Trading time: 15 projects started buybacks, Bitcoin and US stocks are correlated at several times the volatility level

1. Market observation

Keywords: MOVE, ETH, BTC

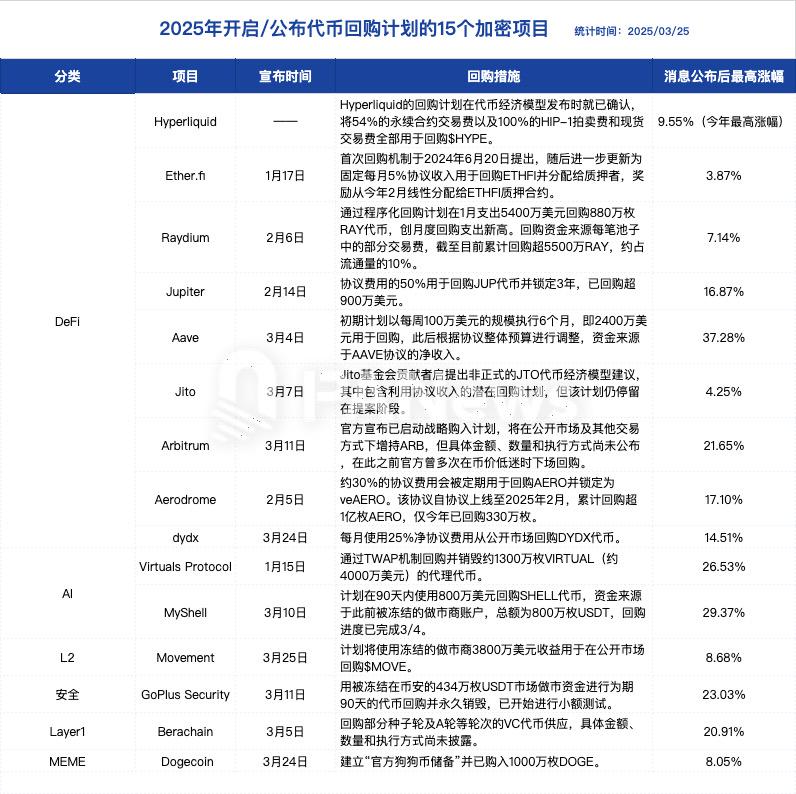

A "buyback wave" has swept the crypto industry, with 15 projects including Aave, Arbitrum, and Movement announcing token buyback plans, ranging from millions to tens of millions of dollars. The sources of buyback funds include protocol income, confiscated assets, and fund expenditures. This move is not only a stopgap measure to save the market in the short term, but also an important strategic layout for projects to reshape the token economy and give long-term value. At the same time, Immutable received a notice of termination of the SEC investigation, bringing a clear signal of regulation to the Web3 gaming industry.

Bitcoin prices continue to show a trend that is highly correlated with the U.S. stock market, with volatility remaining several times higher than that of U.S. stocks. Investors on both sides focus on the Fed's expectations of rate cuts. Analyst Daan Crypto Trades pointed out that Bitcoin is still trading at a solid premium, and if it can maintain this level and slowly recover to more than $90,000, it is expected to create a new high. The Greeks.live community briefing shows that the market is divided on the trend of cryptocurrencies. Some investors believe that it is suitable to buy on dips, while short sellers expect Bitcoin to fall to the $84,500 range.

In the regulatory field, the SEC announced that it will hold four roundtable meetings from April to June 2025, covering key topics such as crypto trading, custody, asset tokenization and DeFi. Commissioner Hester Peirce called this move a "spring sprint to crypto clarity," showing that regulators are shifting from an enforcement orientation to a constructive dialogue. It is worth noting that traditional financial institutions are increasingly accepting Bitcoin, and the GameStop board of directors has unanimously approved an update to its investment policy to include Bitcoin as one of the company's reserve assets. At the same time, the Oklahoma House of Representatives passed the Strategic Bitcoin Reserve Act, further demonstrating the recognition of Bitcoin by institutions and governments. In addition, Ripple reached a preliminary settlement agreement with the SEC, and the SEC agreed to refund a $75 million fine, marking the end of the long-term legal dispute between the two parties.

At the macro level, the market generally expects the Fed to shift from quantitative tightening (QT) to quantitative easing (QE), which may inject new liquidity into the financial market. However, Benjamin Cowen, CEO of crypto research firm IntoTheCryptoVerse, reminded that quantitative tightening has not completely ended, but has only reduced its scale from $60 billion per month to $40 billion. In addition, Goldman Sachs' latest report warned that Trump's upcoming reciprocal tariff policy may cause the market to experience "first collapse and then stability" and violent fluctuations, and the actual tax rate may be twice as high as market expectations.

