AVAX Targets $9 After Breakout – Channel Support Sparks Reversal Hopes

AVAX consolidates following the wedge breakout at $9 target. Channel bottom at 5.5B market cap indicates possible turnaround. Analysts eye $26-$42 upside targets.

Avalanche has broken out of a technical pattern. AVAX now clusters in a key price area. The market participants closely observe the approach of the asset to major support levels.

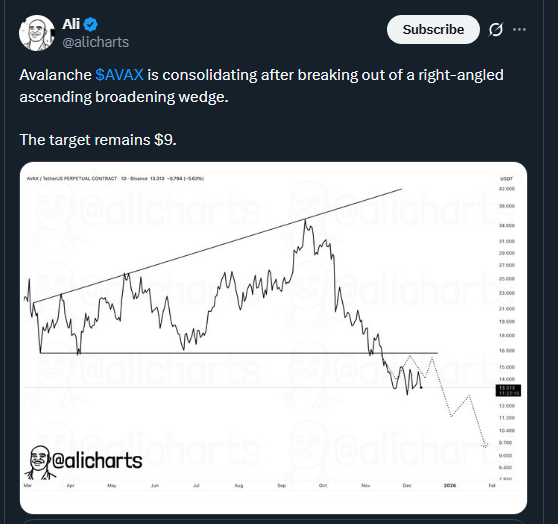

AVAX emerged through an ascending broadening wedge on the right angle according to Ali Charts on X. The trend indicates the existence of a price target of 9 dollars. This technical structure is usually followed by great price movements, after the consolidation is over.

Source: Ali Charts

Critical Channel Support Tests Bulls’ Resolve

AVAX is bottom trading. This channel has remained relevant for 2 years. The trend reversal potential is formed by the positioning.

PStrade2 pointed out on X that the fundamentals are still intact. There is evidence of life in the ecosystem. Its present market capitalization is approximately 5.5 billion. This valuation might act as a starting point for new impetus.

Source: PStrade2

The bottom of the channel is a historically important area. Past meetings with this tier led to massive demonstrations. The next significant move depends on the capacity of AVAX to hold here.

You might also like: Crypto News: AVAX One Hits 13.8M AVAX After $110M Accumulation Spree in November

Dual Scenarios: Reversal or Deeper Correction

There are two possible consequences of existing price action. The intention of bulls is to guard the channel support zone. A strong upward trend could be precipitated by success.

PStrade2 presented a conservative and aggressive objective on X. A conservative scenario speculates in terms of a 26-dollar gain, an increase that is 100 percent. The upper channel target will rise to $41-42, which represents a 225 percent potential rise.

Not being able to support exposes downside risk. AVAX may undergo additional consolidation or re-test the lower levels. The prevailing path will depend upon market structure and market volume.

The blockchain technology used by Avalanche keeps drawing more attention to developers. On-chain statistics indicate continued activity in the face of price weakness. The blending of technical organization and basic action results in an interesting risk-reward profile.

The competition in layer-1 blockchain is high in the industry. AVAX is required to show implementation and usage to gain market share. Existing pricing can provide points of entry to those who are optimistic about long-term opportunities.

The post AVAX Targets $9 After Breakout – Channel Support Sparks Reversal Hopes appeared first on Live Bitcoin News.

You May Also Like

Voltage Debuts Programmatic Revolving Credit Line for Lightning Network Payments

Vitalik Buterin Sells Millions in Ethereum – Is ETH Price Crashing?