Solana Price Prediction: Best Crypto to Buy Now?

The crypto market recently took in the FOMC interest rate decision, which included a widely expected 0.25% cut.

Because the announcement brought no surprises, the market reacted mainly through normal order flow, even with the slight bearish move that followed. Solana (SOL) now sits in a month-long consolidation phase and still lacks the short-term momentum for a clear breakout.

Even so, strong network fundamentals and growing technical pressure point toward a major bullish move by the end of December.

SOL continues to build strength for a potential breakout that could secure its position as a top Layer 1 performer and one of the best cryptos to buy now.

At the same time, many investors are already rotating into the next wave of infrastructure growth, which centers on Bitcoin Layer 2 (L2) scaling solutions.

Source – Cilinix Crypto YouTube Channel

Major Factors Supporting Solana’s Growth

Despite the sideways price action, Solana’s core metrics show clear bullish strength.

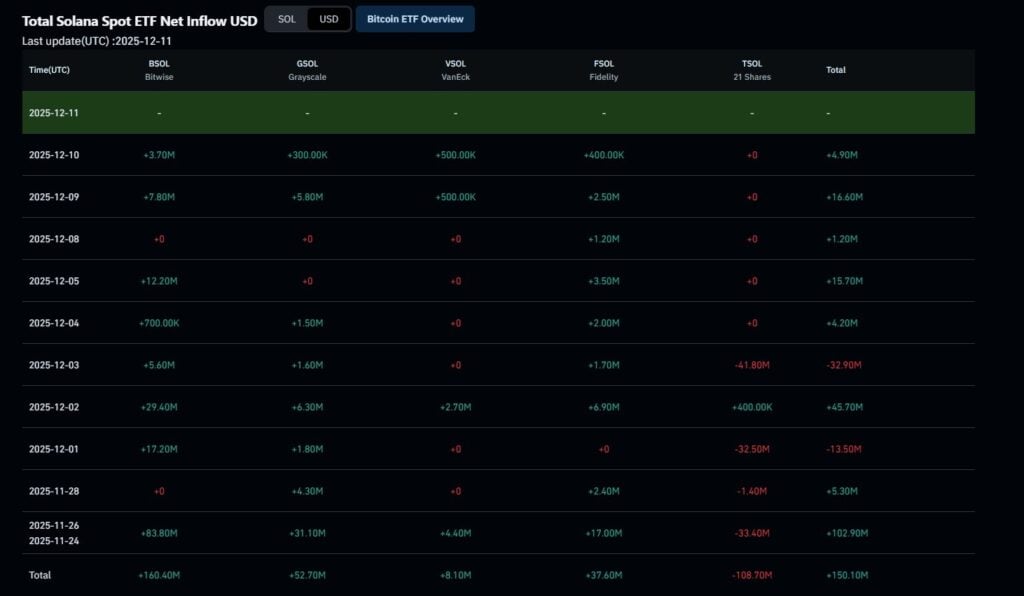

ETF inflows have stayed positive for five straight days and have already offset a single-day $32 million outflow earlier in the month. This steady buying shows that institutional investors continue to support Solana’s long-term outlook.