2. Key data (as of 13:30 HKT on March 26)

-

Bitcoin: $87,346.87 (-6.65% year-to-date), daily spot volume $28.634 billion

-

Ethereum: $2,055.65 (-38.48% year-to-date), with a daily spot volume of $11.309 billion

-

Fear of corruption index: 47 (neutral)

-

Average GAS: BTC 1.4 sat/vB, ETH 0.36 Gwei

-

Market share: BTC 60.7%, ETH 8.7%

-

Upbit 24-hour trading volume ranking: MOVE, XRP, LAYER, BTC, CRO

-

24-hour BTC long-short ratio: 1.0496

-

Sector ups and downs: Meme sector rose 4.74%, Layer2 sector rose 4.62%

-

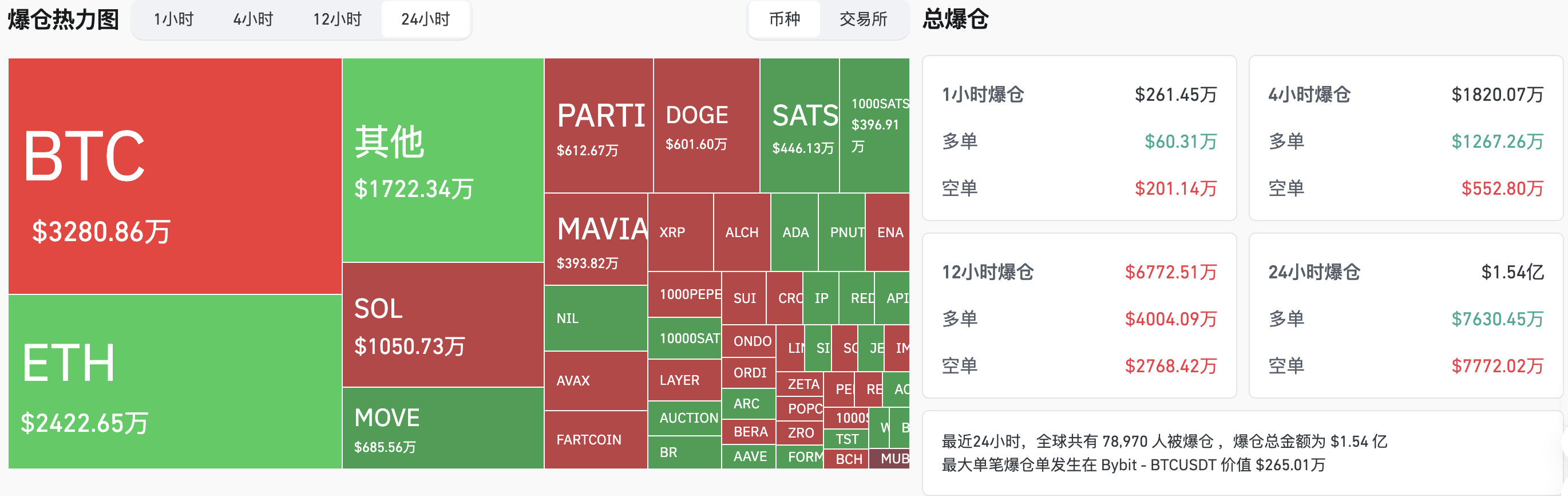

24-hour liquidation data: A total of 78,970 people were liquidated worldwide, with a total liquidation amount of US$154 million, including BTC liquidation of US$32.8 million and ETH liquidation of US$24.22 million

3. ETF flows (as of March 25 EST)

-

Bitcoin ETF: $26.83 million

-

Ethereum ETF: -$3.21 million

4. Today’s Outlook

-

Pump.fun plans to expand to Binance Smart Chain (BSC)

-

Testnet Hoodi will activate Pectra upgrade at epoch 2048

-

Celo officially activates Ethereum L2 mainnet, hard fork block height 31057000

-

Walrus Protocol plans to launch on mainnet

-

U.S. Senate holds hearing on Paul Atkins' qualifications to serve as SEC Chairman on March 27

-

GRASS Airdrop One claim ends (planned for March 27, block 329341917)

-

Blockchain game Immortal Rising 2 completes $3 million in financing, TGE scheduled for March 27

-

Binance Launches Solv Protocol (SOLV), the 7th Phase of BNSOL Super Staking

-

Yield Guild Games (YGG) will unlock approximately 14.08 million tokens at 22:00 on March 27, accounting for 3.28% of the current circulation and worth approximately US$3 million.

The biggest gainers among the top 500 stocks by market capitalization today: WhiteRock (WHITE) up 64.41%, Movement (MOVE) up 29.04%, Gigachad (GIGA) up 26.88%, Particle Network (PARTI) up 25.61%, and Solayer (LAYER) up 17.92%.

5. Hot News

-

GoPlus has repurchased approximately 34.9 million GPS tokens in the first round, and all will be destroyed after the repurchase is completed.

-

Movement wallet address has received 10 million MOVE USDC from Binance in the early morning Treasury minted 300 million USDC on Ethereum in the early morning Ripple will recover $75 million in court fines from the SEC and withdraw its appeal

-

GameStop Adds Bitcoin to Company Reserve Assets

-

The U.S. SEC’s cryptocurrency working group will hold four new roundtable meetings in the next three months to discuss regulatory issues

-

US SEC terminates investigation into Immutable and related parties, finding no violations

-

CBOE Submits Solana ETF Application for Fidelity

-

Greeks.live: The community is divided on the current direction of the crypto market, some are bullish and believe that it is necessary to buy on dips

-

Paidun: GMX and MIM Spell hacker attacks have caused losses of about $13 million

-

BlackRock to Launch Bitcoin ETP in Europe

-

OKX will launch NAVI Protocol (NAVX)

-

Bithumb will list Redstone (RED) and Nillion (NIL) Korean Won trading pairs

-

Arbitrum DAO proposes to withdraw 225 million ARB game incentive plan, questioning mismanagement

-

Oklahoma House passes Strategic Bitcoin Reserve Act

-

Dogecoin Foundation sets up official reserve, first purchases 10 million DOGE

You May Also Like

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”

Trump Owns $870 Million Bitcoin Amid Crypto Market Meltdown