UK Regulator Tests Industry-Led Solution to Protect Crypto Investors

The Financial Conduct Authority has admitted RegTech platform Eunice into its Regulatory Sandbox to trial an industry-designed framework for enhancing transparency across Britain’s digital asset markets.

The initiative brings together major exchanges, including Coinbase, Crypto.com, and Kraken, to develop standardized disclosure templates.

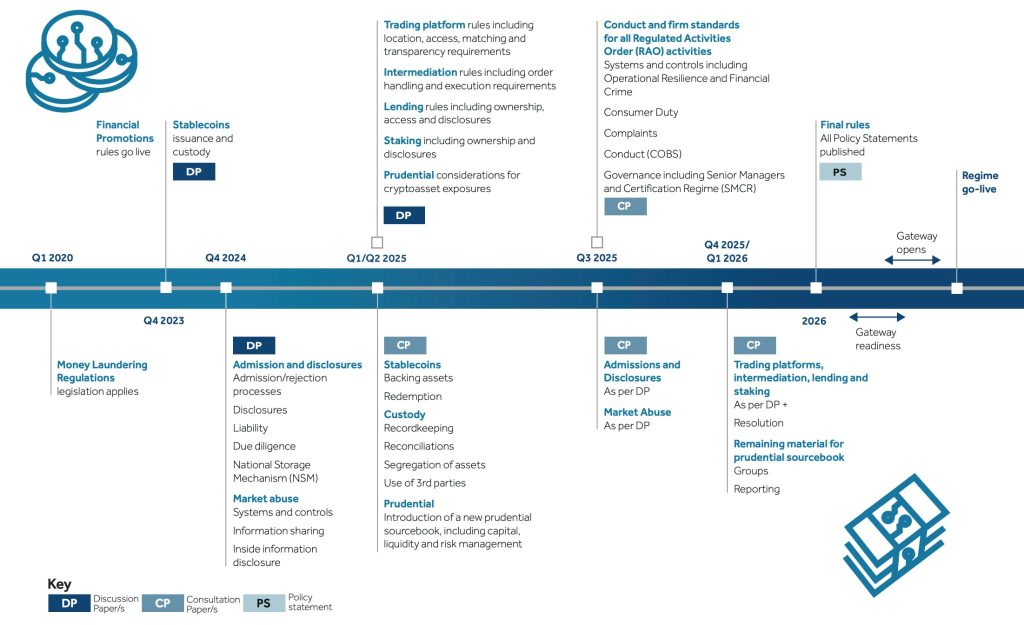

Eunice’s sandbox participation is the latest chapter in Britain’s accelerating push toward comprehensive crypto regulation, building on the FCA’s roadmap to publish final rules throughout 2026.

Source: FCA

Source: FCA

The working group led by Eunice has created uniform disclosure standards to simplify compliance for firms while ensuring investors receive key risk information before transactions.

Industry Collaboration Shapes UK’s Regulatory Future

The disclosure template project emerged directly from the FCA’s Admissions and Disclosures Discussion Paper published in December 2024, which invited industry expertise to inform upcoming regulations.

Eunice will now experiment with these templates in the sandbox environment to achieve maximum transparency, with the findings expected to directly influence the FCA’s final disclosure requirements for cryptoassets.

The platform specializes in helping financial institutions, regulators, and businesses work with cryptoassets, tokenized assets, and on-chain infrastructure.

Yi Luo, CEO and co-founder of Eunice, emphasized the importance of the collaboration.

“The FCA Sandbox is where regulators and industry participants meet to build the foundations for a safer and smarter digital asset market,” Luo stated.

Colin Payne, head of innovation at the FCA, also pointed out the regulator’s track record in supporting beneficial market innovations.

“Our Regulatory Sandbox accepts applications year-round from all types of firms who are looking to test their innovative ideas,” Payne explained.

“We encourage any firm to apply who are looking to test a similar solution to help inform our regulatory approach to cryptoassets.“

Broader Framework Addresses Market Conduct Standards

The disclosure initiative forms one component of Britain’s broader regulatory transformation, which has gained momentum following years of industry criticism over restrictive oversight.

The FCA’s crypto roadmap outlines staged policy publications covering stablecoins, market abuse, trading platforms, intermediation, lending, and staking.

Consultation Paper CP25/25, launched in September, proposed applying traditional financial institution standards to crypto firms, including governance obligations, financial crime controls, and operational resilience measures.

The regulator seeks feedback on whether its Consumer Duty principle, requiring firms to deliver good customer outcomes, should extend to digital assets.

David Geale, executive director of payments and digital finance, acknowledged that the proposals won’t eliminate crypto’s inherent risks but seek to build sector trust through minimum regulatory standards while considering exemptions for the sector’s unique aspects.

Discussion Paper DP24/4 on Admissions and Disclosures and Market Abuse Regime for Cryptoassets invited feedback until March 2025, with the regulator holding policy roundtables in April and May 2024 to gather industry perspectives.

The proposals seek to reduce risks without stifling growth by improving regulatory clarity, ensuring consumers have the necessary information, requiring fair trading controls, and reducing money laundering and fraud risks.

Market Maturation Through Infrastructure Development

Beyond regulatory frameworks, Britain’s digital asset infrastructure continues expanding.

The FCA approved ClearToken’s CT Settle platform earlier this month, positioning the London-based firm to offer institutional settlement for cryptocurrencies and tokenized assets using delivery-versus-payment models.

The authorization grants ClearToken status as an Authorised Payment Institution and registered cryptoasset firm, with plans to seek additional Bank of England approval through its Digital Securities Sandbox.

As a result of this growing regulatory appetite for digital assets-related regulations, IG Group analysts project Britain’s crypto market could expand roughly 20% over the next year as regulatory clarity and new infrastructure take effect.

This can be seen in the recently announced KR1 plans to move its stock listing from the Aquis Stock Exchange to the main market of the London Stock Exchange (LSE). This is one of the biggest British blockchain investment firms.

Similarly, the Treasury’s Wholesale Financial Markets Digital Strategy is advancing blockchain-based digital gilts and a two-year pilot of tokenized sterling deposits with six major banks, including Barclays and HSBC, to test distributed ledger technology for faster settlement across the financial system.

You May Also Like

The Channel Factories We’ve Been Waiting For

Trump adviser demands Fed economists be 'disciplined' for arguing with presidential tactic