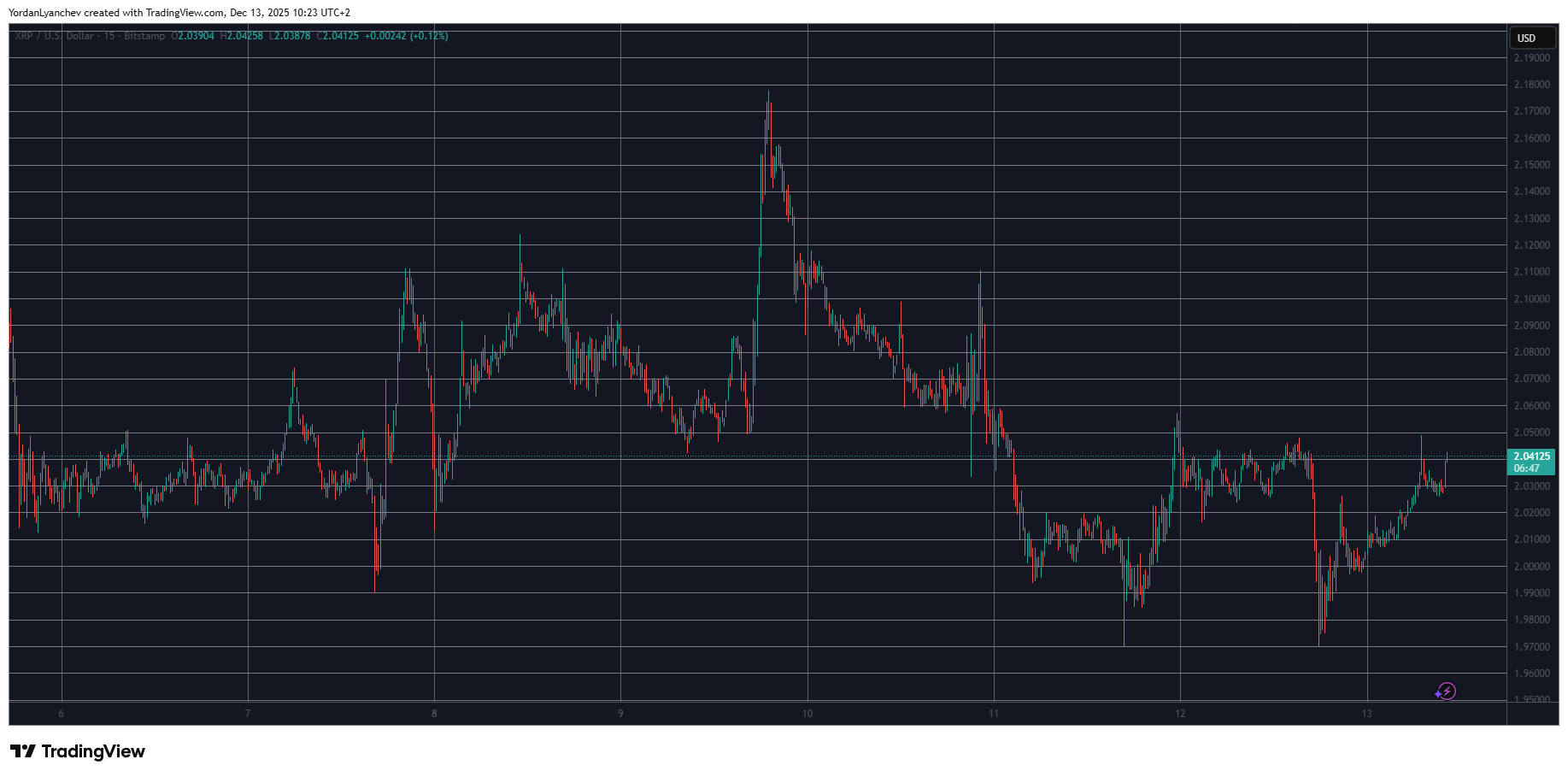

Both of these developments were announced in the span of less than 24 hours. Yet, the price of the underlying asset has not felt any positive consequences and continues to struggle to remain above $2.00.

Ripple’s Latest Wins

CryptoPotato reported at the end of November that Ripple is having its best year on record, with massive acquisitions, such as Hidden Road, the conclusion of the lawsuit against the US SEC, as well as the launch of numerous spot XRP ETFs. However, its cross-border token has slumped by more than 40% since the July all-time high of $3.65 and is underwater YTD.

As mentioned above, the company made two additional significant announcements on Friday that only build on its impressive 2025 performance. At first, the firm partnered with the Swiss-based AMINA Bank, which will use its stablecoin to support near-real-time cross-border payments for clients using Ripple Payments.

Just a few hours later, Ripple CEO Brad Garlinghouse outlined ‘huge news’ for the company he runs, indicating that it had received conditional approval from the US Office of the Comptroller of the Currency to launch a national trust bank. Thus, Ripple joined other digital asset-related companies, such as Circle, BitGo, Paxos, and Fidelity, in obtaining such licenses.

No Pump for XRP

Such major news typically impacts the underlying asset. However, this hasn’t been the case with XRP lately. In the first month of the launch of the spot XRP ETFs in the US, the asset’s price has tumbled from above $2.50 to just over $2.00 as of now, even though the financial vehicles have seen impressive inflows of nearly $1 billion.

The Friday announcements failed to stage a recovery for XRP either. In fact, the token slipped below $2.00 once again – for the second time in 36 hours – during the overall market-wide correction on Friday afternoon.

Although it has managed to reclaim that level and to trade around $2.04 now, it’s still down nearly 20% in the past month. Moreover, it has lost over 40% of its value since its July all-time high, while the company behind it continues to notch new victories on different fronts.

XRPUSD Dec 13. Source: TradingView

XRPUSD Dec 13. Source: TradingView

The post Ripple Scores Major Victories but XRP’s Price Continues to Fight for Survival at $2 appeared first on CryptoPotato.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Stunning $207 Million USDT Transfer from OKX Sparks Major Whale Movement Speculation