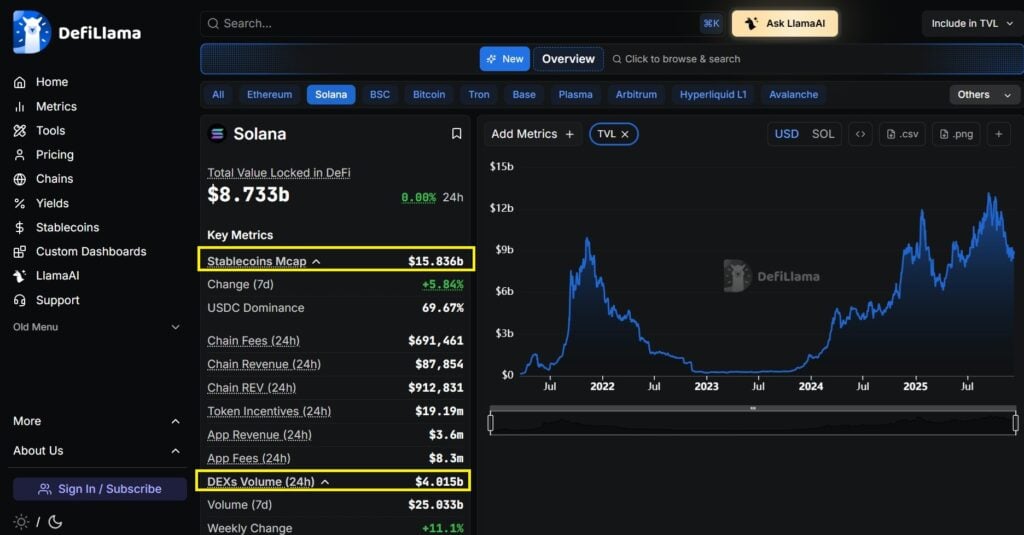

Stablecoin market capitalization on the network also climbed from $13.1 billion to $15.8 billion in only three weeks. This rise shows that liquidity is growing, more users are active, and utility across the ecosystem is expanding.

DEX trading volumes, which had fallen earlier, now show a clear recovery. This rise points to stronger on-chain activity and more user engagement across the network.

These combined trends strengthen Solana’s position as a top platform for decentralized trading and show that the fundamentals continue to improve even while the price consolidates.

Solana Price Prediction

SOL now trades inside a critical medium-term consolidation range, and this structure will eventually lead to either a bullish breakout or a bearish drop.

The price continues to react to two important levels: horizontal resistance near $144 and a dynamic trend line around $127. SOL still lacks strong momentum for an immediate breakout, but the chart favors a bullish move later in December.

Most traders expect SOL to stay inside this range for a bit longer. A stronger Bitcoin outlook, which shows signs of a forming local bottom and possible bullish momentum in December and January, creates supportive macro conditions for Solana.

Traders should stay alert for a short-term dip if negative news hits, but SOL often reclaims its range quickly after brief shakeouts.

If SOL builds enough strength to push above $144, the chart opens a path toward $156 and then the $172 to $175 zone. The 200 EMA and rolling VWAP often pull price into this area, which makes it a realistic target once momentum picks up.

Solana continues to build pressure inside this tightening structure. Even though the price looks flat, stronger network metrics and rising ETF inflows show that momentum is building. A move toward the $170 range by year-end remains possible if this pressure continues.

As Solana prepares for a breakout, many investors are also looking for high-upside plays in the Bitcoin ecosystem. Bitcoin Hyper stands out as one of the best crypto to buy now for anyone seeking exposure to the next stage of Bitcoin Layer 2 growth.

Bitcoin Hyper Aims to Bring Solana-Level Speed to Bitcoin

Bitcoin Hyper brings Solana-style speed and low fees to Bitcoin while keeping the Bitcoin base layer in place. Instead of letting BTC sit as a passive store of value, the project wants to turn it into productive capital that supports payments, DeFi, and gaming on a Bitcoin-secured Layer 2.

By using the SVM, Bitcoin Hyper delivers very fast transactions and smart contracts, aiming for performance that can match or even beat Solana. For users, this means near-instant wrapped BTC payments, cheap swaps, and smooth NFT or gaming actions that feel as fast as a Web2 app.

The project also focuses on real utility, offering DeFi lending, staking, high-speed BTC payments, and gaming dApps built with Rust tools.

The presale has already raised around $29.3 million and is close to hitting the $30 million mark. Influencers like Alessandro De Crypto call it the best crypto to buy and one of the biggest launches of 2026.

$HYPER is priced at $0.013405, and even a small share of the Bitcoin Layer 2 market could push its price 5x or 10x after launch. Presale momentum supports this idea, and smart money is joining in too, with high-net-worth wallets buying close to 400,000 worth in November.

With a live APY of 40%, $HYPER is shaping up as both a yield play and a growth play. To join the presale, visit the Bitcoin Hyper website and buy using ETH, USDT, BNB, or a credit card. You can also check the simple guide on how to buy HYPER before it launches.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Revolutionary: Midas and Axelar Launch Tokenized XRP with 8% Target Yield

Wormhole’s W token enters ‘value accrual’ phase with strategic reserve