Kalshi Becomes CNN’s Prediction Market Partner as Polymarket Relaunches in the US

CNN has chosen Kalshi as its official prediction markets partner, strengthening Kalshi’s effort to make event contracts a mainstream data source for political and economic reporting.

This collaboration follows a series of October expansion moves by both companies: Kalshi raised a $300 million Series D, while Polymarket, its on-chain rival, relaunched in the US and secured major media and TradFi alliances, including Yahoo! Finance.

How Will The Partnership Between CNN and Kalshi Work?

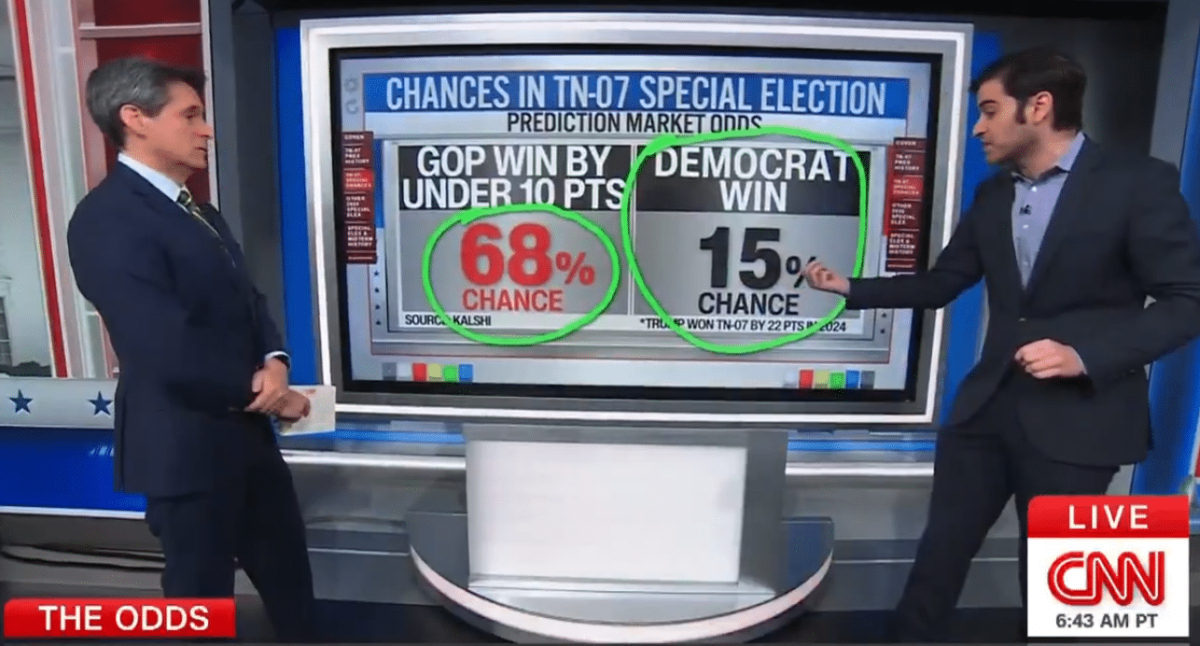

Under the agreement, CNN will integrate Kalshi’s real-time probabilities across TV, digital and social programming, with chief data analyst Harry Enten leading on-air use of the data.

The rollout includes a Kalshi-powered ticker during segments that reference prediction markets, as well as real-time newsroom access to political, economic, weather, and cultural event data for story development and fact-checking, according to their blog.

An example of how CNN will use Kalshi on TV | Source: Host of CNN

Kalshi is Having a Great Time With Some Challenges

Kalshi’s recent $300 million fundraising and expansion followed a resolution of a dispute with the US Commodity Futures Trading Commission in 2024. During this period, some users questioned Kalshi’s legal status. The company later reported a 200-fold surge in trading volumes over the past year and captured over 60% of global prediction-market activity before its international rollout.

Meanwhile, Kalshi is under new legal scrutiny from a class-action lawsuit alleging market manipulation and illegal sports betting. Its crypto integrations continue with new on-chain products on NEAR for US users.

Polymarket’s US Return Raises Stakes

Kalshi’s media win comes as Polymarket ramps back into the United States after securing CFTC relief through the acquisition of licensed derivatives venue QCX and resolving earlier enforcement actions. The platform has begun beta operations for US users and has already secured an exclusive partnership with Yahoo! Finance, mirroring Kalshi’s arrangement with CNN.

Polymarket has also attracted significant backing from traditional finance, with NYSE parent Intercontinental Exchange preparing a roughly $2 billion investment that could value the platform near $10 billion and support its US relaunch. Alongside Google Finance’s integration of both Kalshi and Polymarket feeds, the CNN and Yahoo deals frame a two-horse race for institutional prediction-market data.

nextThe post Kalshi Becomes CNN’s Prediction Market Partner as Polymarket Relaunches in the US appeared first on Coinspeaker.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation